Make Investing Simple Again

📝 Editor’s Note

With markets near highs, I went back to basics this week – looking for value, not noise.

Using SimplyWallSt as a reference, we found 4 interesting stocks trading below intrinsic value.

On one end are familiar global names like Meta and Microsoft, where AI investments are finally translating into engagement and revenue, yet valuations remain reasonable.

Closer to home, Ultragreen.ai highlights the power of niche dominance and long runways, while ST Engineering offers steadiness through its deep orderbook and consistent execution.

Together, these picks reflect a simple idea: value works best when fundamentals and price start to align 🎯

Warm regards 🌱

InvestKaki Team

Table of Contents

Big Hits [U.S.] 💵

Moving on, here are the news that shocked the world…

Meta $META ( ▼ 2.95% ): Is Meta meta? 4Q 2025 results exceeded expectations as revenue grew by 24%. Guess what? It is spending way more on AI in 2026. Think $135 billion [Read More]

Microsoft $MSFT ( ▼ 0.74% ): Microsoft 4Q results also exceeded expectations but investors are not that happy with its slowing cloud growth. Revenue is up by 16.7%, while profits grew even stronger at 60% [Read More]

Starbucks $SBUX ( ▼ 2.06% ): Starbucks turnaround is coming. Same-store growth for 4Q 2025 was up but ultimately, earnings missed expectations. Revenue is up by 6% [Read More]

Comcast $CMCSA ( ▲ 1.74% ): Comcast is in trouble for 4Q results. Well, sort of. Its broadband business is dragging the company down as competition is intense. However, its mobile business is doing pretty well [Read More]

Boeing $BA ( ▼ 0.14% ): Boeing is flying high again. 4Q revenue was up by 140%, but it still made losses. Commercial airplane sales drove the higher performance. [Read More]

Big Hits [Asia] 📊

Here are the news covering the Asia market…

Alibaba: $BABA ( ▼ 2.69% ) has released two newest AI models - Qwen-3-Max-Thinking and Kimi K2.5 (Moonshot AI) - and reportedly are beating OpenAI and Google Deepmind [Read More]

Starhill Global REIT: All steady. 1H 2026 revenue was at $96.3 million, but profit dipped slightly by 0.8%. Meanwhile, contributions were higher from Ngee Ann and Lot 10 [Read More]

Micron $MU ( ▼ 4.8% ): Micron is planning to invest US$24 billion in Singapore over the next decade to expand its manufacturing capacity as it faces severe shortages [Read More]

ST Engineering: Another contract win. ST Engineering has won a contract from Singapore’s Ministry of Defence to produce a fleet of infantry-fighting vehicles [Read More]

OUE REIT: Distribution per unit is up 10% for 2H 2025, driven by stronger Singapore commercial and hospitality portfolio [Read More]

4 Undervalued Stocks

Please see below the list of this week’s hand-picked analyst reports:

Stock | Headline | Link |

|---|---|---|

Meta | AI monetisation staring to show. Shares undervalued | |

Microsoft | AI demand ramping up | |

Ultragreen.ai | Global ICG Colossus | |

ST Engineering | Sizeable contract win |

Stock #1 - Meta

Meta operates social media platforms such as Facebook, WhatsApp, and Instagram and sells advertisements.

It’s quite surprising to see Meta being relevant in the AI space currently. I still remember looking at its large losses from its Reality Labs (which it still is incurring, and Meta is cutting jobs from it) and thinking “When would Meta catch up?”.

But 4Q 2025 results are showing encouraging signs. Most importantly, the analyst report from Morningstar showed that

Meta’s AI investments are driving higher engagement and content recommendation in its social media platforms.

Ad impressions grew by 18% for 4Q.

Ad clicks are up by 3.5% for Facebook and 1% for Instagram.

I was interested in the financial projections for 1Q 2026 and 2026 as a whole and found that this analyst was bullish on its sales growth.

1Q 2026: +30%

2026: +25%

He expects the new LLM model being released by Meta to be comparable to the other models in the market, and views the $125 billion AI investments as positive.

I do agree somewhat with the views here, and generally, I find that Meta is trading at relatively cheap valuations at a price-to-earnings ratio of 30.8 times (industry average: 31.4 times).

