📌 Winking Studios - Riding the Gaming Wave with Scale, M&A and Blue-Chip Clients

📈 Strong 1H2025 performance

Revenue rose 27.3% YoY to US$19.4m, supported by the US$19.8m Mineloader acquisition that contributed US$4.1m in just three months.

Gross profit increased 38% to US$5.9m with margins improving 230bps to 30.2%. Adjusted EBITDA reached US$2.4m (+18%), while net cash stood at US$27.1m.

🧩 Bookings visibility and follow-up revenues

Indicative bookings surged to US$49.4m for the next 24 months, of which US$18.4m is to be recognised in 2H2025.

Repeat “follow-up” work on evergreen franchises contributed 39% of 1H revenue. This gives Winking more than 86% coverage of FY25 revenue forecasts, underpinning earnings visibility.

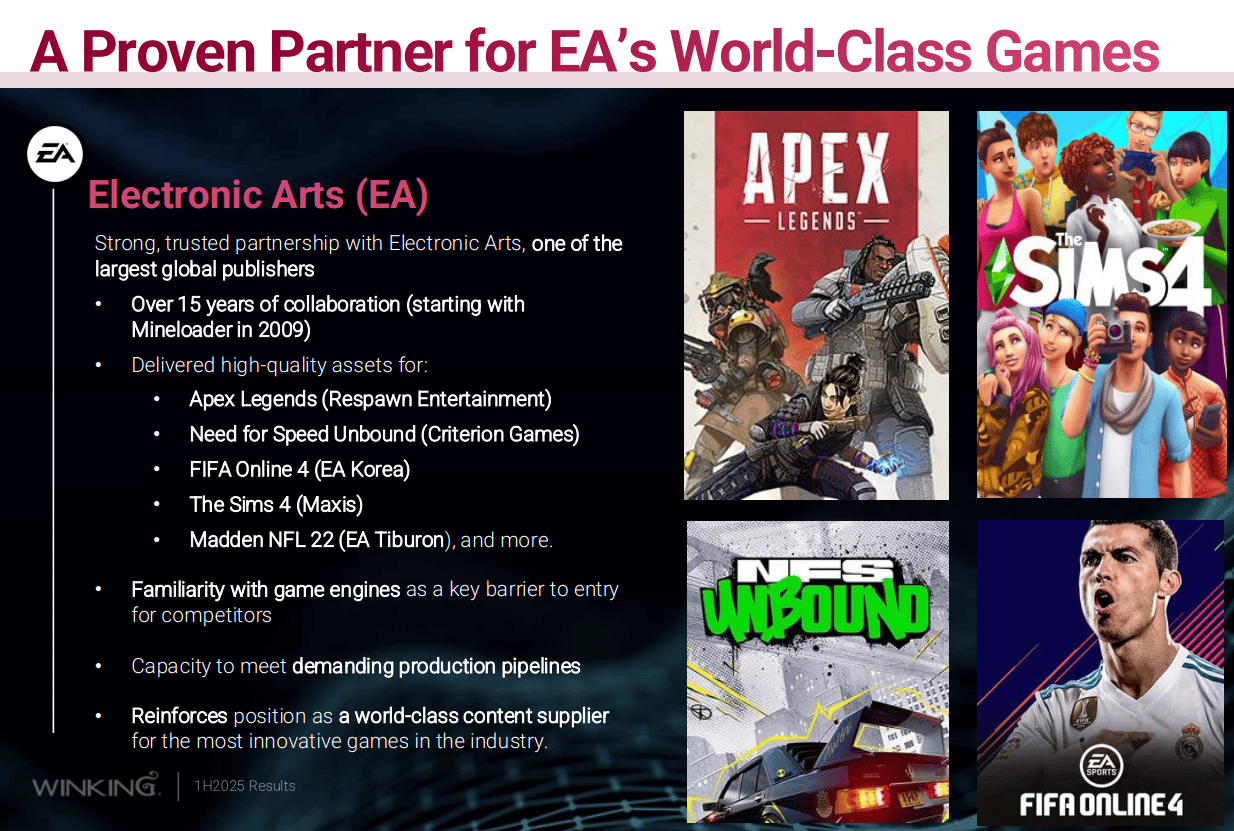

🎮 Blue-chip client base as a barrier to entry

Winking works with 22 of the world’s top 25 game developers, including EA, Take-Two, Activision, Ubisoft, Sony Interactive Entertainment, SEGA, Tencent, NetEase, and Nexon.

These longstanding ties cover marquee titles like Assassin’s Creed, Final Fantasy, FIFA Online, and Genshin Impact, creating sticky relationships and recurring high-value projects.

🌏 Strategic M&A and global expansion

The group has executed three acquisitions in 18 months - On Point Creative, Pixelline, and Mineloader - broadening capabilities and deepening reach into Japan, the US, and Europe.

With Acer’s 64.2% strategic backing, Winking has substantial firepower to pursue further M&A, particularly in Europe, where day rates are 2x higher than Asia.

🏛️ Competitive landscape and valuation

Winking is a global top four art outsourcer with just 0.7% market share in a fragmented US$10.9bn industry.

Peers include Keywords Studios (acquired by EQT at 14x EV/EBITDA), Virtuos, and Pole to Win. Zeus Capital values Winking at 19–21 p/share, implying 33–47% upside, as margins converge toward leaders (28% vs Winking’s 15.1% in 2024).

⚠️ Risks to monitor

Key risks include client concentration (top five contribute 52% of FY24 revenue), acquisition integration, regulatory shifts in China (25% of sales), and potential AI disruption in 2D art. However, diversification into Western clients and sticky “follow-up” work provide important buffers.

📈 Conclusion

With blue-chip partnerships, visible bookings, and next-gen console demand, Winking is well positioned to compound growth.

Backed by Acer’s support and a credible M&A pipeline, it represents a consolidator in global game outsourcing with clear upside from margin expansion.

How Canva, Perplexity and Notion turn feedback chaos into actionable customer intelligence

You’re sitting on a goldmine of feedback: tickets, surveys, reviews, but can’t mine it.

Manual tagging doesn’t scale, and insights fall through the cracks.

Enterpret’s AI unifies all feedback, auto‑tags themes, and ties them to revenue/CSAT, surfacing what matters to customers.

The result: faster decisions, clearer priorities, and stronger retention.

PS – Was this forwarded to you? Join 9,000+ smart investors getting weekly insights direct to their inbox: investkaki.com

P.P.S. Check out this link where we consolidate all the 1-Min Stock Rundown posts together!

Cheers,

James -Dissecting-Stocks-in-1-min- Yeo