This article was created with the help of Simplywall.st, an investing platform that turns complex financial data into easy-to-understand visuals. It’s one of my Favourite go-to tools for analysing company fundamentals and spotting new ideas. You can explore it here.

There might be an opportunity in the mid-cap space of the Singaporean market.

The Monetary Authority of Singapore (MAS) $5 billion Enhanced Equity Market Development Program (EQDP) is targeting mid- and small-cap Singaporean stocks.

Mid-cap stocks are a perfect blend of stability and risks.

They have a large enough size or valuation to be competitive with large-cap stocks.

Provides a moderate mount of risks for investors to take on.

Our investment thesis here is to identify Singaporean mid-cap stocks that could potentially benefit from the increased investor attention from the EQDP program, and also deliver high and steady dividends.

Mid-cap is defined as SG$1 billion to SG$5 billion in market capitalisation.

Above 5% in dividend yield is considered high

The 5 Companies We Are Looking At

1. Venture Corp

Venture Corp provides technology services that includes research and development, product and process engineering, manufacturing and supply chain management.

Its main market is Asia Pacific at 68% of revenue, followed by Singapore (26%).

Industrial & IT segment makes up the bulk of its revenue at 61%, while health & lifestyle segment makes up the remaining.

Venture Corp is a mid-cap Singaporean company with a dividend yield of 5%.

Market capitalisation of SG$4.3 billion

Current dividend yield of 5.0% and has been rising since 2018.

Source: SimplyWallSt

Venture’s financial performance has been volatile the past couple of years.

As it was highly tied to previous smartphone technology cycle, revenue grew at an average rate of 14% from 2020 to 2022.

When it ended, revenue declined by almost a third from 2022 to 2024.

There are of course, questions now on its business outlook.

In its outlook for 2025, it has mentioned that its health & lifestyle segment has softened and that it will refocused its efforts in developing R&D capabilities in its industrial and IT segment.

And one area of growth could be its capability to test semiconductor equipment and parts in the data centre industry.

According to SimplyWallSt, Venture Corp is deemed to be undervalued by 12.4% at this point with a fair value of $17 per share.

Source: SimplyWallSt

2. Comfort DelGro

Comfort DelGro provides public transportation, taxis, private hires, and other private transportation services.

It operates in 13 countries, with Singapore being the biggest source of revenue at 51%. This is followed by the UK and Europe (29%), and Australia (18%).

Public transportation which includes bus and railways make up the majority at 69%, while taxi is at 17%.

Comfort DelGro’s market capitalisation is at $3.2 billion, while providing a 5.3% dividend yield. Yields have been on an increase since 2021.

Source: SimplyWallSt

ComfortDelGro has been growing quite steadily in the past couple of years.

Revenue grew at an average annual rate of 8.4% from 2020 to 2024.

Meanwhile, profits have more than tripled from $60.8 million to $210.5 million.

Revenue and profits grew by 14.4% and 11.2% respectively in 1H 2025.

ComfortDelGro controls about 63% of the taxi industry share in Singapore, and is generally considered a recession-proof company.

Beta is at 0.45 which means it doesn’t really move in line with the general market.

However, the company has faced increasing competition from Grab in the Singapore market.

Grab has been aggressively poaching ComfortDelGro’s drivers over to its platform.

Recently, they have obtained a taxi license from the Singaporean government.

ComfortDelGro is currently considered undervalued by 28.3% from its fair value of $2.05.

Source: SimplyWallSt

3. Bumitama Agri

Bumitama Agri is palm oil producer listed on the Singapore Exchange, with most of its plantations in Kalimantan and Riau, Indonesia.

It mainly sells crude palm oil (89% of its revenue), with palm kernel making up the remaining.

The company is mid-cap stock, with a high dividend yield that has been increasing since 2020.

Market capitalisation: $2.4 billion

Dividend yield: 6.4%

Source: SimplyWallSt

Financially, Bumitama has had quite a strong growth in recent years but is ultimately exposed to the volatility in the oil palm markets.

Revenue grew by 13% every year from 2020 to 2024.

In 1H 2025, both revenue and profits grew by 22% and 41% respectively.

However, in 2023, revenue declined by 7.3% due to lower palm oil prices and fresh fruit yields.

Bumitama’s fortunes are closely related to Indonesia’s domestic demand and exports to India, China, and Pakistan.

