𝐂𝐚𝐩𝐢𝐭𝐚𝐋𝐚𝐧𝐝 𝐀𝐬𝐜𝐨𝐭𝐭 𝐓𝐫𝐮𝐬𝐭: 𝐏𝐨𝐫𝐭𝐟𝐨𝐥𝐢𝐨 𝐑𝐞𝐜𝐨𝐧𝐬𝐭𝐢𝐭𝐮𝐭𝐢𝐨𝐧 𝐃𝐫𝐢𝐯𝐞𝐬 𝐑𝐞𝐬𝐢𝐥𝐢𝐞𝐧𝐭 𝐈𝐧𝐜𝐨𝐦𝐞

📊 1Q 2025 Momentum

Gross profit climbed 4% year-on-year to about S$75 million, fuelled by an 11% lift in RevPAU to roughly US$160. Master leases and guaranteed-income contracts now contribute 70% of gross profit, underpinning steady cash flows even as travel demand normalises.

🏗️ Divest-at-a-Premium Strategy

Management has unlocked more than S$500 million from asset disposals since 2022 at up to 55% above book value, crystallising gains while pruning low-yield tail assets. Part of these realised gains will be distributed over 2025-26 to cushion the temporary DPU dip during refurbishment works.

🔄 Accretive Re-deployment

Roughly S$530 million has already been redeployed into higher-yield properties in Japan, Europe, and the United States at initial yields above 5%, versus the portfolio’s c.4% average. Once fully stabilised, these assets are projected to add about 1.6% to DPU, offsetting income lost from divestments.

💰 Balance-Sheet Discipline

Gearing stands at 39.9% with an all-in cost of debt of 2.9% and interest cover of 3.2×. With S$1.4 billion in available liquidity and 79% of borrowings on fixed rates, the trust can pursue opportunistic deals without immediate equity-dilution risk.

🌍 Competitive Landscape Check

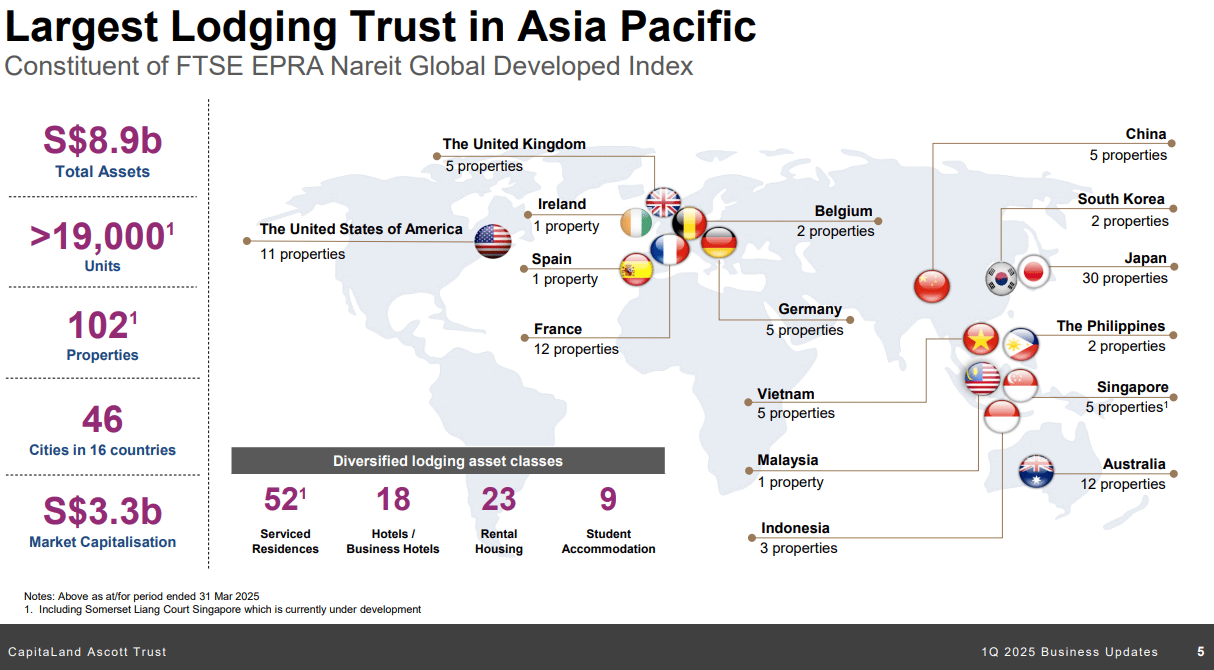

With S$8.8 billion of assets across 46 cities, CLAS dwarfs local lodging peers such as CDL Hospitality Trusts (AUM ≈ S$3.5 billion) and Far East Hospitality Trust (AUM ≈ S$2.6 billion). Its larger footprint and diversified income mix give CLAS greater flexibility to recycle capital and defend distributions across cycles.

🔮 Analyst View

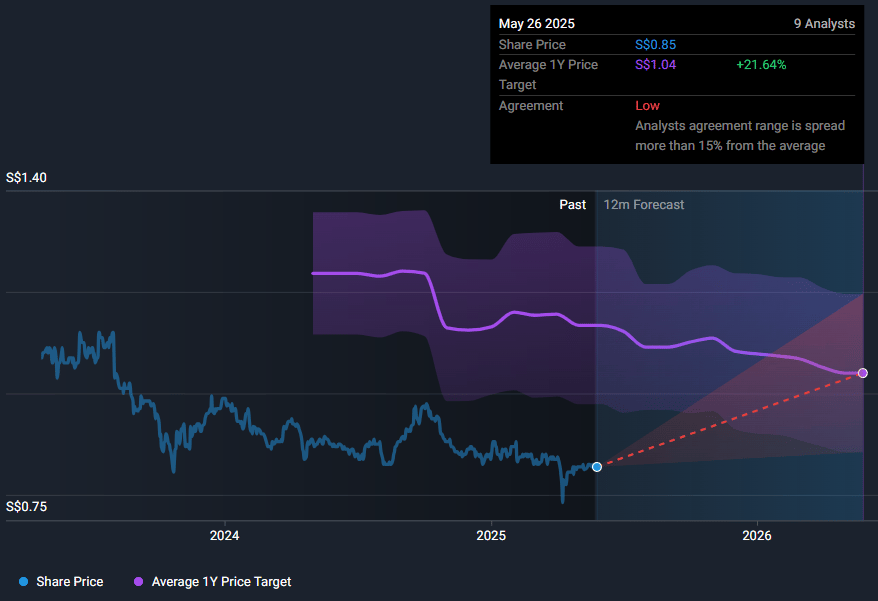

According to simplywall.st, analyst consensus targets sit near S$1.04, implying c.21% upside and a forward yield around 7%. Analysts cite the visible growth pipeline, disciplined capital management, and RevPAU recovery as key supports, while cautioning that renovation-related DPU drag remains a short-term watch-point.

📈 Conclusion

Asia-Pacific’s largest lodging trust pairs defensive income today with embedded growth levers for tomorrow, offering investors a balanced play on travel recovery and disciplined capital recycling.

PS – Was this forwarded to you? Join 9,000+ smart investors getting weekly insights direct to their inbox: investkaki.com

P.P.S. Check out this link where we consolidate all the 1-Min Stock Rundown posts together!

Cheers,

James -Dissecting-Stocks-in-1-min- Yeo