This article was created with the help of Simplywall.st, an investing platform that turns complex financial data into easy-to-understand visuals. It’s one of my Favourite go-to tools for analysing company fundamentals and spotting new ideas. You can explore it here.

Last week was a bloodbath.

Almost all of the AI tech big boys plunged when investors got jittery about the AI bubble and the Federal Reserve not cutting interest rates.

But amidst the uncertainty, there are pockets of opportunities.

For one, it allowed us to look deeply again into the Magnificent 7 companies’ prospects for the long-term.

For this week’s edition, we will dive deeper into the company financials, prospects and valuations to determine which Mag 7 stocks are worth investing into.

Financials: Solid 5-year annual growth of above 10% for revenue and profits

Prospects: Company developments in the long-term

Valuations: Price-to-earnings ratio (PER) that are fair or lower than historical or peers.

The 5 Companies We Are Looking At

1. Alphabet $GOOGL ( ▲ 0.64% )

Formerly, Google, Alphabet has been one of the stand-out performers last week when most of the Mag 7 stocks dipped.

It rose by 6.6% for the November month (as of 24 Nov)

Alphabet is technically an investment holding company. It holds the popular Google search platform, YouTube and ‘Other Bets’ segments that houses its other projects.

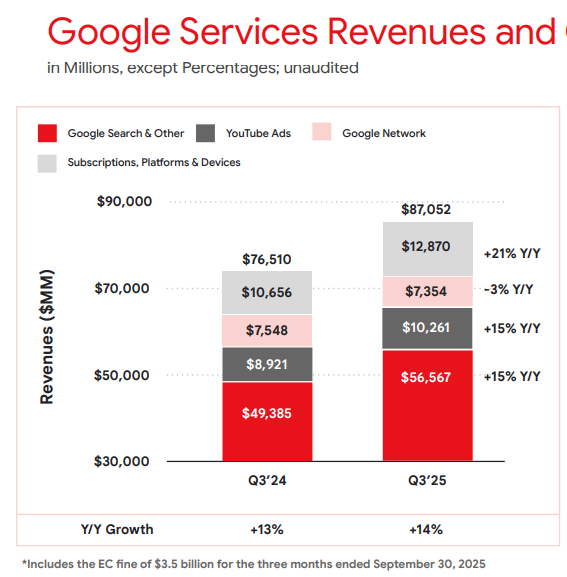

Google Search still makes up the bulk of its business at 55% of its revenue, followed by Google Cloud (15%), YouTube ads (10%), and Google Network (7%).

The U.S. is its main contributor at 48% of revenue, with Europe & Middle East (30%) and Asia (16%) rounding up the rest.

Source: Alphabet 3Q 2025

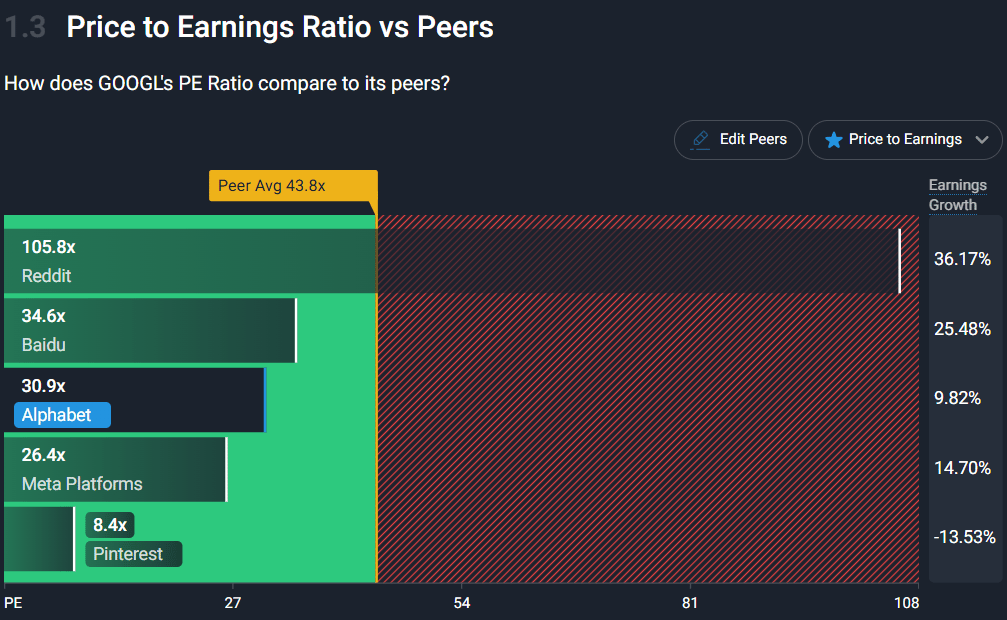

Alphabet is currently trading at a relatively fair price-to-earnings ratio (PER) of 31 times compared to its historical average of 26 times.

It is however, trading at a lower PER compared to its peers average of 43.8 times.

Its DCF valuation indicates that is slightly overvalued by 4.3%.

