📌 Stoneweg Europe Stapled Trust - Re-shaping for Growth & Yield Resilience

🏗️ Portfolio reset in motion

SERT executed or agreed divestments of non-core offices, including Cassiopea 1-2-3 in Italy for €11.35m (completion targeted 4Q25) and completed the €7.8m sale of Arkońska Business Park in Poland.

Management frames these as part of a multi-year rotation out of B/C-grade offices to reinforce logistics, light industrial and data centre exposure while supporting a 35–40% medium-term gearing target.

📊 Solid 1H25 operating lift despite higher rates

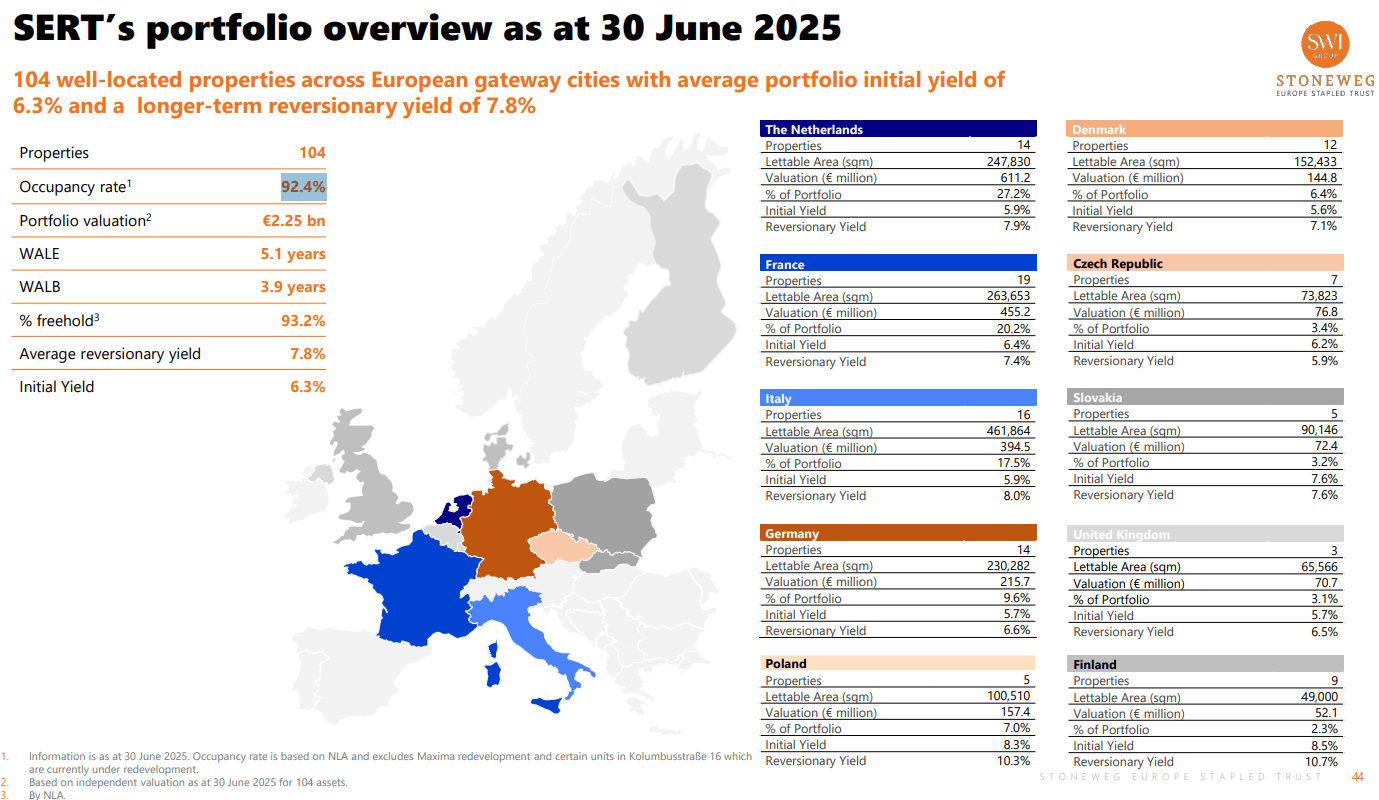

Like-for-like NPI rose 4.9% with +11.9% rent reversion, helping NAV per stapled security rise 3.5% to €2.05. DPS for 1H25 was 6.553 Euro cents (-7% YoY), in line with expectations as higher interest costs offset NPI gains.

