This article was created with the help of Simplywall.st, an investing platform that turns complex financial data into easy-to-understand visuals. It’s one of my Favourite go-to tools for analysing company fundamentals and spotting new ideas. You can explore it here.

Tumultuous is probably an appropriate word to describe 2025.

Trump got elected, waged a tariff war on the world (which is still ongoing), and plunged markets into uncertainty.

Russia and Ukraine are still fighting. The Middle East is in perpetual conflict.

China is starting to show that it has U.S.-level type of economic power, by threatening to curb exports of rare earth metals.

Worse, the AI bubble is showing signs of bursting and unravelling.

So, we feel this is a great time to talk about stocks that have defensive properties that can weather any kind of risks in the market.

Specifically, we are looking for U.S. stocks that have:

Low beta of between 0 and 0.5. Beta is an indicator of how the stock moves with the market. The higher it is, the more it moves in line with the market, and thus, are affected by risks in the market.

Decent dividend yields that will compensate for limited movements in its share price.

The 5 Companies We Are Looking At

1. Verizon $VZ ( ▲ 0.36% )

Verizon is a telecommunication company that provides communication, information and entertainment products.

It operates wholly in the United States

76% of its revenue is derived from regular customers, while 22% is from businesses.

It recorded a 5-year beta of 0.32, while also delivering a 6.7% dividend yield.

Telecommunications companies are normally considered as recession-proof. Consumers and businesses still have to buy phone plans and internet regardless.

Verizon’s dividend yield is above the industry’s average of 5.5%.

Financially, Verizon’s financial performance has been stable over the past five years from 2020 to 2024

Revenue grew at an annual average of 1.2% and averaged about US$130 billion to US$140 billion.

Annual profits are a bit more volatile, but generally are around the range of US$15 billion to US$20 billion.

It is severely undervalued by 62% at this point according to the Discounted Cash Flow valuation.

Source: SimplyWallSt

2. Allstate $ALL ( ▲ 1.78% )

Allstate provide insurance services to people and businesses especially for property and real estate.

84% of its revenue comes from property liability insurance premiums, while protection services for shopping goods contributes about 4%.

Most of its business are in the United States (96%), with overseas market making up the remaining.

Insurance businesses are very recession-proof, and incredibly stable. Nobody wants to go without insurance in any situation.

Beta is at 0.26 compared to the financial sector average of 0.70.

Dividend yield is at 1.9% but that’s because its dividend payout ratio is low at 13%.

Allstate has been generating strong financial performance.

Revenue grew at an average annual rate of 11.2% from 2020 to 2024.

However, profits have been uncertain as it recorded a peak of US$5.7 billion in 2021, but declined to US$4.7 billion in 2024.

However, in 2025, profits have rose considerably. Quarterly revenue averaged US$2.2 billion compared to 2024’s average of US$1.2 billion.

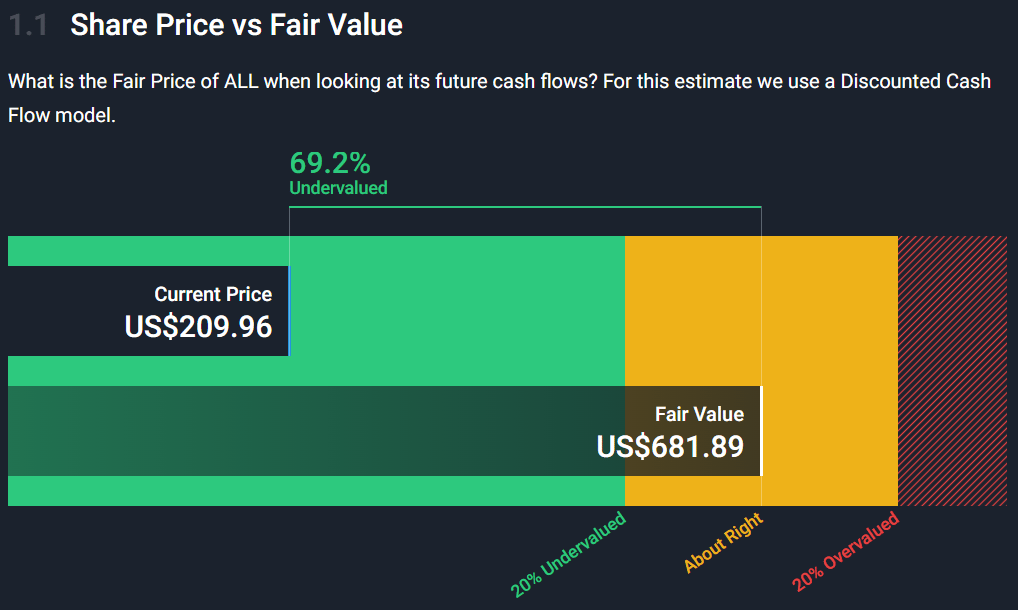

Valuation-wise, Allstate is undervalued by 69% according to SimplyWallSt’s DCF valuation.