Indonesia is initiating the B50 biodiesel blend program.

Exports to India, China and Pakistan makes up 45% of Indonesia’s total CPO exports.

The company is valued at a fair value of $2.48, and is 44.4% undervalued.

Source: SimplyWallSt

4. First Resources

Another palm oil company in Indonesia, and listed in the Singapore Exchange.

Its geographic plantation is similar to Bumitama - Most of it in Kalimantan and Riau, Indonesia.

However, most of its business is in processing and refining palm oil (downstream) which makes up 79% of its revenue.

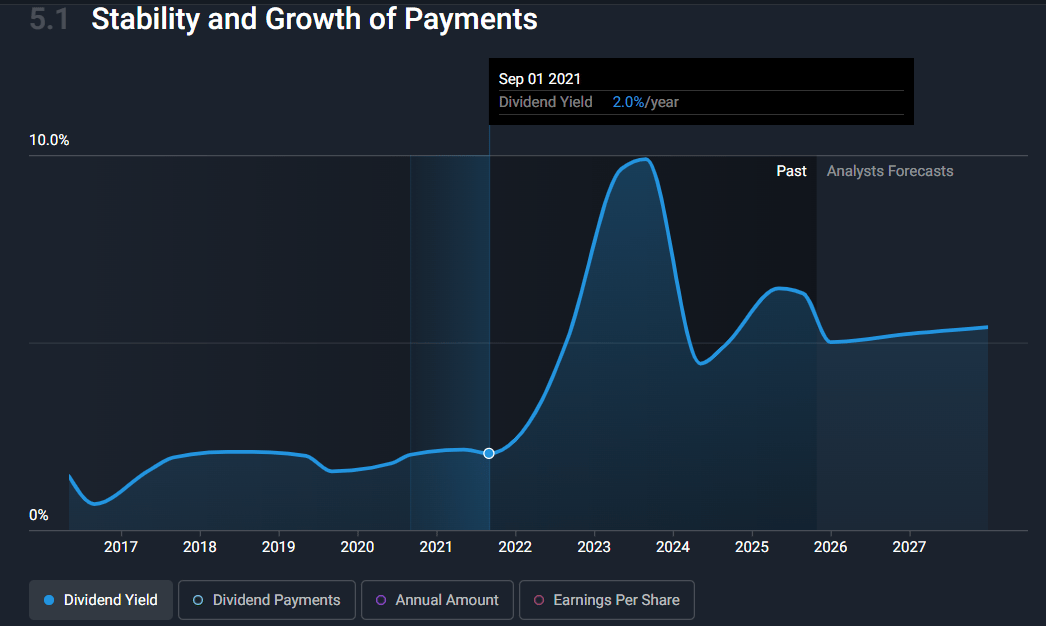

First Resources have a market capitalisation of $3.1 billion and a dividend yield of 5.4%. Yields have been increasing since 2021 and reached its peak of 9.9% in 2023, when the stock was sold due to its declining revenue performance.

Source: SimplyWallSt

First Resources financial performance and story is similar to Bumitama

Average revenue growth of 11% from 2020 to 2024.

Strong 1H 2025 performance. Revenue and profit growth of 44.8% and 41% respectively.

Decline in revenue in 2023 due to soft palm oil market.

The catalysts for First Resources are about the same for Bumitama.

First Resources is estimated to be 67.8% undervalued with a fair value price of $6.15.

Source: SimplyWallSt

5. StarHub

Starhub provides telecommunication, entertainment and digital solutions and operates entirely in Singapore.

Most of its business is centered around telecommunications, making up close to 90% of its revenue

Starhub is a mid-cap Singaporen company with a market capitalisation of $2 billion, and dividend yield of 5.3%. Yields have been broadly increasing since 2021.

Source: SimplyWallSt

Starhub’s financial performance has been steady from the revenue side. However, profits are volatile.

From 2020 to 2024, revenue grew at an average rate of 4.0%

In 1H 2025, revenue grew at a positive rate of 2.2% after declining in 2024.

Profits have been volatile since 2020.

The company is hugely undervalued according to SimplyWallSt, with a fair value of $4.91.

Source: SimplyWallSt

If you enjoy exploring stocks through clean visuals and data-driven insights, Simplywall.st is worth checking out. It’s an intuitive way to uncover investment ideas and understand the fundamentals behind every chart you see.

👉 Find out more here.

Cheers,

James Yeo