Make Investing Simple Again

📝 Editor’s Note

Happy Chinese New Year, Investing Kakis!

May you ride the horse to more profits this year…

With this in mind, we have selected 5 CNY stocks to highlight this week that we think can HUAT BIG BIG!

Besides that, we have some news from Bill Ackman’s new bet on Meta and earnings results for Ford, Coca-Cola, McDonald’s, DBS, Elite UK REIT, and Wing Tai.

✨❤️🔥 發 ah

InvestKaki Team

Table of Contents

Big Hits [U.S.] 💵

Moving on, here are the news that shocked the world…

Ackman X Meta $META ( ▼ 1.55% ): Bill Ackman has unveiled a $2 billion bet on Meta platforms, citing its AI integration benefits on its applications. [Read More]

InPost $FDX ( ▲ 1.42% ) $ADN ( ▼ 6.82% ) : Fedex and Advent are buying parcel locker firm, InPost for $9.2 billion to expand their reach in Europe [Read More]

Ford $F ( ▲ 1.95% ): Ford’s earnings missed expectations as it’s hit by tariffs, shortage of aluminum, and electric vehicles losses. It declared a total 2025 loss of $8.2 billion. [Read More]

Coca-Cola $KO ( ▼ 0.41% ): Coca-Cola earnings missed expectations as consumers shift to more budget-conscious beverages. Sales volume only grew by 1% for the year [Read More]

McDonald’s $MCD ( ▼ 1.36% ): Earnings topped expectations as its value meals are driving its business. Budget-conscious consumers are favouring lower-priced meals. [Read More]

Big Hits [Asia] 📊

Here are the news covering the Asia market…

Lenovo $LNVGY ( ▲ 2.79% ): Lenovo’s earnings beat expectations. Revenue and adjusted earnings are up by 14% and 36% on stronger PC, tablet and smartphone demand [Read More]

Anchor Fund: The Singaporean government will launch an additional $1.5 billion tranche of the Anchor Fund, and expand the EQDP program to $6.5 billion [Read More]

DBS: Earnings were down by 10% for 4Q 2025 as it incurs higher taxes. Full-year earnings were also down by 3% as DBS made higher special allowances for losses [Read More]

Elite UK REIT: The REIT reported a higher DPU of 5.6% for 2025 due to a one-off gain. Revenue dropped by 1.3% due to higher repositing expenses [Read More]

Wing Tai: Wing Tai’s earnings were up by 300% as it recognises more sales from River Green and Lakegarden residences. [Read More]

5 CNY Stocks to Watch

Please see below the list of this week’s hand-picked analyst reports:

Stock | Headline | Link |

|---|---|---|

Spotify | Strong 4Q results despite price increases | |

Salesforce | Rise in agentic AI to drive growth | |

Xpeng | Leading EV manufacturer in China | |

Sea Ltd | Margin recovery with undervalued share price | |

DBS | Top dividend player with sound asset quality |

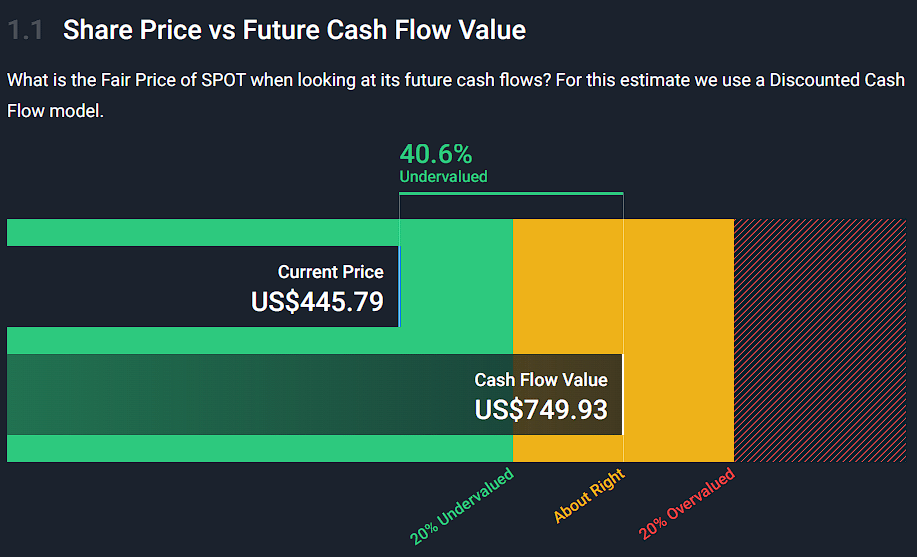

Spotify has been hitting its stride in the latest quarter. It added 38 million total users, with 9 million of them being paid. For the whole year of 2025, it added 25 million paid subscribers, proving that people will pay for easier access to music streaming.

However, AI music is starting to eat into the business. While it won’t wholly replace Spotify’s value proposition, Spotify has acknowledged that it will affect its business.

Why we like this: Spotify recorded its highest growth in monthly users in 4Q 2025, and we view this as positive considering that AI music is starting to eat into the industry.

In the past 6 months, share price is down by 38%, presenting an attractive opportunity to enter. Price-to-earnings ratio is trading at 35 times, compared to its peers’ average of 80 times.

The era of agentic AI is fast approaching. And Salesforce is the poster boy for customer relationship management. While it has a 30% market share, analysts are saying that it still has room to grow as companies look to automation to cut cost and drive growth.