Source: SimplyWallSt

3. Arch Capital Group $ACGL ( ▲ 0.49% )

Arch Capital Group (ACG) provides underwriting services for insurance, reinsurance and mortgages.

Reinsurance and insurance businesses make up the core segments at 49% and 45% of revenue respectively.

North America makes up most of its revenue at about 50%, with Europe making up 16%.

Source: Arch Capital Group

The insurance company has a 5-year beta of 0.45 compared to the financial sector average of 0.70, making it a safe bet during difficult times in the market.

Arch Capital has done very well in the last 5 years.

Revenue doubled from US$8.4 billion in 2020 to US$16.9 billion in 2024.

Profits tripled from US$1.4 billion to US$4.3 billion over the same period.

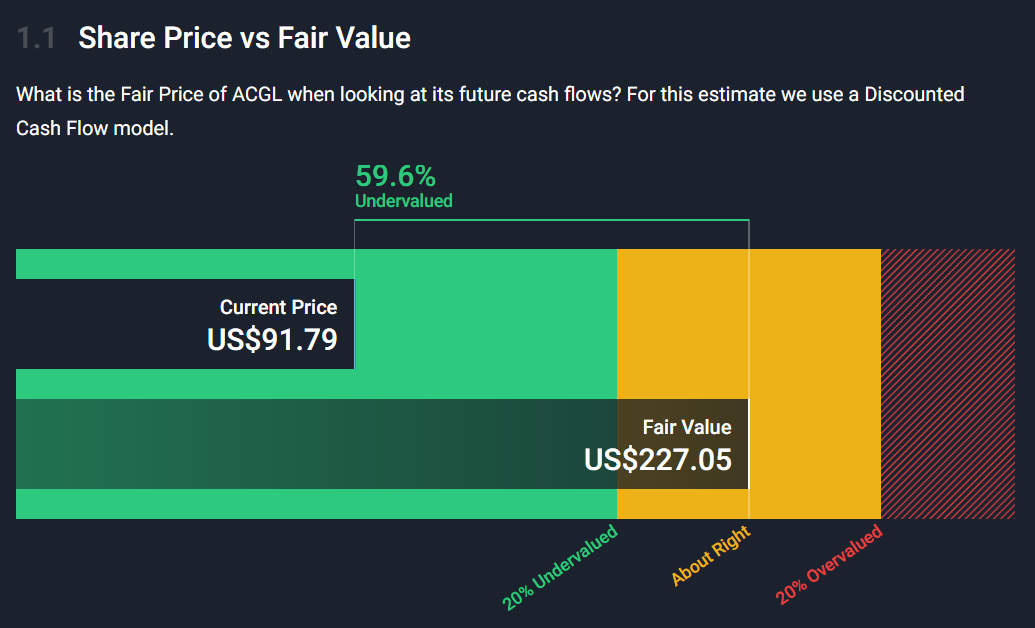

Similar to the previous 2 companies, the company is 60% undervalued according to SimplyWallSt’s DCF valuation.

Source: SimplyWallSt

4. Globe Life $GL ( ▼ 0.25% )

Globe Life provides life and health insurance products to its customers.

Life insurance business makes up 56% of revenue, with health insurance at 24%. Investment products make up the remaining.

All of its business are in the United States.

Globe Life’s 5-year beta is at 0.48, while giving a low dividend yield of 0.8%.

Globe Life’s dividend payout ratio is low at about 9%.

The company has been growing steadily over the years. Revenue grew by an annual average of 5.1% from 2020 to 2024.

Profits on the hand, grew an average of 10% over the same period.

This means that its profit margins have improved significantly from 15.5% to 18.5%.

Meanwhile, in 3Q 2025, it is currently delivering a margin of 25% with profits growing by 28%.

According to SimplyWallSt, Globe Life is undervalued by 63% according to DCF valuation.

Source: SimplyWallSt

5. Cal-Maine Foods $CALM ( ▲ 0.89% )

Cal-Maine Foods sells and distributes eggs in the United States.