Source: SimplyWallSt

Revenue for Alphabet has almost doubled from US$182 billion in 2020 to US$349 billion in 2024. Based on 2025 financials, it is on track to register close to US$400 billion.

In 3Q 2025, Google Cloud segment grew by 34% to US$15 billion, representing the steep AI demand for storage and computing power.

However, operating profit margins for Google Cloud still lack behind at 24% compared to Google Services (38%).

Alphabet had two important developments that propel it above its Mag 7 peers.

Berkshire Hathaway revealed that it had taken a US$4.3 billion position in the company.

It released its Gemini 3 AI model that reportedly outperformed the other AI models in the market.

It is currently fairly priced according to most analysts in the market with an implied upside of +1.4%. However, this might not have taken into account its strong 3Q results and the latest release of Gemini 3.

Source: SimplyWallSt

2. Amazon $AMZN ( ▲ 1.0% )

Amazon is an online retail shopping platform that also provides cloud services to businesses and consumers.

Its retail arm is separated into two - America (59%) and International (22%) - and makes up the majority of its revenue at 81%. This is followed by its Amazon Web Services at 18%.

Source: Amazon 3Q 2025

Amazon is currently trading at a PER of 31.6 times compared to its 5-year historical average of 72 times.

It is trading lower than its peers’ average of 33.6 times.

Source: SimplyWallSt

Amazon’s revenue has also almost doubled from US$386 billion in 2020 to US$638 billion in 2024, and is on track to deliver US$716 billion in 2025.

Most of its growth in 2025 has been driven by Amazon Web Services (AWS), which grew by 20% in 3Q 2025.

Meanwhile, profits for the first 9 months of 2025 increased by 53% to US$76 billion, also driven by the higher margin AWS segment.

AWS is the future growth driver for Amazon, with a operating profit margin of 33%.

Its retail segment’s margins are about 3.0% to 4.5%.

AWS is also the market leader with a 30% cloud market share.

Amazon’s prospects will lie in its in-built AI chips to power its data centre and computing power. Currently, it is relying on Nvidia’s GPUs to power.

Its own custom AI chip, Trainium saw a strong 150% growth in 3Q 2025

Its Project Rainier, an AI compute cluster will utilise 500,000 Trainium to power Antrhopics Claude AI program.

While it has not seen widespread adoption like Nvidia’s GPUs, it could carve out a niche for itself.

It currently has a +30% upside from analysts.

Source: SimplyWallSt

3. Nvidia $NVDA ( ▲ 1.41% )

What’s there not to say about Nvidia.

It is currently the world’s largest company by market capitalisation at US$4.4 trillion, and at one point, breaching the US$5 trillion level.

Nvidia manufactures and sells semiconductor components like Graphic Processing Units for data centres, gaming and other applications.

Its compute & networking segment (data centre) contributes the most to revenue at 89%, followed by its gaming and PC segment at 11%.

United States make up the most also at 66%, followed by China at 11%. Taiwan makes up a huge bulk also at 21%, but its end point is actually to customers in the U.S. and Europe.

Revenue for Nvidia in the 3Q 2025 rose by 62% as it continues to be powered by increasing demand for AI chips to power data centres and large-language models.

Blackwell Ultra is becoming the driver for Nvidia at the current point, while its networking business has become the biggest tin the world.

Source: Nvidia 3Q 2025

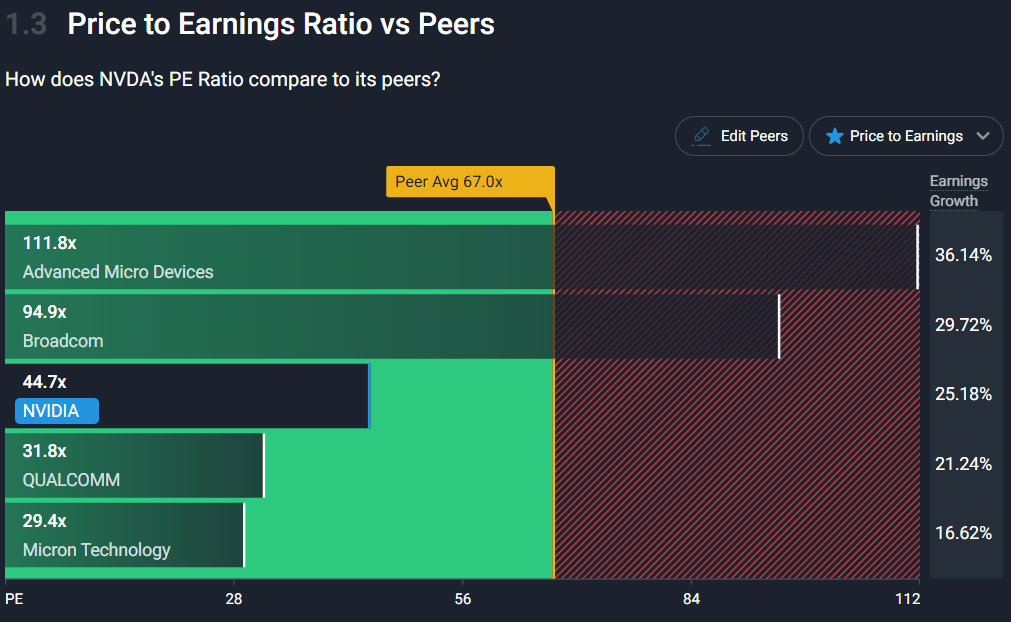

It is currently trading at a PER of 44 times, compared to its historical average of 73 times.

