📌 StarHub: Resilience Amid Transformation

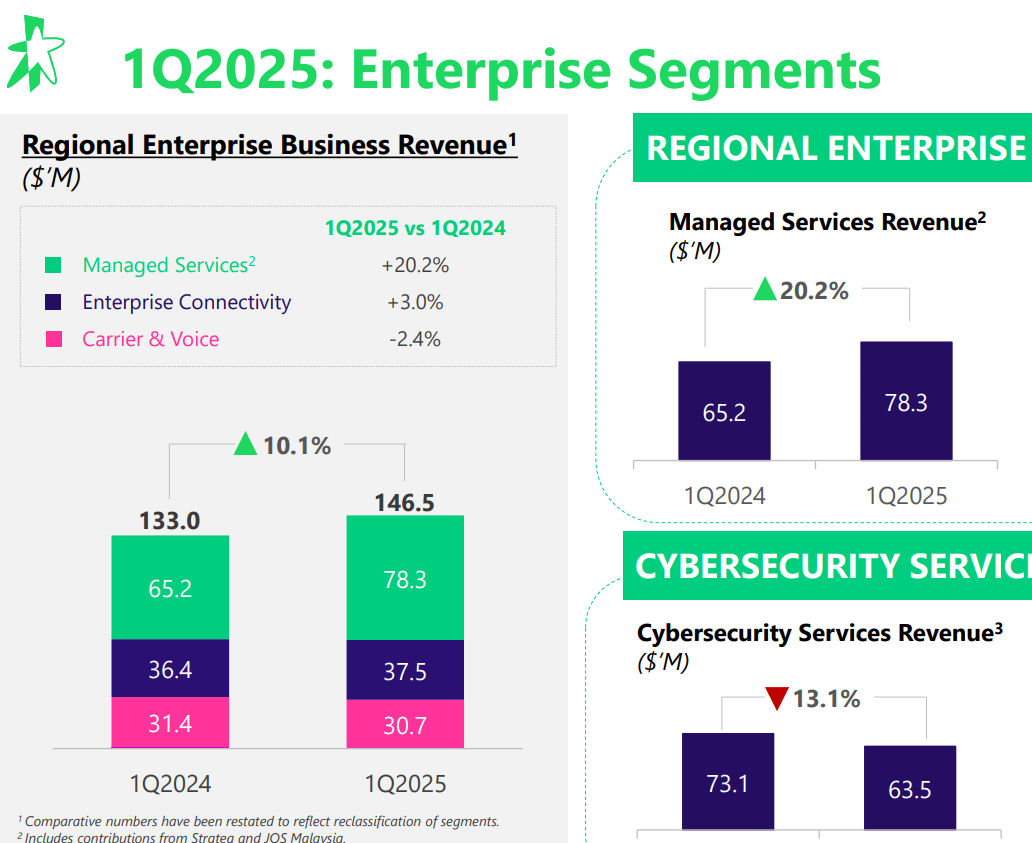

📊 Service revenue totalled S$464 million in Q1 2025, flat YoY, held back by timing issues in the cybersecurity arm, Ensign, while broadband revenue rose ~5% and regional enterprise grew ~10%.

📉 EBITDA came in at S$100 million, constrained by mobile gross profit declines due to subdued roaming and mobile services, although cost savings initiatives and enterprise momentum partly offset headwinds.

📦 Strengthened balance sheet with net debt/EBITDA at just 1.26x - well below the regional telecom average - continuing to provide optionality for organic investment or potential acquisitions.

🚀 Ensign cybersecurity business generated nearly S$400 million in trailing revenues (~15% of group revenue) but remains close to break‑even; management expects project timing to catch up over the rest of the year.

🏢 In competitive telecoms landscape, StarHub is pivoting deeper into enterprise and broadband segments, while peers like Singtel dominate with larger scale in ICT and cloud services; Telstra and Verizon also leverage scale in enterprise tech.

🎯 Management is actively executing its DARE+ digital transformation strategy and expects CapEx of 9–11% of revenue in FY2025, with disciplined spend expected to wrap up by mid‑2025.

📈 Conclusion

StarHub delivers a mixed first quarter: core mobile and entertainment segments under pressure, but growth in enterprise and broadband offers tangible hope.

With robust financial flexibility and cybersecurity revenues poised to catch up, it remains a name to watch for investors seeking yield and disciplined capital execution in the Singapore telecom space.

PS – Was this forwarded to you? Join 9,000+ smart investors getting weekly insights direct to their inbox: investkaki.com

P.P.S. Check out this link where we consolidate all the 1-Min Stock Rundown posts together!

Cheers,

James -Dissecting-Stocks-in-1-min- Yeo