📌 Alphabet Inc: Turning AI & Cloud Leadership into Durable Value

📈 Solid Fundamentals with Room to Unleash

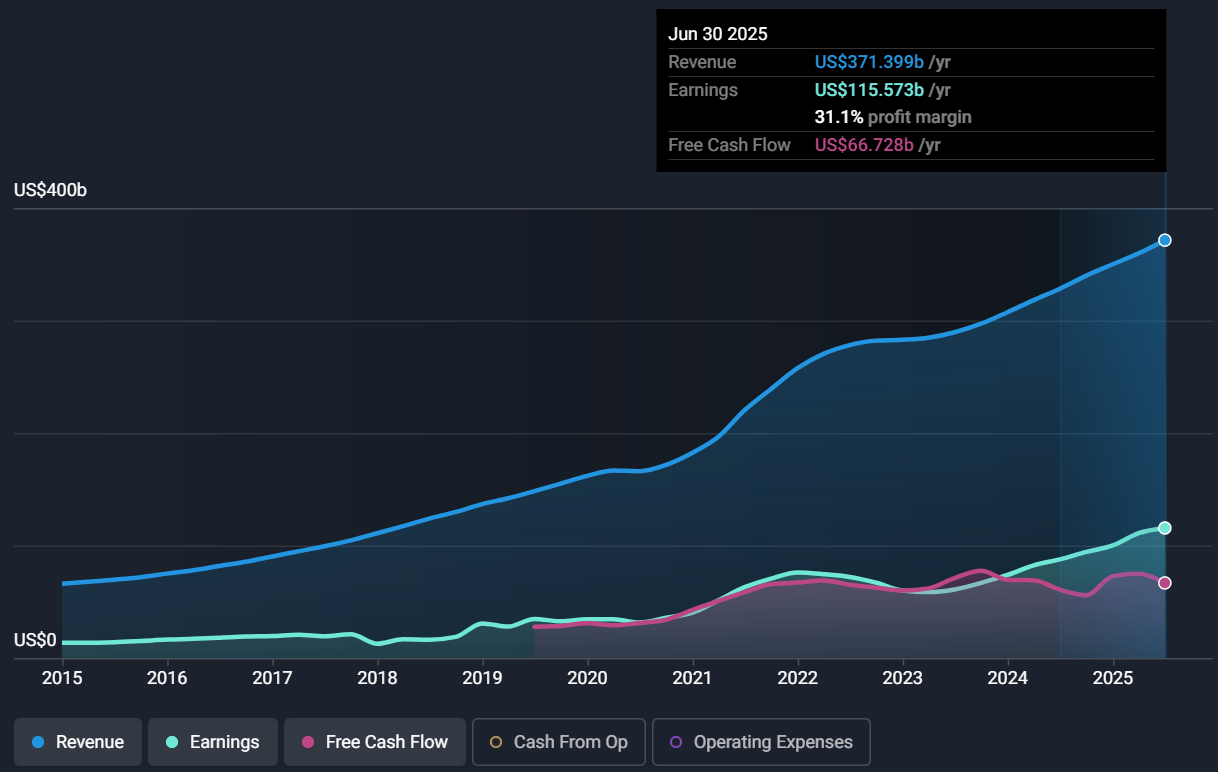

Alphabet delivered US$96.43 billion in Q2 2025 revenue, up 14% year-over-year, beating consensus. Net income rose ~19% to US$28.2 billion (EPS US$2.31), demonstrating resilience even amid heavy investments.

Profit margin held at ~31%, showing the company can scale AI and cloud investments without collapsing profitability.

💰 Strong Balance Sheet & FCF Optionality

Alphabet sits on a massive cash and investments war chest (~US$90-100 billion), providing strategic optionality.

With the core business generating robust free cash flow, management has the flexibility to reinvest aggressively, return capital, or lean into acquisitions.

The recently raised 2025 CapEx outlook to ~US$85 billion underscores a capital-intensive buildout, but also signals confidence in long-term return potential.

The key risk is whether the ROI on these investments - especially in infrastructure and AI - remains high enough to outweigh the capital burden and depreciation.

📊 Monetization Flywheel & AI Engagement

Alphabet is weaving AI deeply into its core products: “AI Overviews” and “AI Mode” in Search are already boosting query engagement and time-on-platform.

