Make Investing Simple Again

📝 Editor’s Note

Will Trump survive his presidency?

From James Talarico potentially disrupting Republican politics in Texas to Trump tariff being struck down.

Things aren’t going well for him

However, these are great news for the markets.

This week, we take a look at some stocks such as Walmart, Him & Hers, SANY International, Far East Hospitality Trust and Singapore Airlines.

Chinese New Year enters its second week. Time to count our ang pows.

✨❤️🔥 發 ah

InvestKaki Team

Table of Contents

Big Hits [U.S.] 💵

Moving on, here are the news that shocked the world…

Trump Tariffs $SPX ( ▲ 0.69% ): The Supreme Court has struck down most of Trump tariffs, claiming that he exceeded his authority as president [Read More]

U.S. EV Write-Down $F ( ▲ 1.67% ) $GM ( ▲ 0.05% ) $STLA ( ▲ 2.93% ): The Big 3 of General Motors, Ford, and Stellantis have announced more than US$50 billion in write-down as EV incentives expire for most car-makers [Read More]

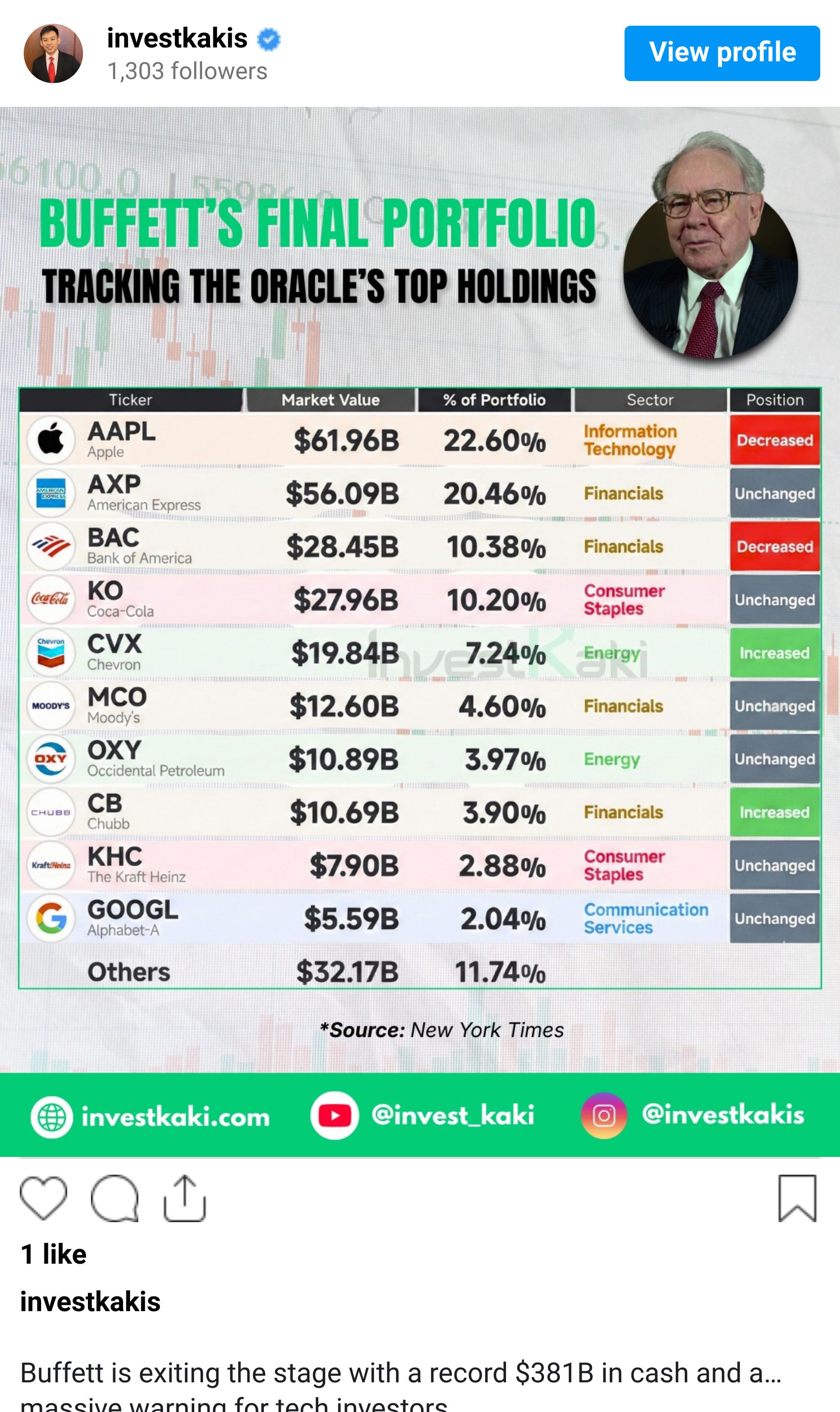

Berkshire $BRK.A ( ▲ 0.05% ): Berkshire Hathaway sold some of its positions in Amazon, Bank of America and Apple, and added a stake in New York Times. Meanwhile, Berkshire maintained its stake in Kraft-Heinz after rumours that it wants to sell its stake [Read More]

Danaher x Masimo $DHR ( ▼ 0.83% ): Danaher is acquiring Masimo – a medical device maker – for US$10 billion. Masimo will operate as a standalone company under Danaher’s diagnostics segment. [Read More]