However, compared to its peers average of 61 times, Nvidia’s valuation is considered cheap.

Source: SimplyWallSt

Nvidia has a lot going. Its prospects essentially remain intact despite the mini AI bubble crash. There are some companies that compete directly with it, but ultimately Nvidia still maintains an almost monopolistic position in the AI chip market.

According to CSI market, Nvidia holds a 40% market share, with Broadcom (12%), and Cisco (12%) behind.

And in the market, companies are investing increasingly more into AI capabilities and projects.

Most of it are coming from Alphabet, Amazon, and Meta.

Source: Citi Research

Analysts have Nvidia at a target price of about US$240 with an implied upside of +36.1%.

Source: SimplyWallSt

4. Microsoft $MSFT ( ▲ 2.98% )

Microsoft, the starter of all of these AI boom.

It sells software, hardware, cloud and other services to customers. It is the provider of Microsoft products such as 360 and Windows.

Microsoft now has two core business. Its traditional Productivity & Business Processes (Microsoft 360 products, etc) generates about 42% of its revenue, while its intelligent cloud (AI) business contributes 40%.

United States make up about half of its revenue, with the rest of the world taking up the other half.

Valuation-wise, it is trading at a PER of 33.6 times, quite in line with its historical average of 35 times and peers’ average of 35 times.

However, its DCF valuation indicates that it could potentially be 22% undervalued.

Source: SimplyWallSt

Consistent with the other companies here, revenue almost doubled from US$168 billion in 2020 to US$282 billion in 2024.

In 2025 itself, it is on track to register a revenue of US$300 billion.

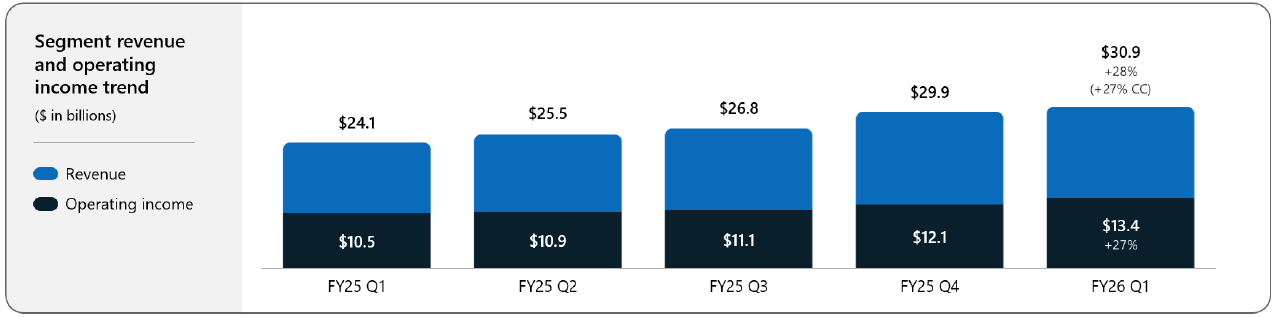

Microsoft’s prospects can be summed up into how its Azure segment will perform in the future.

For 3Q 2025 (1Q 2026 by Microsoft reporting period), Azure grew by 28%, making it the fastest growing segment in Microsoft.

Source: Microsoft 1Q 2026

With the restructuring of OpenAI, Microsoft is now no longer the exclusive provider, and thus will now embark on sourcing for more clients for its cloud services.

On this front, its commercial bookings grew by 112%.

Analysts now have Microsoft at a target price of US$625 with an implied upside of +32%

Source: SimplyWallSt

5. Apple $AAPL ( ▲ 0.77% )

Apple rounds off this list.

We have to admit, Apple seems like the odd one out here. Firstly, it is considered behind in the AI front to most of the Mag 7 companies here.

Apple Intelligence is not progressing as well as the company has hoped for.

However, the recent strong iPhone 17 sales provided some fundamental backing to Apple that does not just rely on AI.

We have to admit, after the recent AI debacle, it’s good to go back to basics on what a company sells. And for Apple, it’s cold-hard physical products.

Apple is currently trading at a PER of 36.4 times, higher than its historical average of 30 times and peers’ average of 34 times.

Financially, it has hit some road blocks as it was losing its position in the China market to cheaper competitors.

However, revenue have grown at an average annual rate of 3.2% from 2021 to 2025.

Meanwhile, profits have grown by 19.5% in 2025.

If you enjoy exploring stocks through clean visuals and data-driven insights, Simplywall.st is worth checking out. It’s an intuitive way to uncover investment ideas and understand the fundamentals behind every chart you see.

👉 Find out more here.

Cheers,

James Yeo