This Week at InvestKaki:

Big Hits [U.S.] 💵

Moving on, here are the news that shocked the world…

Trump-Greenland $SPY ( ▼ 0.01% ): Classic TACO. Trump threatened tariffs on Greenland, then withdrew it after negotiating a framework with the European Union on how to extract minerals. [Read More] 💪

Micron $MU ( ▲ 6.1% ): Micron is running out of parts. Memory chips are in short supply as AI demand skyrockets and puts the company into a shortage until 2027 now. [Read More]

Netflix $NFLX ( ▼ 1.1% ): 4Q 2025 earnings slightly beat expectations as its paid subscriber base reaches 325 million. Revenue and profits are both up by 18% and 30% and it has proposed cash instead to buy Warner Bros [Read More]

United Airlines $UAL ( ▲ 0.84% ): United Airlines earnings exceeded expectations. Despite a 1.6% revenue drop, profits are up by 6% for 4Q 2025 and has projected that 2026 could be record earnings year [Read More]

Johnson & Johnson $JNJ ( ▲ 1.46% ): Might be a tough year for pharmaceutical companies. J&J has signed a deal with Trump to lower drug prices but are forecasting revenue and profits for 2026 higher than market expectations. [Read More]

Big Hits [Asia] 📊

Here are the news covering the Asia market…

T-Head IPO: Alibaba’s chip unit, T-Head is getting ready for an IPO. However, the company wants to separate the unit out first before it does that [Read More]

Toku IPO: Toku closes 14% higher than its offer price on the first day of trading, as the cloud communications and customer experience platform raised $16.3 million in proceeds to fund potential partnerships and global expansion [Read More]

Suntec REIT: Suntec REIT’s DPU is up by 13.6% despite a 1.6% growth in revenue only. It recorded strong performances in the Singapore market to offset weaker ones in its Australian market [Read More]

Keppel: Keppel is entering into a 25-year agreement with an unnamed global telco for the Bifrost subsea cable system. It expects to sign it in 2Q 2026 [Read More]

ST Engineering: The company has signed a 5-year agreement with LOT Polish Airlines to provide maintenance, repair and overhaul services to its 15 Boeing 787 fleet [Read More]

Will Your Retirement Income Last?

A successful retirement can depend on having a clear plan. Fisher Investments’ The Definitive Guide to Retirement Income can help you calculate your future costs and structure your portfolio to meet your needs. Get the insights you need to help build a durable income strategy for the long term.

5 Stocks I’m Watching

Please see below the list of this week’s hand-picked analyst reports:

Stock | Headline | Link |

|---|---|---|

Procter & Gamble | Positive on long-term prospects and stability | |

Johnson & Johnson | Long-term growth supported by oncology and immunology | |

Trip.com | Dominant market position despite government investigation | |

Sea Ltd | Selling pressure presents buying opportunity | |

Grab | Able to withstand impact from Indonesian cap on commissions |

Editor’s Note (Here’s what we think about the 5 stocks mentioned above):

Firstly, Trump flipping back and forth from tariffs is not new. But the volatility he creates with his X comments is real.

Markets have become volatile again, and the short-term view is that it might continue to be so.

To me, many investors are pivoting back to safe stocks that are boring. P&G and J&J represents this and could benefit.

P&G: 4Q results was okay, not fantastic. Morningstar highlighted two important points - arrival of new CEO, Shailesh Jejurikar and P&G’s focus on keeping a tight ship on cost management.

It’s the boring stuff but it works. I like that the new CEO is trying to drive cost efficiencies in the consumer market where it has been quite weak recently.

I foresee the U.S. consumer market to gradually recover in 2026 despite the tariffs uncertainties (again).

While Morningstar thinks that the company is fairly valued now, I believe that it has legs to run in the long-term given that most of its products are ‘necessities’ and is still Berkshire Hathaway’s favourite stock to hold.

Target price from Trading View is $166.5 with an implied upside of +11%.

J&J: The company has agreed to reduce prices on its products as the pharmaceutical industry was hit by Trump’s policy changes last year. The report here highlights that despite this, some of its divisions did well - oncology and immunology.

That’s what I try to find in companies with long-term prospects - diversity in its businesses.

Unlike other pharmaceutical companies that are now chasing the weight-loss trend, J&J has focused on a wide array of medical sub-segments.

Going over to China, news of an anti-monopoly investigation into Trip .com presented an interesting opportunity.

Trip .com: The travel monopoly is now being investigated by the Chinese authorities for using the ‘Choose one from the two’ rule in its business practices. And if found guilty, the company could incur up to 3 to 4% of its 2026 revenue in fines.