Furthermore, it intends to improve its margins and profitability considering that the company is entering its maturing stage.

Why we like this: We like Salesforce dominant market position (30% market share) and see that it still has legs to run on.

The recent improvement in the U.S’ jobs gain data in January 2026 indicates that companies are hiring again and the labour market is gradually recovering. We view this as a positive sign for Salesforce to expand its business with improving business sentiment.

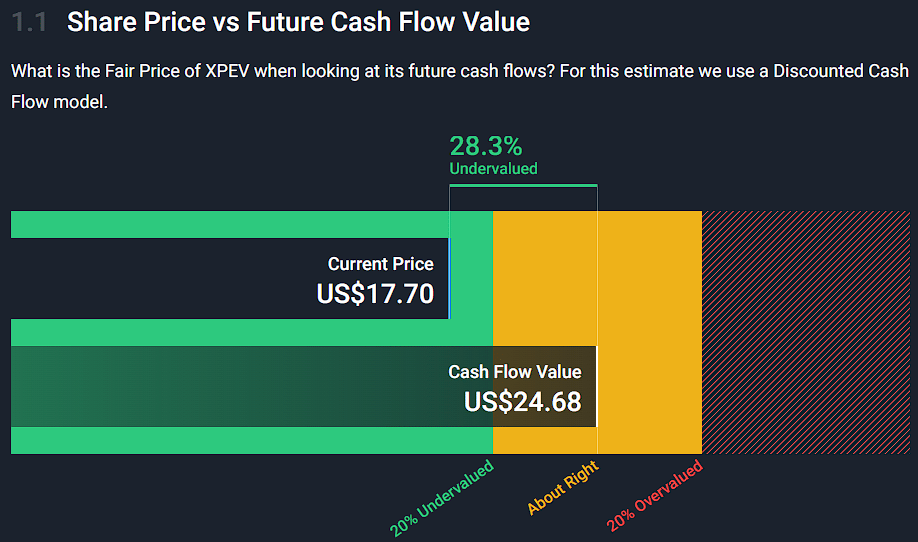

China’s electric vehicle market continues to be hyper-competitive. While margins for most players are still under pressure, Xpeng has carved out a niche for itself by developing its own autonomous driving software. It does not rely on third-party software providers.

Why we like this: A clear undervalued trend is emerging in China’s EV sector. While the headwinds of price war and trade tensions (with the U.S. and Europe) continue, the sector has been oversold in recent months.

It’s undeniable that the global EV sector will be dominated by Chinese players in the next few years. Xpeng’s discounted-cash-flow valuation has indicated that it’s now undervalued.

SEA Ltd has been gaining by leaps and bounds in the past couple of years. It has significantly declined by 38% from 6 months ago after reaching its second-highest peak in August 2025 (first peak was in 2021).

In 2026, Sea is focusing more on AI to improve its operations and explore more monetisation channels.

Why we like this: SEA Ltd still represents a market leader story with Shopee having a strong foothold in the Southeast Asia e-commerce industry.

Potentially, AI usage could push Sea to have better margins and expand monetisation opportunities.

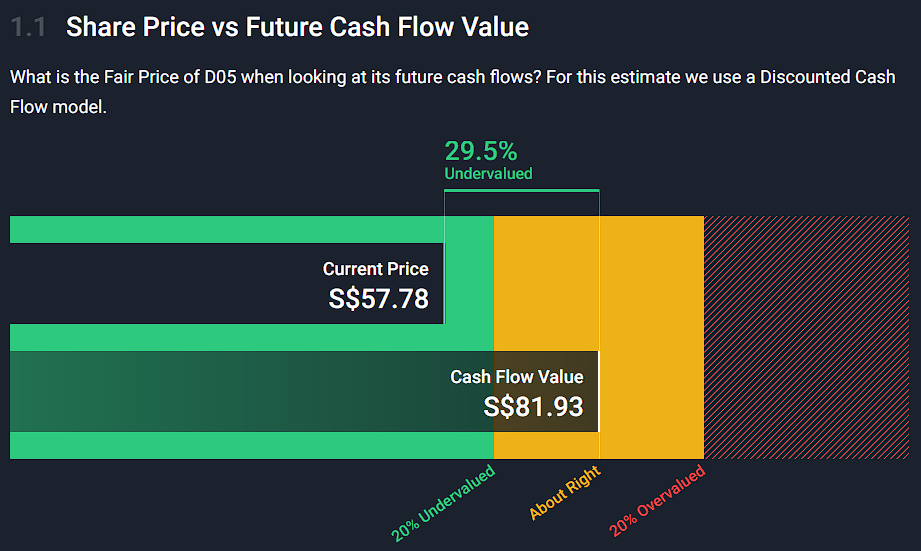

DBS Group recently reported that its profits fell by 10%, as it cited that it faced rate headwinds, higher tax expenses and absence of non-recurring gains.

Why we like this: Despite the results, the OCBC report above highlighted that DBS had achieved record results in the past four years. Its asset quality remains high with a low non-performing loans ratio.

DBS is still a dividend powerhouse in the Singapore market. This could present an attractive cheap opportunity at this point.

Is there an opportunity in the SaaS space?

👉 Follow us on YouTube here!

Hope the above is fruitful for you all..

Cheers,

James Yeo

Socials of the Week