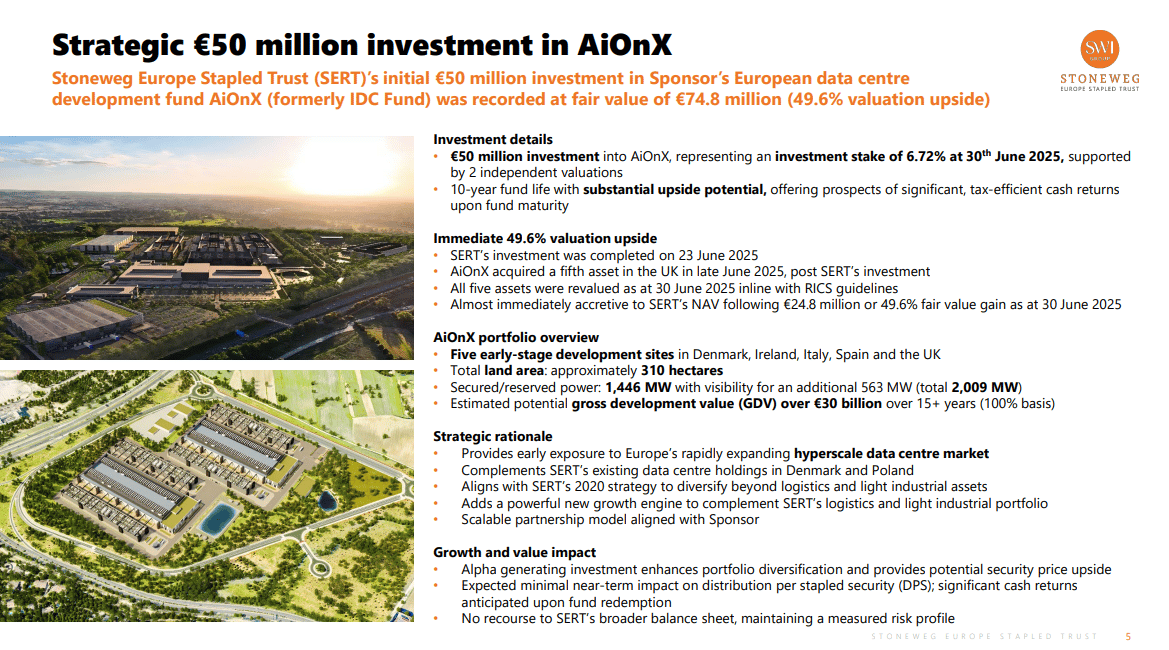

🔌 Strategic data centre optionality

A €50m early entry into AiOnX (the Sponsor’s European hyperscale DC development fund) was marked at €74.8m as at 30 Jun 2025, implying a 49.6% uplift and immediate NAV accretion.

The fund spans five sites across Denmark, Ireland, Italy, Spain and the UK with 1.45GW power secured/reserved, positioning SERT to participate in Europe’s AI-driven compute build-out.

💸 Balance sheet: term out, headroom intact

Following a €500m six-year green bond issued in Jan 2025, there are no maturities until late-2026; interest cover stood at 3.2x. Net gearing was 41.8% in 1H25 with an expectation to dip below 40% post announced/advanced divestments; undrawn RCF liquidity adds further flexibility.

🏬 Leasing momentum and occupancy

Portfolio occupancy improved to 92.4% by 2Q25 with office WALE extended to 5.1 years, matching logistics.

Notable wins included a 20-year, 26,039 sqm lease with NN Group at Haagse Poort (+~50% rent uplift) and broad-based rent reversions across sectors (+15.5% in 2Q25).

🌍 Competitive landscape - where SERT fits

Among SGX names with European exposure, IREIT Global concentrates on Continental office/retail (€859.8m portfolio; c.89.5% occupancy), while Elite UK REIT is UK-only and largely government-leased, emphasising income stability.

Frasers Logistics & Commercial Trust offers a broader APAC/Europe industrial-commercial mix. SERT differentiates via a diversified Western Europe footprint plus an aligned DC development sleeve, offering both cashflow from core assets and NAV upside potential from data centre optionality.

💹 Market context & trading snapshot

SERT trades on SGX in EUR (SET) and SGD (SEB). Recent quotes show SEB around S$2.30 with typical daily liquidity, offering investors a listed gateway to European logistics/light-industrial, offices under active repositioning, and emerging data centre exposure.

📈 Conclusion

A cleaner, more future-proofed portfolio, improving leasing metrics and data-centre-linked NAV torque make this one to watch for investors seeking diversified Europe real assets with capital-discipline and optional growth drivers.

Financial News Keeps You Poor. Here's Why.

The scandalous truth: Most market news is designed to inform you about what already happened, not help you profit from what's coming next.

When CNBC reports "Stock XYZ surges 287%"—you missed it.

What you actually need:

Tomorrow's IPO calendar (not yesterday's launches)

Crowdfunding deals opening this week (not closed rounds)

What real traders are positioning for (not TV talking heads)

Economic data that moves markets (before it's released)

The financial media industrial complex profits from keeping you one step behind.

Stocks & Income flips this backwards. We focus entirely on forward-looking intel that helps you get positioned before the crowd, not informed after the move.

Stop chasing trades that happened already.

Start prepping for the next one.

Stocks & Income is for informational purposes only and is not intended to be used as investment advice. Do your own research.

PS – Was this forwarded to you? Join 9,000+ smart investors getting weekly insights direct to their inbox: investkaki.com

P.P.S. Check out this link where we consolidate all the 1-Min Stock Rundown posts together!

Cheers,

James -Dissecting-Stocks-in-1-min- Yeo