This article was created with the help of Simplywall.st, an investing platform that turns complex financial data into easy-to-understand visuals. It’s one of my Favourite go-to tools for analysing company fundamentals and spotting new ideas. You can explore it here.

It’s an open secret that Singapore is fast-becoming the premier location for data centres in Asia.

With its developed infrastructure and expertise, many technology companies are investing more and more in the country.

Amazon has committed to SG$14 billion in investments in Singapore’s cloud infrastructure and ecosystem.

Alphabet is investing US$6.7 billion into data centres in Singapore

While there are some concerns now about the availability of land in Singapore, the Singapore government launched the second “Data Centre – Call for Application” (DC-CFA2), and is increasing the allocated capacity from 80MW to 200MW.

Furthermore, according to JP Morgan’s Ranjan Sharma, Singapore’s data centre market possess high rental rates and pricing power and most importantly, there is an undersupply situation where demand exceeds capacity.

Based on these tailwinds, this is a good time to evaluate Singaporean stocks that act as ‘enablers’ to the AI data centre ecosystem.

That’s right, we are talking about power, REITs, semiconductors and electrical services stocks in Singapore that could stand to benefit.

The 5 Companies We Are Looking At

1. Sembcorp Industries

33% - that’s the number that you should know about Sembcorp Industries.

It supplies 33% of the data centre energy demand in Singapore, and holds the number one position in the market.

Sembcorp Industries supplies and provides utility services, and also help with terminal and storage of petroleum products and chemicals.

Singapore makes up the majority of Sembcorp’s revenue at 71%, followed by the United Kingdom (9%), China (7%), and India (7%).

Meanwhile, gas & related services contribute close to 71% of its revenue also, followed by renewables (16%) and urban solutions (5%).

The power giant counts Singtel, ST Telemedia Global Data Centres, and Equinix as its major data centre clients.

It has also recently signed long-term (5 to 10 years) power purchase agreements (PPA) totalling over 120 MW with data centre players in Singapore.

Furthermore, it is now looking at Batam Indonesia as its next data centre client expansion. Batam is fast emerging as a data centre hub with new submarine cables connecting from Singapore to Batam, coming online by 2026.

Source: Sembcorp 1H 2025 Results Presentation

Financially, Sembcorp’s 1H 2025 results indicate a decline, but some context is needed about its potential for the future.

Revenue declined by 8% due to lower energy prices in Singapore. However, this was buffered by its higher volume sold during this period.

Source: Sembcorp 1H 2025 Results Presentation

Sembcorp is actually very well-positioned to supply data centre power demand as its contracted capacity (long-term contracts) remains low at about 58%.

As data centres typically require consistent long-term energy, data centres prefer long-term contracts.

SimplyWallSt’s discounted cash flow valuation (DCF) indicates that the company is undervalued by 23%

Source: SimplyWallSt

2. YTL Power

A competitor to Sembcorp in Singapore.

YTL Power is a power and energy company listed in Malaysia, but have such an extensive operation in Singapore that it is hard to exclude it.

Singapore makes up 54% of its revenue, followed by United Kingdom (27%), and Malaysia (15%).

Power generation makes up 56% of its business, while water and sewerage segment is at 32%.

And YTL Power is in a strong position in the Singapore power generation market. It currently has about 19% market share. Hence, it does have the capacity to supply to the data centres operating there.

YTL Power does have some expertise in building data centres. It has one data centre in the northern region called Dodid,

Recently, it has also invested in data centres in the Johor-Singapore Special Economic Zone.

Financially, YTL Power’s revenue has doubled from MYR10.8 billion in 2021 to MYR21.8 billion in 2025. Profits have also turned from a loss of MYR146 million to a profit of MYR2.6 billion.