Walmart $WMT ( ▼ 1.51% ): Earnings topped expectations as higher-income households spend more in Walmart while global advertising revenue rose by 46%. Revenue was up by 5.6%, while profits were down by 19%. [Read More]

Him & Hers $HIMS ( ▼ 1.2% ): Him & Hers Health is acquiring digital health company, Eucalyptus for US$1.2 billion as it seeks to expand into Australia and Japan. [Read More]

Big Hits [Asia] 📊

Here are the news covering the Asia market…

HSBC $HSBC ( ▲ 1.51% ): HSBC is cutting about 10% of its workforce in the U.S.-based debt capital market as it continues its restructuring that it started last year [Read More]

SIA Engineering: 3Q 2026 earnings were up by 9.7%, while revenue grew by 8.7%. Results were higher due to steady demand for maintenance, repair and overhaul services [Read More]

CSE Global: Contracts for CSE Global more than doubled to $514.7 million in 4Q 2025, driven by the works for the Liquefied Natural Gas (LNG) and data centre industries [Read More]

United Hampshire REIT: Distributable per unit rose by 8.1% for the full year 2025, but revenue and profits declined by 1.7% due to absence of contributions from Lowe’s Building and Sam’s Club Building [Read More]

Rex International: Rex International has guided for losses in 2025 as it faces difficulties in drilling operations in Benin. [Read More]

When Is the Right Time to Retire?

Determining when to retire is one of life’s biggest decisions, and the right time depends on your personal vision for the future. Have you considered what your retirement will look like, how long your money needs to last and what your expenses will be? Answering these questions is the first step toward building a successful retirement plan.

Our guide, When to Retire: A Quick and Easy Planning Guide, walks you through these critical steps. Learn ways to define your goals and align your investment strategy to meet them. If you have $1,000,000 or more saved, download your free guide to start planning for the retirement you’ve worked for.

Buffett’s final moves in Berkshire’s portfolio before he retires.

👉 Follow us on Instagram here!

5 CNY Stocks to Watch

Please see below the list of this week’s hand-picked analyst reports:

Stock | Headline | Link |

|---|---|---|

Walmart | Strong 4Q results | |

Him & Hers Health | Positive on Eucalyptus Acquisition | |

SANY International | Traction in mining truck segment | |

Far East Hospitality Trust | Expected strong operational performance | |

Singapore Airline | Improving fundamentals |

Walmart is the world’s biggest retailer, and sells its products through its physical stores and e-commerce channels. In the recent quarterly results, it has highlighted that its same stores growth in the United States was at 4.6%. Meanwhile, its global e-commerce growth was at 24%.

Why we like this: Walmart’s position in the U.S. market is undeniable. It is the largest retailer. While the Morningstar report above highlighted that Walmart is trading at an expensive valuation, we believe that the valuation is justified. The retailer is benefitting from the K-shaped economy where high-income households are spending more. And even though lower-income households are cutting back, they are still going to Walmart to shop for convenience.

Source: SimplyWallSt

Him & Hers Health is a telehealth platform that connects people to licensed healthcare professionals in the United States, United Kingdom, Canada and other countries. It has recently acquired Eucalyptus for US$1.2 billion to expand into Australia and Japan. Keonhee Kim, Morningstar analyst said that this was a good move and ‘drama-free’ compared to the episode of abruptly ending the oral semaglutide launch in early February.

Why we like this: It’s simple really. Him & Hers Health move to acquire Eucalyptus aligns with its core business. It provides skin care, hair loss, sexual health, and weight-loss services which are high in demand now. Yes, the move to end oral semaglutide launch was disappointing but its core businesses remain intact. And we like that it’s trading at very cheap valuations.

SANY International manufactures and sells mining and logistics equipment, electricity, power station, petroleum and new energy manufacturing equipment in China and for the international market. The stock has risen by 70% year-to-date as mining activities in China is ramping up for another commodity upcycle.

Why we like this: The narrative is straightforward. SANY is China’s largest construction machinery company and is top 3 in the world. Mining for rare earth and commodities are projected to ramp up as U.S. and China tensions escalates. Countries that have rare earth reserves are now rushing to invest and mine for them as they fear China might cut off the supply as a bargaining chip with the U.S.

Far East Hospitality Trust is a real estate investment trust (REIT) that operates and manages hotel and serviced apartments. Last year, average daily rates for the company was strong due to big events such as World Aquatics Championship and Blackpink’s World Tour.

Why we like this: The REIT’s sponsor is Far East Organisation, one of the largest private property player in Singapore. Li Jialin from CGS International highlighted an interesting opportunity in that it can tap into its sponsor’s pipeline of hotels and still has SG$600 million of debt room to take on before its gearing reaches 45%.

Singapore Airlines provides flight transportation services for both people and goods under the Singapore Airlines and Scoot brands.

Why we like this: SIA has a dominant market position in Singapore as a premier airlines but also providing budget flights. While growth has slowed after the pandemic, it has recently showed signs of improvement especially after Air India (SIA has 25% share) losses after the crash of Ahmedabad plane crash. SIA is currently trading at relatively cheap valuations.

Hope the above is fruitful for you all..

Cheers,

James Yeo

Socials of the Week