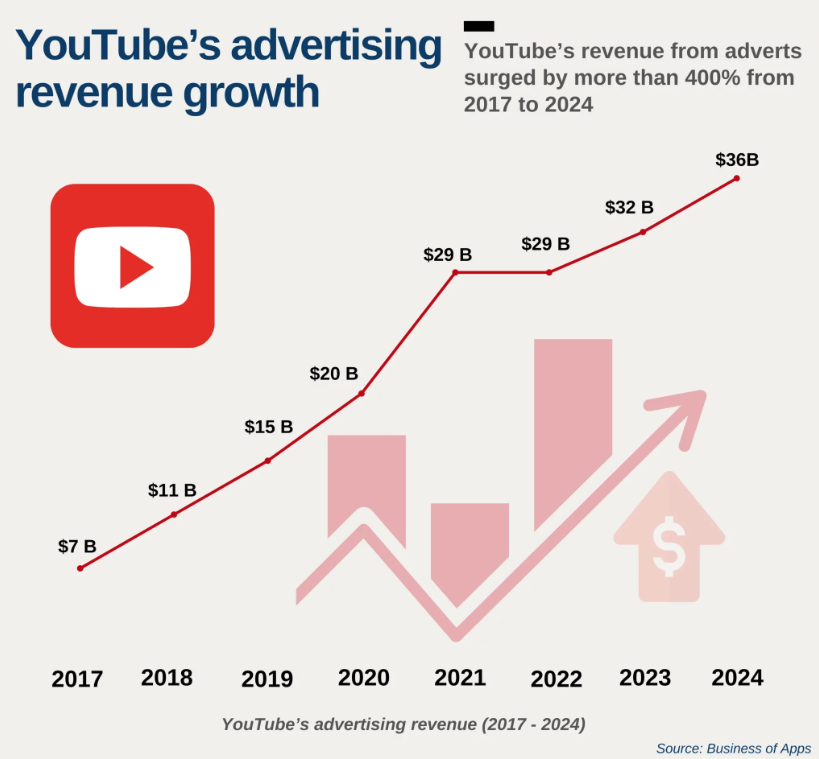

YouTube ad revenue is nearing US$10 Billion per quarter, aided by rising viewership, ad formats, and AI-driven recommendation tools.

Subscription, device, and platform revenues (e.g. Play, hardware) grew ~20%, helping diversify away from pure ad dependence.

The synergy between Search, Ads, Cloud, and AI features gives Alphabet a unique flywheel advantage that many pure-play AI rivals can’t replicate.

🧩 Competitive Position & Moat

Alphabet’s main adversaries in the enterprise AI/cloud space include Microsoft (Azure + Copilot), Amazon AWS (incl. Bedrock), OpenAI, and Anthropic.

But Alphabet uniquely controls major components - data, models (Gemini), compute infrastructure, and productivity tools - enabling tighter integration and smoother upgrades.

Its scale allows it to invest in proprietary TPUs, data centres, and model R&D at a scale few competitors can match.

Still, the biggest threats lie in regulatory risk (antitrust, search monopoly scrutiny), geopolitical pressure, and the possibility of disintermediation by new AI platforms.

🤖 Gemini Enterprise: Inflection for Enterprise AI

Alphabet just launched Gemini Enterprise, a full-stack AI agent platform for business automation.

It offers no/low-code agent creation, data integration across enterprise systems (Workspace, Salesforce, SAP), and built-in governance.

Pricing starts around US$30/user per month (with lower tiers for smaller firms). Early users include Gap, Figma, Klarna, Virgin Voyages, and others - giving it initial commercial validation.

This move shifts Alphabet’s identity further toward being an AI infrastructure and productivity vendor, rather than a legacy ad / consumer tech company.

📈 Conclusion

Alphabet today represents a rare combination: an advertising cash machine layering on fast-growing AI and cloud engines.

With strong free cash generation, balance sheet strength, and deep integration across infrastructure and models, it’s a high-conviction name in the AI transition.

The launch of Gemini Enterprise only accelerates its pivot toward monetizable, enterprise-grade AI.

Wall Street Isn’t Warning You, But This Chart Might

Vanguard just projected public markets may return only 5% annually over the next decade. In a 2024 report, Goldman Sachs forecasted the S&P 500 may return just 3% annually for the same time frame—stats that put current valuations in the 7th percentile of history.

Translation? The gains we’ve seen over the past few years might not continue for quite a while.

Meanwhile, another asset class—almost entirely uncorrelated to the S&P 500 historically—has overall outpaced it for decades (1995-2024), according to Masterworks data.

Masterworks lets everyday investors invest in shares of multimillion-dollar artworks by legends like Banksy, Basquiat, and Picasso.

And they’re not just buying. They’re exiting—with net annualized returns like 17.6%, 17.8%, and 21.5% among their 23 sales.*

Wall Street won’t talk about this. But the wealthy already are. Shares in new offerings can sell quickly but…

*Past performance is not indicative of future returns. Important Reg A disclosures: masterworks.com/cd.

PS – Was this forwarded to you? Join 9,000+ smart investors getting weekly insights direct to their inbox: investkaki.com

P.P.S. Check out this link where we consolidate all the 1-Min Stock Rundown posts together!

Cheers,

James -Dissecting-Stocks-in-1-min- Yeo