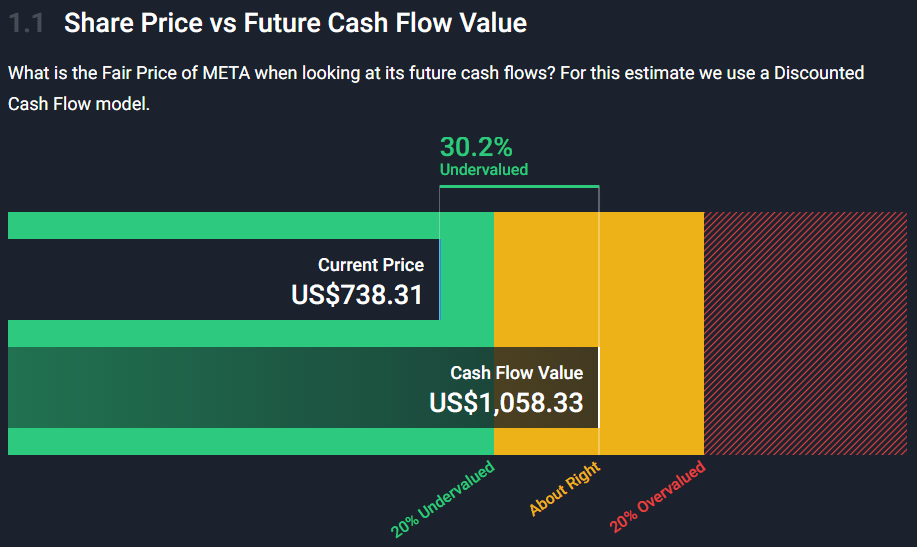

Source: SimplyWallSt

Furthermore, based on SimplyWallSt’s discounted cash flow (DCF) valuation, it is deemed to be 30.2% undervalued.

Stock #2 - Microsoft

Microsoft develops and sells software such as Microsoft 365, Windows operating systems, Copilot and many other more.

Not all has been positive for Microsoft last year. When it unveiled its plan to spend more on AI investments, investors greeted it with lukewarm responses. Many were afraid that the Magnificent 7’s investments were not generating returns.

However, it has started to bear fruit in the latest financial results.

Commercial bookings rose by a whopping 228% for 2Q 2026 (quarter ending Dec 2025), driven by Azure, its cloud computing platform. Azure AI grew by 38% for the quarter.

Microsoft Co-pilot has 15 million paid seats.

No doubt, investors are still right in doubting Microsoft. Capital expenditures are still projected to grow by over 80%, far outpacing the sales growth of its AI products.

I do see a case for Microsoft to gradually get more clients and customers for its AI services, considering that most of the world uses its Windows platform.

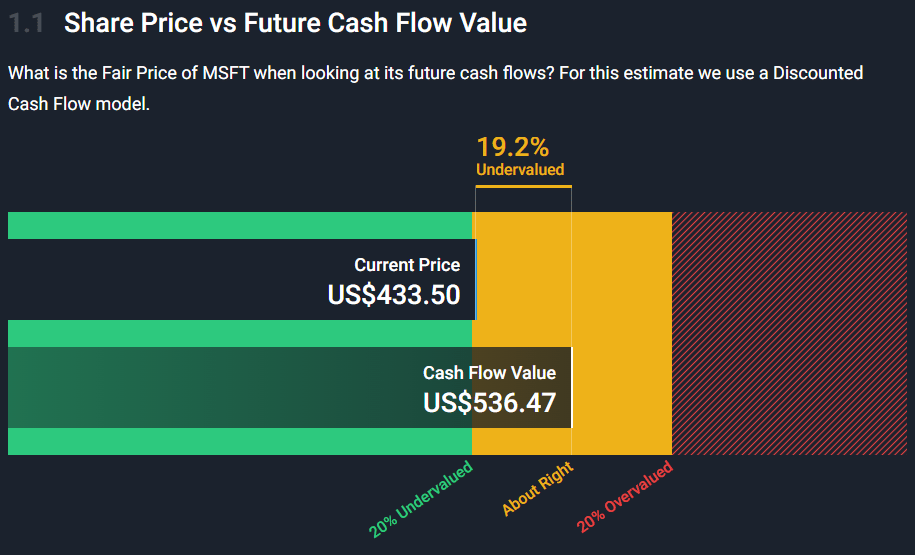

But it all comes down to valuation for me. And SimplyWallSt’s DCF showed that it is 19% undervalued.

AI opportunities are not just in the U.S. In the Middle Kingdom, AI companies are booming as never before.

Stock #3 - Ultragreen.ai

Ultragreen produces and sells indocyanine green dye and imaging systems that enables real-time imaging for surgeries.

