Bumitama Agri: Margin Momentum & Dividend Yield in Focus

📊 Revenue Momentum

1Q25 revenue climbed 19% YoY to IDR 4.59 trillion, driven by resilient benchmark CPO prices and a normalised production base after last year’s supply spike. Management notes the quarter represents the seasonal low-crop period, signalling room for stronger volumes into 2H25.

💹 Profit & Margin Lift

EBITDA surged 36% YoY to IDR 1.01 trillion with margin expanding to 22%, while net profit jumped 51% to IDR 495.9 billion. Improved cost discipline and higher extraction rates cushioned fertiliser-related cost pressures, placing the group ahead of street FY25 run-rate assumptions.

💼 Balance-Sheet Strength

Full repayment of a term-loan facility in March 2024 slashed current liabilities by IDR 1.19 trillion and lifted the group into a small net-cash position by December 2024. This enhances financial flexibility for accelerated replanting and potential downstream moves.

💵 Dividend Upside

Shareholders have approved a final dividend of 5.44 Singapore cents per share, payable 15 May 2025. At the current share price near S$0.76, the ttm dividend yield comes up to roughly 8.7% - one of the highest among mid cap stocks.

🌱 Sustainability & Growth Capex

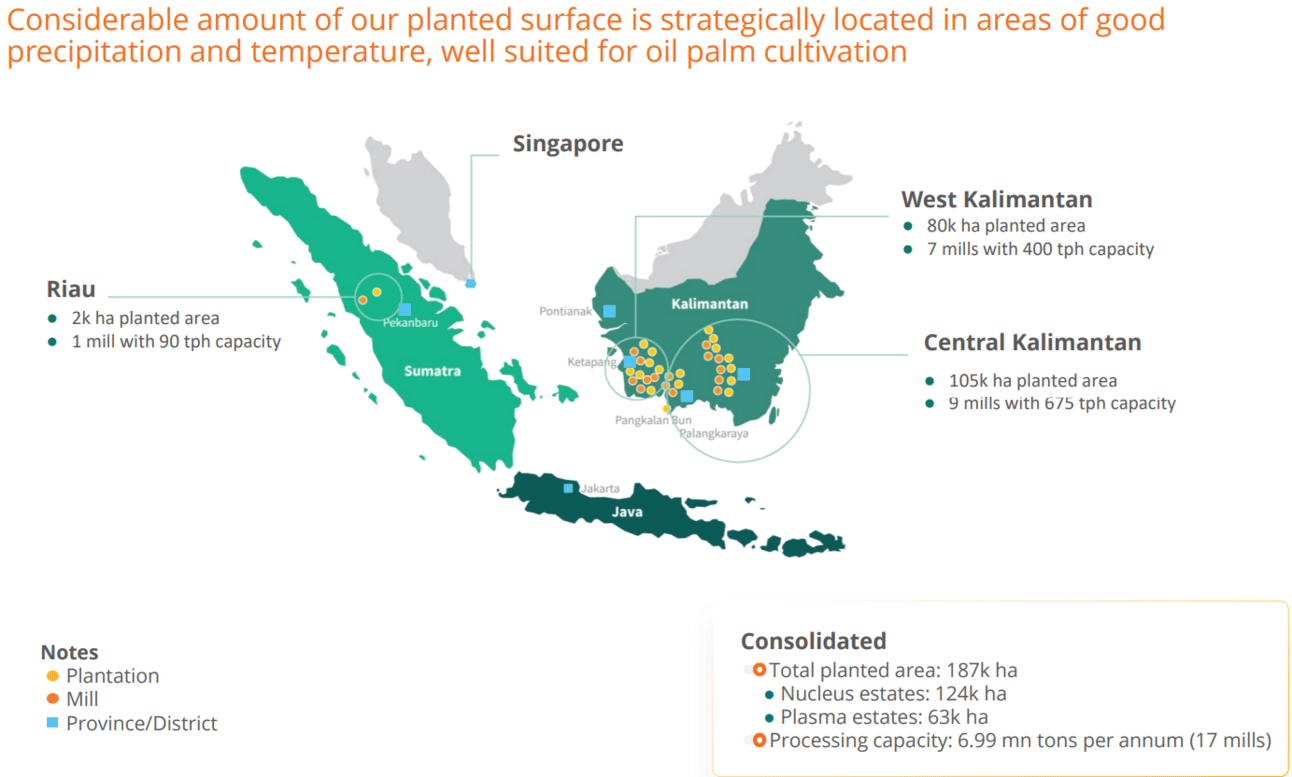

The 2024 Annual Report outlines plans to replant more than 6,000 hectares per year and install methane-capture facilities. Management expects the twin focus on yield uplift and emissions reduction to deliver lower unit costs and safeguard market access under tightening ESG standards.

🌏 Competitive Landscape

Within SGX’s plantation universe, Bumitama’s FY2024 revenue rose about 12%, with a healthy 16.4% net margin. By comparison, Golden Agri delivered 12% revenue growth but a slimmer 3.3 % margin and Wilmar’s integrated model produced flat revenue growth of 0.3% and a 1.7% margin.

Bumitama’s pure upstream focus makes it more sensitive to CPO prices yet historically more profitable on a per-hectare basis, giving it a leg up versus Wilmar’s downstream diversification and Golden Agri-Resources’ larger but lower-margin estate.

📈 Market Reaction

The stock has advanced 6.9% YTD and 18.4% over twelve months, outperforming the Straits Times Index as investors rotate toward high-yield commodity plays amid sticky inflation and easing bond yields.

📈 Conclusion

Bumitama’s margin rebound, leaner balance sheet and >7% forward dividend yield present an attractive proposition for investors seeking CPO-leveraged returns with disciplined capital distribution. Sustained CPO pricing and execution on sustainability capex remain key catalysts through 2025.

PS – Was this forwarded to you? Join 9,000+ smart investors getting weekly insights direct to their inbox: investkaki.com

P.P.S. Check out this link where we consolidate all the 1-Min Stock Rundown posts together!

Cheers,

James -Dissecting-Stocks-in-1-min- Yeo