📌 Elite UK REIT - Evolving the Portfolio for Durable Yield and Upside

📈 1H2025 Results Momentum

Distribution per unit rose 10% YoY to 1.54 pence on the back of interest savings, tax benefits and stable income from UK government leases.

Distributable income growth and a tighter cost base underpinned the improvement despite ongoing asset recycling. The manager highlighted the REIT’s counter-cyclical characteristics as a key support for earnings stability.

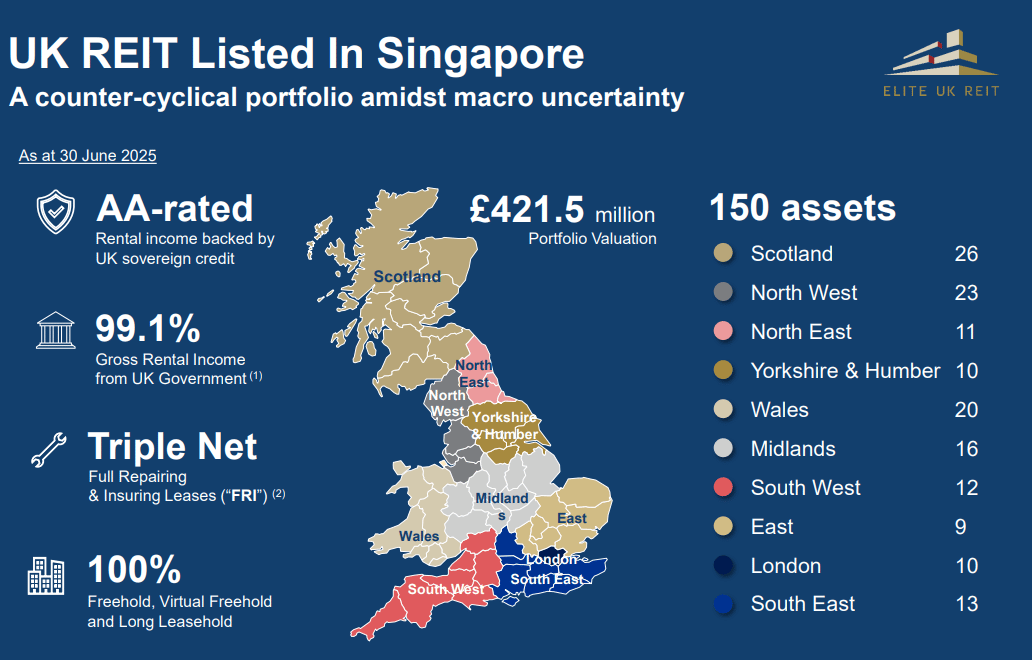

🏢 Portfolio Health & KPIs

Occupancy improved to 95.0% as at 30 Jun 2025, with WALE at 2.9 years after active lease management and early negotiations with the Department for Work & Pensions (DWP).

The portfolio remains nationally diversified across the UK, with mission-critical government workplaces providing long-tenor income visibility. As at 31 Dec 2024, the estate comprised 149 assets totaling ~3.7m sq ft.

➕ Accretive Acquisitions, Lower Concentration Risk

In June, the REIT agreed to acquire three government-tenanted assets for £9.2m at a 7.6% discount to average valuation, with a blended GRI yield of ~9.2%.

Post-deal, DWP concentration eases (c.94.4% → 92.3%) as contributions from non-DWP government occupiers rise, modestly diversifying income. These assets sit near key logistics/port nodes, supporting tenancy resilience.

