Make Investing Simple Again

📝 Editor’s Note

The pivot is here.

Investors are getting out of AI and into everything else.

Using SimplyWallS,, we found 5 interesting stocks that could benefit from this.

In the U.S., we took a look at Disney and Uber. A new CEO for Disney means new things to come. Uber’s performance is still strong, with a catalyst (or threat) from autonomous vehicles.

Yum China seems to be getting some love as spending improves.

Finally, in Singapore, we dived into Coliwoo for its first expansion and Netlink NBN Trust for its potential involvement in Jurong Island data centre park.

Warm regards 🌱

InvestKaki Team

Table of Contents

Big Hits [U.S.] 💵

Moving on, here are the news that shocked the world…

Palantir $PLTR ( ▲ 4.53% ): Palantir earnings exceeded expectations. Revenue grew by 70% driven by higher government and commercial contracts [Read More]

Devon-Cottera $DVN ( ▲ 1.48% ) $CTRA ( ▲ 1.16% ): Devon Energy and Cotera Energy are merging to form a US$ 58 billion shale oil giant in the Permian Basin [Read More]

Oracle $ORCL ( ▲ 4.65% ): Oracle is looking to raise $50 billion in funding to invest and develop additional capacity for its AI clients [Read More]

Pfizer $PFE ( ▲ 2.76% ): Pfizer’s earnings top expectations with revenue declining by 1%. Covid-19 vaccines are dragginf the company down, while its weight-loss drug, Paxlovid shows promises [Read More]

Alphabet $GOOG ( ▼ 2.48% ): Google is acquiring Intersect, a wind and solar energy player, to get access to more energy to power their AI capacity [Read More]

Big Hits [Asia] 📊

Here are the news covering the Asia market…

China EV: Chinese electric vehicles players are not doing well. Deliveries across most players are down as tax incentives expires and Chinese consumers cut back [Read More]

SGX: SGX earnings are up by 11.6% for 1H 2026, boosted by 15 listings on the market and higher foreign exchange transactions [Read More]

Digital Core REIT: The REIT’s DPU rose by 2.5%, boosted by higher contributions from new purchases in 2024, and its Singapore hospital portfolio. [Read More]

Parkway Life REIT: Another contract win. ST Engineering has won a contract from Singapore’s Ministry of Defence to produce a fleet of infantry-fighting vehicles [Read More]

ESR REIT: ESR REIT’s DPU rose by 3.4%, while revenue grew by 20%, boosted by ESR Yatomi Kisosaki Distribution Centre and 20 Tuas South Avenue 14 contribution [Read More]

5 Interesting Stocks

Please see below the list of this week’s hand-picked analyst reports:

Stock | Headline | Link |

|---|---|---|

Disney | Appointment of new CEO perfect for Disney | |

Uber | Strong earnings and undervalued shares | |

Yum China | Undervalued shares with consumer sentiment improving | |

Coliwoo Holding | First expansion in hotel property | |

Netlink NBN Trust | Potential project in Jurong Island data centre project |

Stock #1 - Disney

Where dreams come true. Disney is a family entertainment company that produces content and theme park rides/experiences. It sells merchandises also from its famous intellectual properties.

Bog Iger is retiring, again. Josh D’Amaro, the head for the Disney Parks, Experiences and Products (PEP) will replace him.

Markets cheer. Disney fans rejoice.

After all, Disney had a rough patch these five years. Share price is down by 42.9% after climbing to its peak in 2021.

D’Amaro brings with him almost 20 years of experience in the company. And he has steered the PEP segment to new heights.

PEP generated 38% of Disney’s revenue, but contributed 72% of its operating income in 1Q 2026.

Operating profit margin for the segment is highest at 33%, compared to Entertainment (9.4%) and Sports (3.9%).

Morningstar analyst thinks that this is the perfect situation with an insider as CEO. He has proven to be effective in leading the PEP segment, and will reignite some energy and hope into Disney.

However, the real test will be Disney’s transition to streaming, and what place would it have in the industry.

Disney is currently deemed undervalued compared to its peers, trading at a price-to-earnings ratio of 15.2 times.

Source: SimplyWallSt

Stock #2 - Uber

Uber operates a platform that allows people to get ride and food transportation services to their doorstep.