It is not often I find such a big global player. And in Singapore? But that’s what Ultragreen is. It is the global market leader with over 60% market share.

DBS is very positive on the company for the following reasons:

Strong moat as regulatory approval takes 5 to 6 years, which limits entries of new players.

Ultragreen is 2.6 times bigger than the second biggest player in the world.

Long growth runway as ICG has proven to be cost-effective and safe.

Quantification software is a big catalyst should it be more commercially viable.

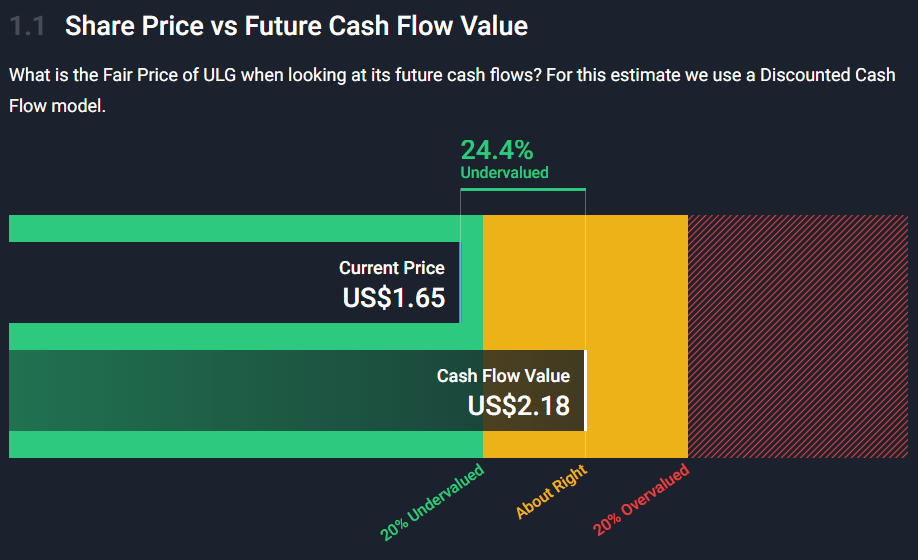

Furthermore, the company is considered 24.4% undervalued by SimplyWallSt’s DCF. All signs are green, with little red flags.

Stock #4 - ST Engineering

ST Engineering is a technology, defense and engineering company.

The company is a contract-winning machine. And it is winning them from large established players, and government ministries.

It is no wonder that it currently has an orderbook of $32.6 billion, which could sustain the company for the next 3 years.

Its latest contract win from Singapore’s Ministry of Defense, solidifies ST Engineering’s reputation in the industry.

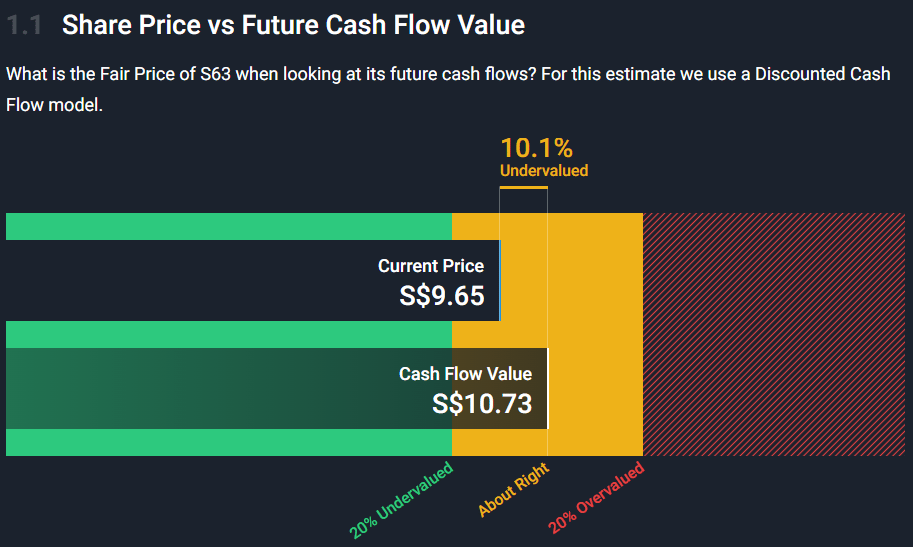

SimplyWallSt’s DCF values the company as being 10% undervalued.

Getting deep and real about REITs and AI Stocks with Jun Yuan!

👉 Follow us on YouTube here!

Hope the above is fruitful for you all..

Cheers,

James Yeo

Socials of the Week