There are two core businesses for Cal-Maine. Conventional eggs make up about 67% of revenue, while specialty eggs contribute 28%.

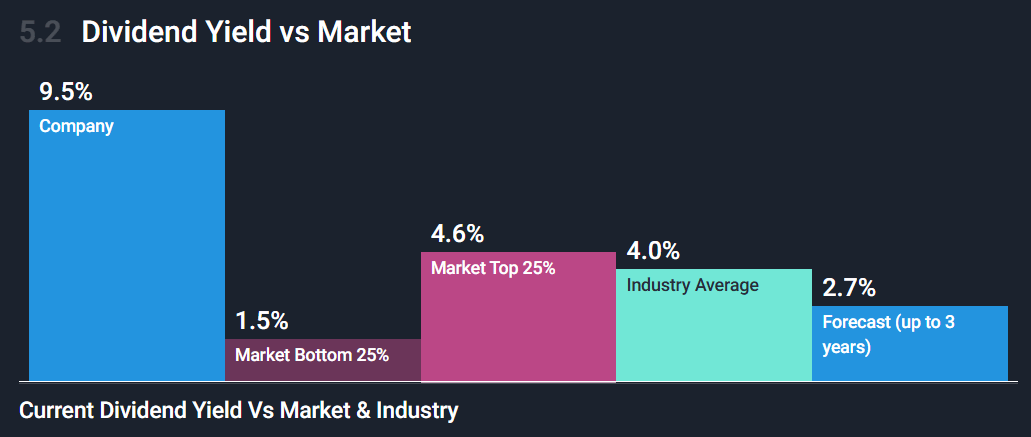

The company’s 5-year beta is very low at 0.22, while providing a high dividend yield of 9.5% to dividend investors.

Beta of 0.22 is much lower compared to consumer staples sector average of 0.70.

Its 9.5% dividend yield is much higher compared to the industry average of 4.0%.

Source: SimplyWallSt

Cal-Maine’s financials have skyrocketed but is volatile.

Revenue quadrupled from US$1.4 billion in 2020 to US$4.3 billion in 2024.

However, revenue declined by 26% in 2023 due to egg shortages before rebounding by 83% in 2024.

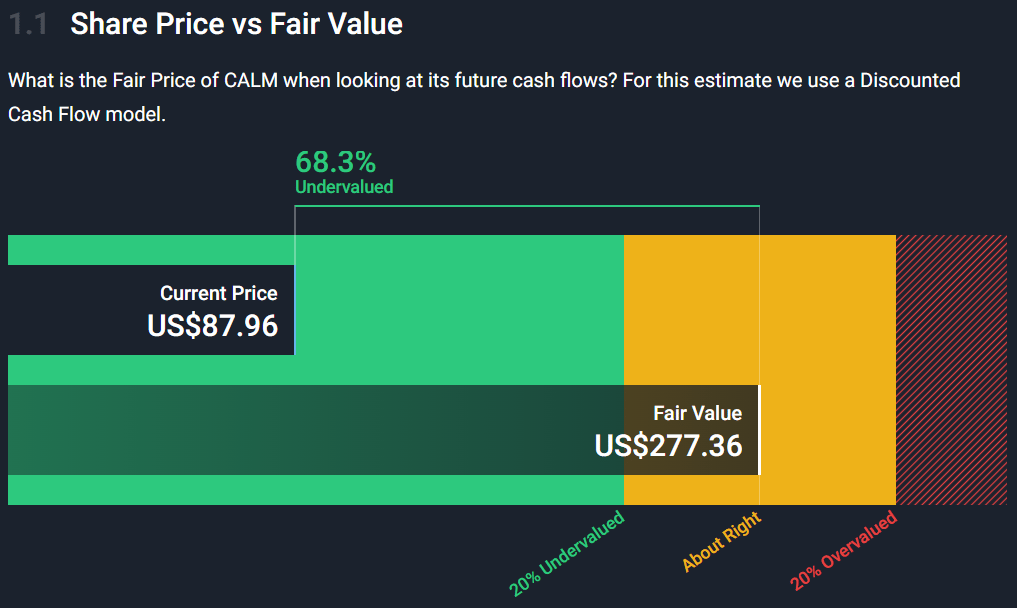

The company is now 68% undervalued according to analyst in SimplyWallSt.

Source: SimplyWallSt

If you enjoy exploring stocks through clean visuals and data-driven insights, Simplywall.st is worth checking out. It’s an intuitive way to uncover investment ideas and understand the fundamentals behind every chart you see.

👉 Find out more here.

Cheers,

James Yeo