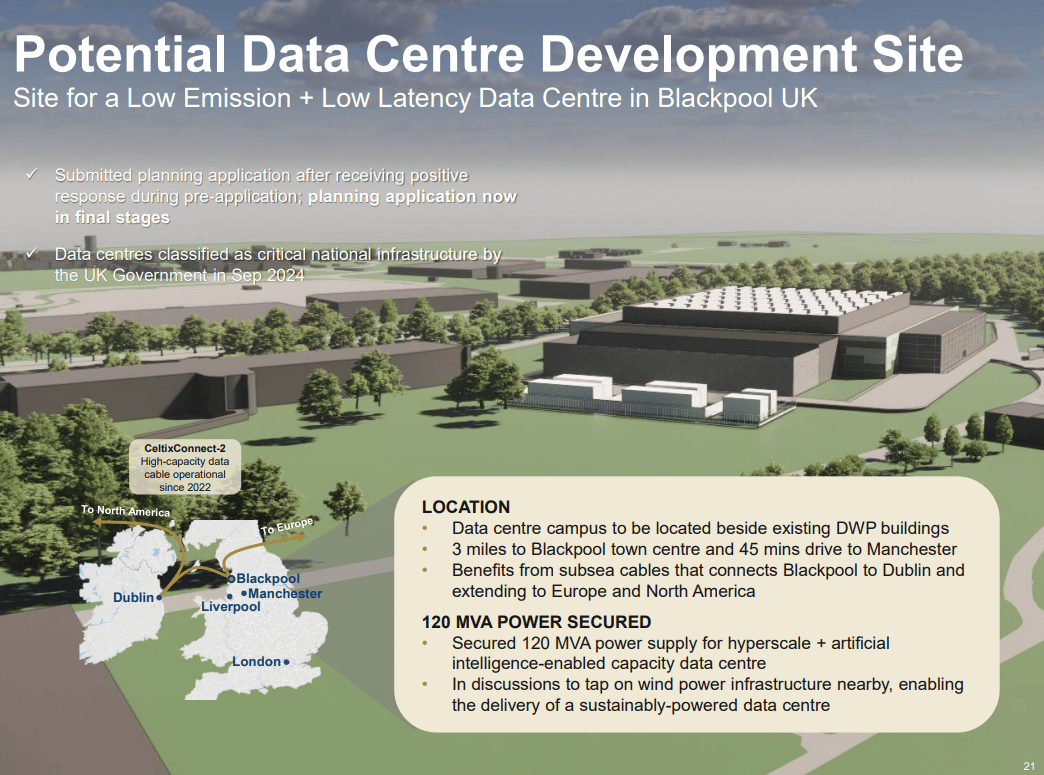

🌱 Growth Prospects - Repositioning & New-Economy Optionality

In a bid to diversify into high-growth sectors and reduce single-tenant exposure, the REIT is looking to reposition the government workplace sites for Built-to-Rent residential and Student Housing.

In fact, planning consent has been secured for “Lindsay House” in Dundee to be repositioned into a 168-bed purpose-built student housing asset. The project carries a pro-forma yield-on-cost of >7%, and an estimated ~18% ROI, targeted completion in year 2027.

On top of that, a potential data centre campus in Blackpool is also advancing through planning, supported by a secured 120 MVA power supply and proximity to subsea cables - offering optionality to tap AI/compute demand should economics and approvals align.

💷 Pricing, Yield & Street View

At ~£0.355, consensus target of £0.385 implies ~8.5% upside, with an indicated cash yield around 5.6%. Valuation continues to reflect UK rate path and GBP dynamics, but improving KPIs are a supportive counter-trend.

🌐 Competitive Landscape (Peers & Positioning)

Elite UK REIT is the only Singapore-listed pure-play on UK government-leased workplaces, offering differentiated sovereign-backed income versus SGX peers focused on Europe-wide offices (IREIT Global, Cromwell European REIT) or data centres (Keppel DC REIT, NTT DC REIT).

📈 Conclusion

With rising occupancy, measured tenant diversification and improving funding metrics, Elite UK REIT offers a differentiated, government-anchored income stream. One to watch for income investors seeking GBP exposure with upside from lease regearing and selective acquisitions.

PS – Was this forwarded to you? Join 9,000+ smart investors getting weekly insights direct to their inbox: investkaki.com

P.P.S. Check out this link where we consolidate all the 1-Min Stock Rundown posts together!

Cheers,

James -Dissecting-Stocks-in-1-min- Yeo