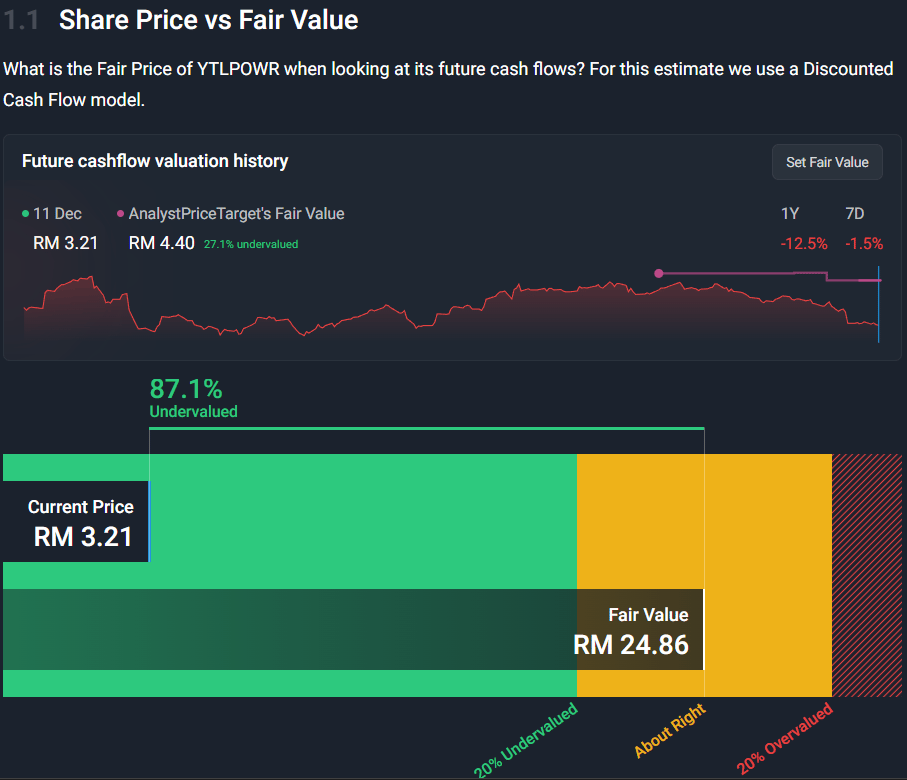

The company is also deemed massively undervalued by 87% according to SimplyWallSt’s DCF valuation.

Source: SimplyWallSt

3. Keppel Ltd

Keppel is involved in the provision of offshore and marine engineering and construction services.

Singapore makes up 92% of its revenue, followed by China (4.5%).

Infrastructure encompasses about 70% of revenue, followed by connectivity (20%), and real estate (10%).

There are two key advantages that we can see for Keppel in the Singapore data centre space.

It has a big data centre portfolio.

It is an ecosystem partner provider for data centres.

Firstly, it has expanded its data centre portfolio by 20% to a total power capacity of 650 MW, with data centres across 35 countries in Asia Pacific and Europe.

Plans to double its capacity to 1,200 MW in the near-term.

Successfully developed and divested two data centres at the Keppel Data Centre Campus in Singapore to Keppel DC REIT for SG$1.38 billion.

Developing a third data centre at the same Singapore campus.

Secondly, Keppel provides energy, subsea cable connection, and water cooling services that are vital to data centres.

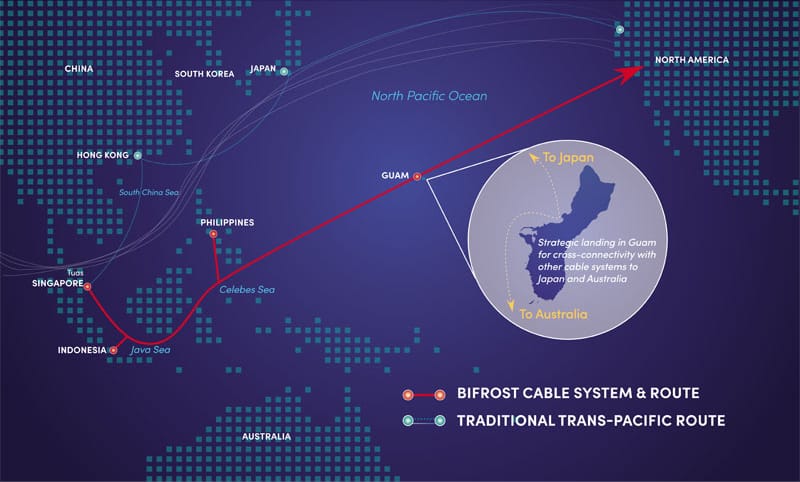

Keppel is developing the Bifrost Cable System that connects Singapore to the west coast of the U.S. via Indonesia. It has the largest capacity high-speed transmission cable across the Pacific Ocean.

