📌 Wee Hur Holdings: Strong Revenue Growth, Strategic Reinvestment and Dormitory Expansion

📈 Revenue Up 43% YoY

Wee Hur Holdings reported a 43% increase in 1H2025 revenue to S$156.0 million, driven by a one-off performance and disposal fee from the partial sale of its PBSA Fund I to Greystar, alongside robust progress in its Singapore property development arm.

Gross profit surged 89% to S$84.3 million, lifting margins to 54.1%, while adjusted net profit climbed 164% to S$61.7 million.

🏗️ Construction Order Book at Record High

The Group’s construction order book hit an all-time high of S$629 million, boosted by two new HDB projects worth S$439.4 million secured in May 2025. This positions Wee Hur to capture sustained demand amid Singapore’s public housing and infrastructure boom, with the Building and Construction Authority projecting S$39–46 billion in annual demand between 2026–2029.

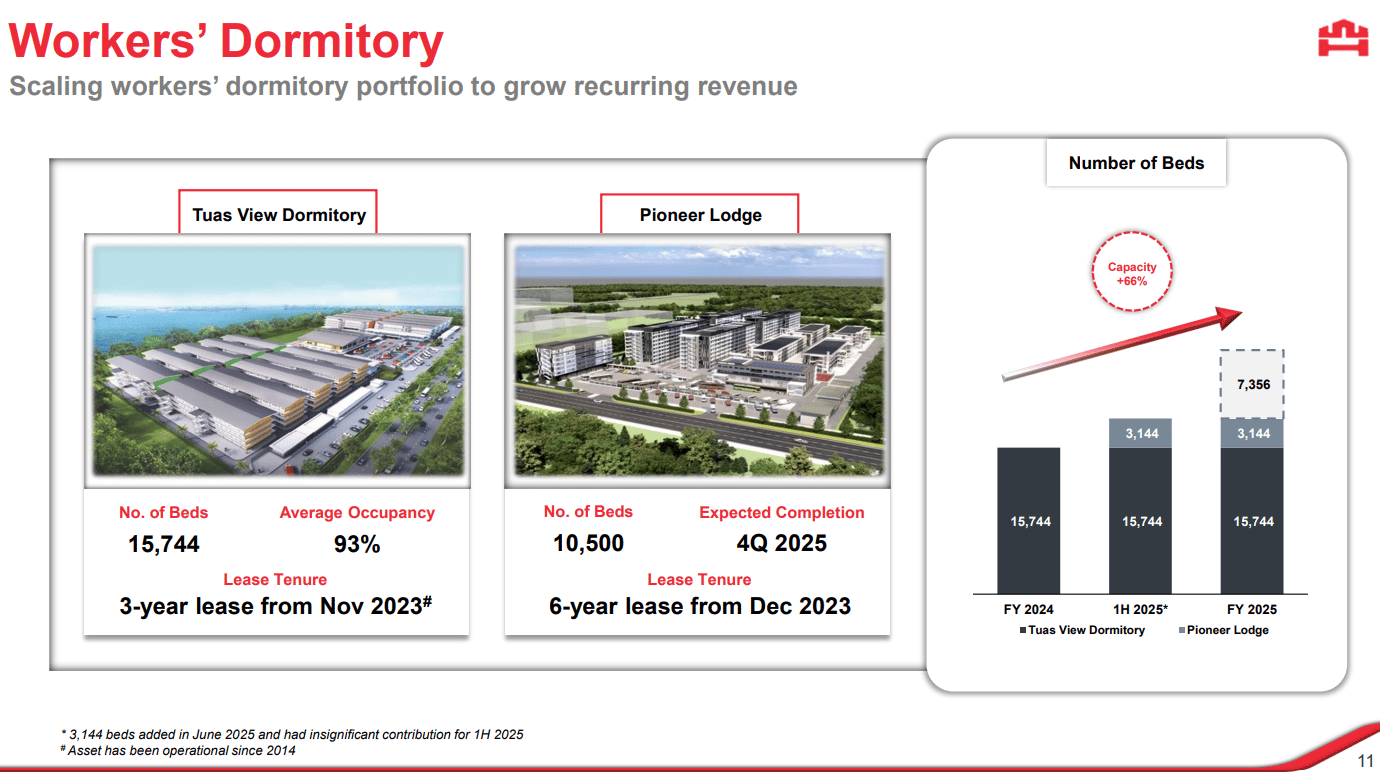

🏘️ Workers’ Dormitory Capacity Set to Expand 66%

With the launch of Pioneer Lodge Dormitory in June 2025 (3,088 beds operational), Wee Hur’s total dormitory capacity will rise to 26,244 beds by year-end.

This expansion addresses Singapore’s tight worker accommodation supply, complementing its stable 93% occupancy at Tuas View Dormitory and supporting steady recurring income.

🏢 Singapore Property Development Momentum

Revenue from Singapore’s property development surged 158% YoY to S$47 million, led by progressive recognition from the fully sold Bartley Vue project. Its Mega@Woodlands industrial property also achieved a 99% sales rate, reinforcing the Group’s strong execution record in the local real estate market.