In the meantime, I think the company will be under selling pressure for the next 4 to 6 months.

This presents an interesting opportunity as the report also highlighted that the company will probably be fine even if it is found guilty.

CGS International has lowered its target price to HK$605 which is still an upside of about +24%. Meanwhile, this could be an undervalued position as its price-to-earnings ratio is now trading at only 9.2 times.

Lastly, to the Singapore side.

The theme I am looking at this week is similar to China’s one - stocks that have good risk-reward ratios.

SEA Ltd: The company that owns Shopee is on a brutal downward trend since August 2025, losing 30% of its value in just 6 months. But that might be at an end. Maybank in its report highlighted that the company has been oversold.

This is an interesting opportunity. SEA Ltd is actually on track to record about $1.2 billion in profits for 2025 - the most it ever had.

Shopee’s position in the Southeast Asia market is as secure as ever.

Maybank thinks that there is about a 25% potential upside for SEA Ltd now.

Grab: Another Singapore unicorn (or Malaysian depending on how you see it) is facing another headwind.

The Indonesian government is proposing to cap the commission on ride-hailing at 10%, which will hurt Grab’s margin in Indonesia.

However, CGS International’s opinion is that Grab has other monetisation channels which can offset the loss in profits.

The impact on earnings is about 5% to 10%, which is substantial but not too big that it derails the company’s long-term prospects.

There is a potential +65% upside for Grab, which at this moment, presents a pretty good risk-reward ratio.

Posts of the Week

👉 Follow us on Instagram here!

And if you are looking for a guide on investing in copper! Here’s one being done by our writer in SmallCapAsia.

Stock of the Week

We have highlighted Micron before this, but this week brought the company some important insights into the AI boom

It’s still going strong.

Micron reported that there will be a supply shortage going into 2027 also. Remember that we thought it would only last till 2026.

Turns out it’s even longer now.

This means that demand for AI components and chips are as strong as ever. To make matters even better, the gaming and other industries are also trying to grab a piece of Micron’s chip knowing that there will be a shortage.

I see that the company will be able to increase prices quite sharply for the year and heading into 2027. Margins are probably going to be strong also.

The stock is already up by 34% for the year as companies rush for a limited pipeline of AI chips in the market.

And you know what’s the interesting thing is?

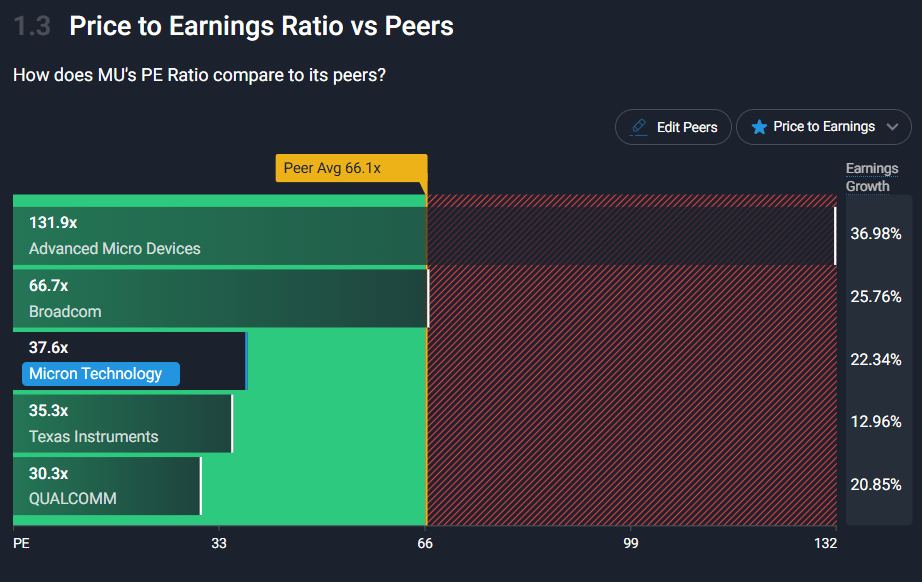

Its valuation is not that high compared to its peers. It’s currently trading at a price-to-earnings ratio (PER) of 38 times compared to its peers’ average of 66 times.

Source: SimplyWallSt

SimplyWallSt’s analysts view Micron as being significantly overvalued now. But I suspect this might change in a couple of week’s time, when its earnings results are out.

Source: SimplyWallSt

Hope the above is fruitful for you all..

Cheers,

James Yeo