The ride-hailing unicorn has now matured.

4Q 2025 bookings grew by 22%, exceeding analyst expectations of 20%.

Revenue grew by 18% to $52 billion for 2025

Profit is up by 40.6% to $5.8 billion.

Both segments of ride-hailing (+19%) and food delivery (+30%) continue to grow at strong rates in 4Q 2025.

The big question now is - would Uber be successful in transitioning yet again to autonomous vehicles (AV)?

Will it rely on Waymo? And pay large fees in the partnership?

Or will it be able to develop its own AVs?

Morningstar thinks that Uber is undervalued. Discounted Cash Flow (DCF) valuation indicates that the company could be 60% undervalued.

Source: SimplyWallSt

Stock #3 - Yum China

Yum China owns, operates and franchises food & beverage restaurants in China, with particular focus on Kentucky Fried Chicken and Pizza Hut.

Is consumer sentiment in China improving?

Morningstar seems to think so. KFC recently raised its prices, and financials held up.

Revenue is up by 8.8% to $2.8 billion in 4Q 2025

Operating profit is up by 20% also.

It also raised its delivery prices but managed to log a higher profit margin. The delivery model has lower margins for Yum China.

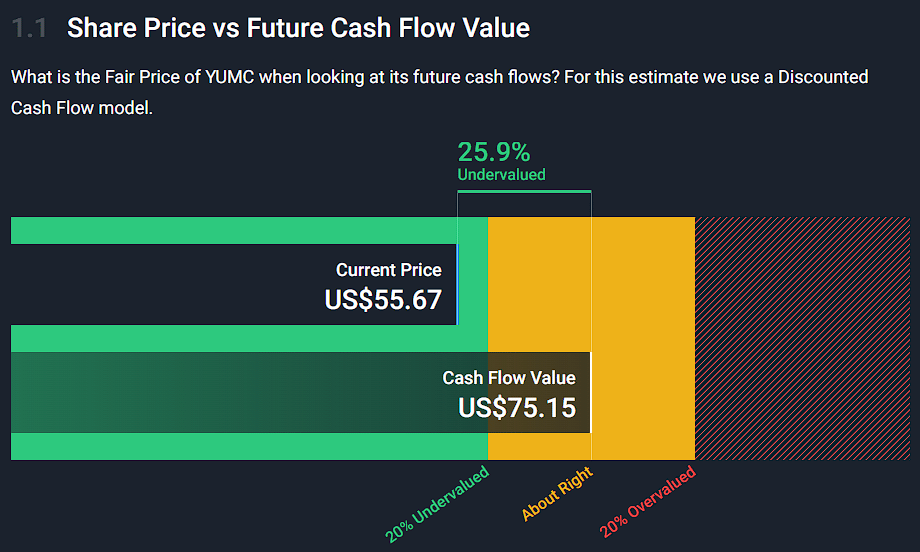

Most importantly, Yum China is only trading at 17 times PER, which is deemed very undervalued. DCF valuation indicates a potential 25% undervaluation.

Source: SimplyWallSt

Stock #4 - Coliwoo Holdings

Coliwoo Holdings is a co-living operator in Singapore, that serves renters that want a diverse array of living experiences.

Its listing in November 2025 got a lot of attention. And investors were excited to see what properties it would expand into.

It has recently purchased a hotel lot at 2 Changi Business Park Avenue 1 for SG$101 million.

It’s close to Changi Airport

Changi Business Park has an established corporate clientele

This will add about 250 rooms to its current 3,200 rooms.

Maybank has targeted a price of SG$0.74 which represents an implied upside of +23%.

Stock #5 - Netlink NBN Trust

Netlink NBN Trust designs, builds and operates fibre network solutions in Singapore and comprises ducts, manholes, and fibre cables.

If you take a look at the company, you might think - boring.

After all, they just provide fiber network solutions. But everyone has internet because of Netlink NBN.

It is the sleeper company that makes everything ticks.

It has recently said that it could participate in the development of the 20-hectar Jurong Island data center park.

That got us listening.

Netlink is working on designing the network infrastructure within the data campus which has a 700MW capacity.

In the meantime, it will continue to provide its services to HDB’s projects around the island.