🏡 Australian Growth Leveraged on Housing Shortages

In Australia, Wee Hur is capitalising on a housing shortfall exceeding 260,000 units by developing 358 residential lots in Queensland and a 708-bed PBSA project in Adelaide (completion by 2027). Its Y Suites PBSA portfolio continues to scale, catering to growing international student demand.

💰 Robust Balance Sheet Enables Growth

Following the S$299.6 million Fund I disposal, Wee Hur maintains a S$277.1 million cash balance, a low 13% gearing ratio, and a S$500 million MTN programme. This provides ample liquidity for reinvestment into property, construction, and fund management.

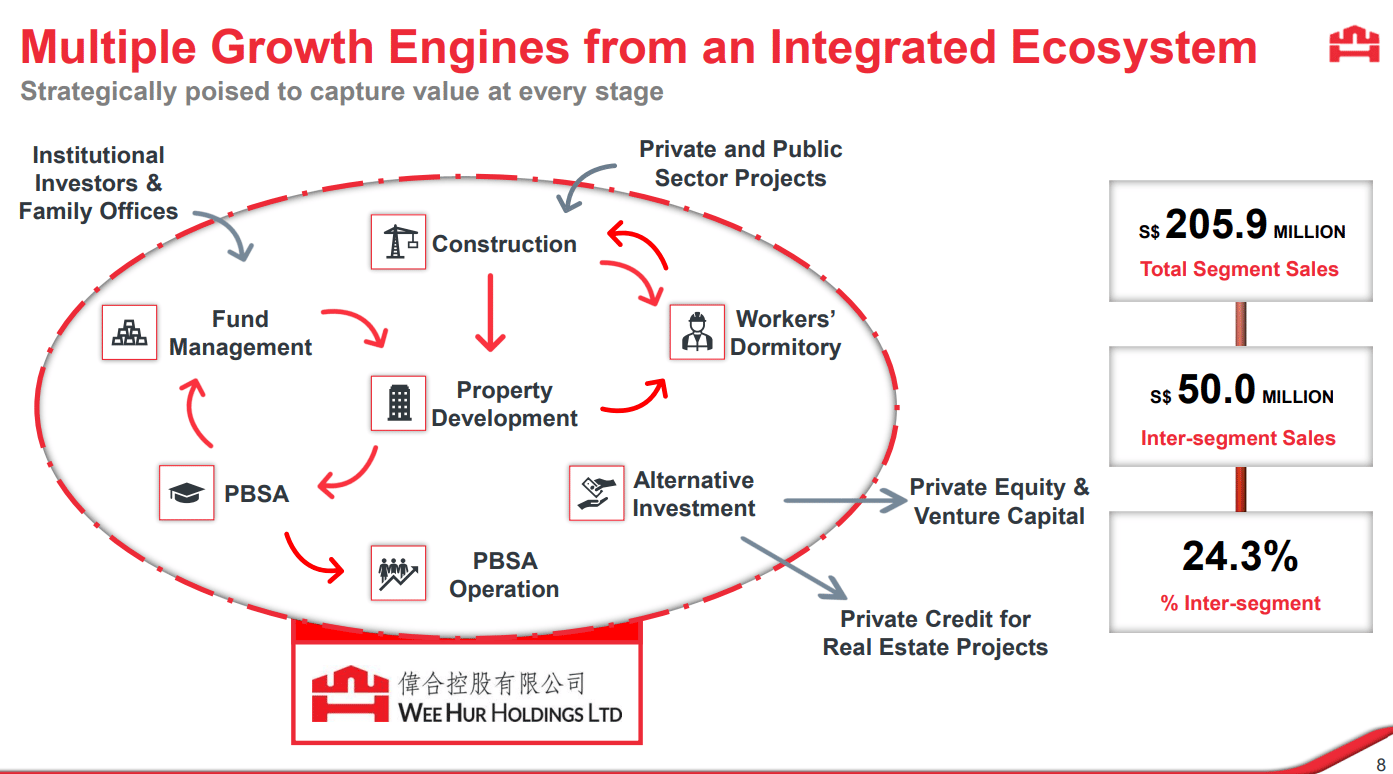

🤝 Competitive Landscape

Wee Hur’s diversified platform positions it alongside peers such as Lian Beng Group, KSH Holdings, and Centurion Corporation, each competing in construction and accommodation assets.

However, Wee Hur’s integrated exposure across PBSA, property development, and fund management offers a unique blend of recurring and growth-driven income streams.

📈 Conclusion

With strong liquidity, rising construction visibility, and recurring dormitory income, Wee Hur is well-positioned for sustainable earnings growth.

Investors seeking a balanced exposure to Singapore’s construction upcycle and Australia’s residential recovery may find this counter a compelling medium-term play.

PS – Was this forwarded to you? Join 9,000+ smart investors getting weekly insights direct to their inbox: investkaki.com

P.P.S. Check out this link where we consolidate all the 1-Min Stock Rundown posts together!

Cheers,

James -Dissecting-Stocks-in-1-min- Yeo