CSE Global: Electrifying Growth Fueled by Acquisitions & Backlog Strength

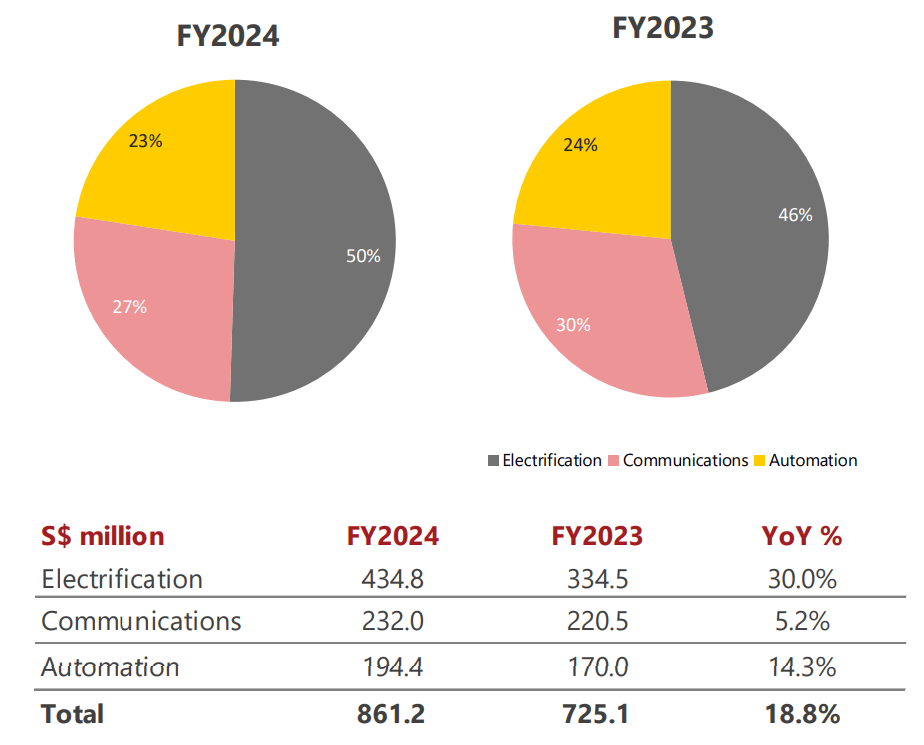

🚀 Record-High Revenue – FY 2024 turnover surged 18.8 % YoY to S$861.2 million, powered by robust Electrification and Automation demand across the Americas and Asia-Pacific. Gross margin held near 28 %, underscoring solid pricing discipline even amid cost inflation.

💰 Profitability Jumps – Core net profit climbed 63.2 % to S$36.8 million, lifting net margin to 4.3%. EBITDA expanded 29 % to S$82.2 million, highlighting operating leverage as scale builds.

📑 Backlog Visibility – The order book closed FY 2024 at S$672.6 million and, after securing S$155.3 million of new wins in 1Q 2025 (41 % communications, 23 % automation, 23 % electrification), still sits at S$616 million - more than 1.2× last-year revenue and supporting forward earnings.

🌐 U.S. Footprint Deepens – Through the recent acquisition of RFC Wireless, Inc., the firm has successfully penetrated the U.S. data-centre communications market. Management intends to expand capacity for its Electrification business in the coming months, with a sharp focus on additional data-centre opportunities and recurring service revenue.

💸 Dividend Sweetener – Trailing twelve months dividends per share stand at 2.4 Singapore cents, translating to a c. 5.4% trailing yield at the recent S$0.44 share price and keeping the payout ratio near 61%, balancing shareholder returns with growth funding.

🏷️ Peer Snapshot – Against Singapore-listed engineering peers, CSE’s valuation looks undemanding. ST Engineering trades around 34x P/E with a 2.21% yield while ISDN Holdings trades at roughly around 16x P/E and 1.5% yield.

CSE Global’s 11x multiple and 5.4% yield, coupled with a strong focus on recurring income, suggest room for a re-rating as its data-centre electrification push scales.

📈 Conclusion

CSE Global pairs an undemanding valuation and a steady dividend payout with a growing North-American footprint - an appealing mix for investors seeking both yield and industrial digital-infrastructure exposure.

PS – Was this forwarded to you? Join 9,000+ smart investors getting weekly insights direct to their inbox: investkaki.com

P.P.S. Check out this link where we consolidate all the 1-Min Stock Rundown posts together!

Cheers,

James -Running-for-1-min- Yeo