It also has acquired Global Marine Group, which has a 31% market share in the global subsea cable infrastructure.

Keppel also provides power and water cooling services.

Source: Keppel Investor Day 2025

Financially, Keppel’s financial performance has been stable, but not that impressive. It recorded a revenue of SG$6.6 billion in 2020, and would register the same revenue level in 2024.

It is trading at a price-to-earnings ratio (PER) of 20 times while analysts pegged Keppel at a target price of SG$11 with an implied upside of +9.6%.

Source: SimplyWallSt

4. Tai Sin Electric

Tai Sin Electric is a relatively unknown company, with a small cap market capitalisation of SG$272 million.

It manufactures and sells cables and wires - components that will prove invaluable to many data centres in Singapore.

Singapore makes up 70% of revenue, followed by Malaysia (19%) and Vietnam (4%).

Cable & Wire segment makes up 71% of revenue, followed by electrical material distribution (22%).

Specifically, Tai Sin supplies low- and medium-voltage cables to more than 70% of data centres in Singapore. It has attributed its 20% revenue growth in 2025 to higher demand from data centre clients.

Tai Sin’s financial performance have been steady in the past five years.

Revenue grew by an annual growth rate of 12.7% from 2021 to 2025.

Profits grew at an equivalent rate of 10%.

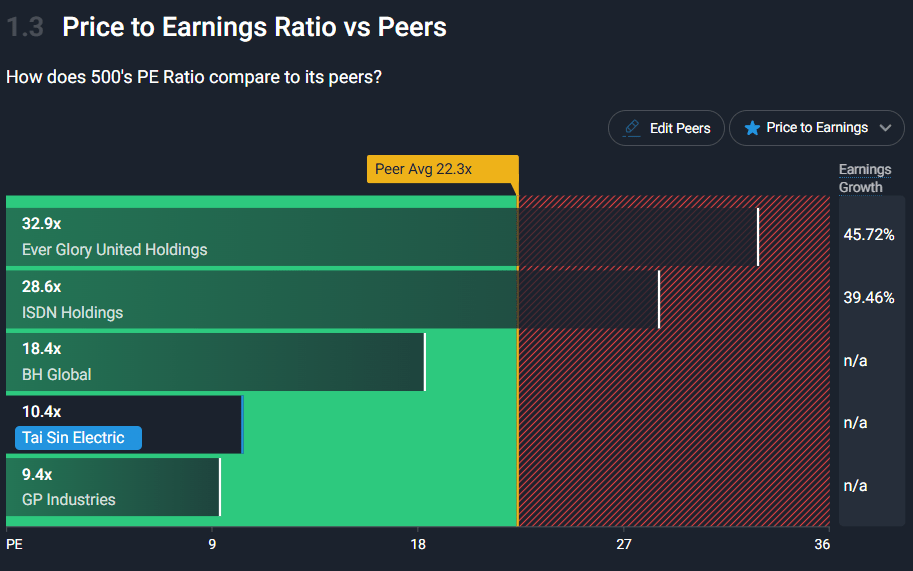

It is currently trading at a PER of 10 times, making it relatively cheap compared to its peers.

Source: SimplyWallSt

5. UMS Integration

UMS Integration (UMS) manufactures high-end semiconductors and other electrical components and also tests them.

Semiconductor makes up the bulk of its business at 85% of revenue.

Singapore is its biggest market at 67% of revenue, followed by United States (13%) and Malaysia (7%).

The E&E company will be vital to the data centre segment in Singapore, as it sells two-third of its components to companies in Singapore.

UMS’ financial performance followed the technology cycle.

Revenue decline in 2023 and 2024 due to the end of the E&E cycle of smartphones.

Rapid revenue growth of about 13% in 2025 due to higher AI-related demand

It is now trading at a PER of 23.2 times with DCF valuation indicating that the company is undervalued by 88%.

Source: SimplyWallSt

If you enjoy exploring stocks through clean visuals and data-driven insights, Simplywall.st is worth checking out. It’s an intuitive way to uncover investment ideas and understand the fundamentals behind every chart you see.

👉 Find out more here.

Cheers,

James Yeo