Did I tell you that the company has a market cap of SG$3 billion and dividend yield of 5.5%?

DCF valuation indicates that the company could be 38% undervalued.

Source: SimplyWallSt

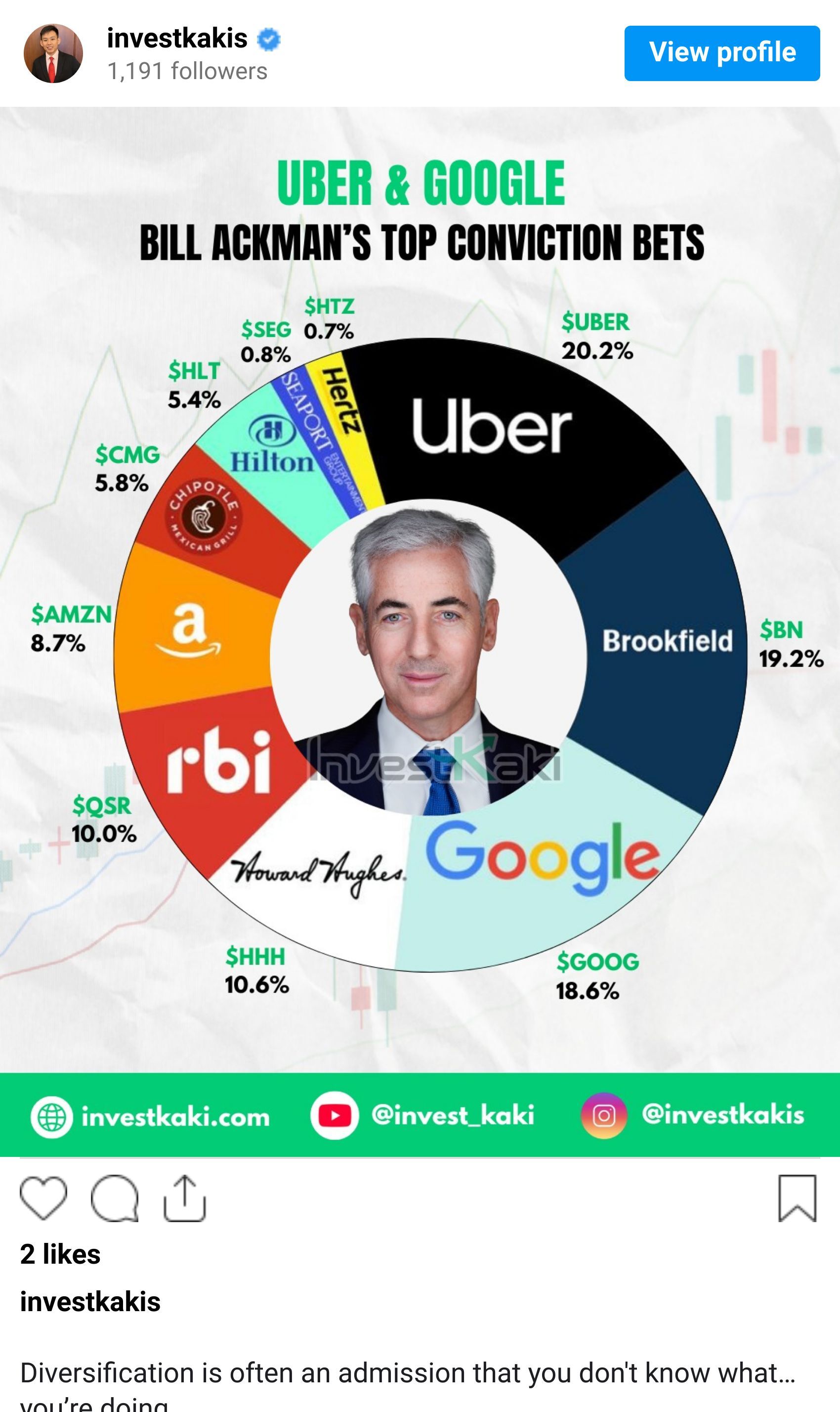

Here’s Bill Ackman’s top conviction bets!

👉 Follow us on Instagram here!

Hope the above is fruitful for you all..

Cheers,

James Yeo

Socials of the Week