This article was created with the help of Simplywall.st, an investing platform that turns complex financial data into easy-to-understand visuals. It’s one of my Favourite go-to tools for analysing company fundamentals and spotting new ideas. You can explore it here.

It’s that time of the season again.

Christmas is coming, and we start to wrap up towards the end of the year.

Where we take stock of our investment portfolio, realises that we made some good bets, some bad ones, and some that were a gamble.

No one’s perfect. And everyone makes mistakes.

So, as we near the year-end, let’s get back to basics and find some Singaporean stocks that are currently undervalued, and yields decently high dividends.

Our criteria:

Price-to-earnings ratio of below 15 times

Dividend yield above 5%

The 5 Companies We Are Looking At

1. United Overseas Bank

You can’t go wrong with one of the Singapore Big 3.

United Overseas Bank (UOB) provides consumer, private, commercial, transaction, and investment banking to clients across 19 countries in Asia, Europe and North America.

Its core market is still Singapore (56% of revenue), followed by Malaysia (10.6%), Thailand (10.3%), Indonesia (4%).

Wholesale banking make up the majority of its revenue at 47%, with the other significant one being retail banking (38%).

UOB is currently trading at a relatively cheap valuation. Price-to-earnings ratio is at 9.5 times, lower than the historical average of 11.1 times and peers average of 12 times.

However, a Discounted Cash Flow analysis of the company indicates that UOB is 43.9% undervalued.

Source: SimplyWallSt

This represents a good opportunity as UOB is currently giving a decent 5.5% dividend yield.

What do you get when you invest in UOB?

Firstly, UOB’s revenue has been growing at a steady rate of 11.7% every year from 2020 to 2024.

Meanwhile, profits have more than doubled over the same period.

As UOB is a bank, its outlook will be dependent on the state of the economy in Singapore (considering that this is their main market).

According to analyst forecasts in September 2025, Singapore’s gross domestic product (GDP) growth has been raised to 2.4% for 2025, higher than the previous projection of 1.7%.

However, do be aware that UOB carries with it some amount of risks.

Even though Singaporean banks are considered blue-chip stocks, they are exposed to the risks of global trade and markets.

Many international companies utilise Singapore as a transit point for the trade between Europe, Africa, India, Middle East and East Asia.

A deterioration of global trade would have an impact on the Singapore economy and banks.

2. Singapore Airlines

The bedrock of Singapore’s aviation and travel industry - Singapore Airlines.

Singapore Airlines is an airline company providing flight transportation services to about 79 destinations around the world.

Its main carrier, Singapore Airlines (SIA) makes up the majority of its revenue at 85%, while its low-cost carrier, Scoot takes up the remaining.

SIA derives most of its revenue from East Asia (52%), followed by Southwest Pacific (16%), Europe (13%) and Americas (7%).

SIA is currently trading at a PER of 7.3 times in line with its 5-year historical median of 7.3 times. However, it is lower than the peer’s average of 9.4 times.

Meanwhile, it is giving out a dividend yield of 6.1%, where its dividend yield has been around a range of 5.9% to 7.5% over the past 3 years.

Discounting the pandemic, SIA’s revenue has being growing steadily at an annual rate of 4.1% since 2019. Meanwhile, in the past 3 years, it has achieved its best ever profits at an average of SG$2.5 billion per year.

In October 2025, passenger traffic for SIA grew at a strong 24.5% rate as it is now aggressively expanding its capacity (capacity grew by 23% in October) to accommodate the increased demand for flights.

Tourist arrivals to Singapore has grown by 3% for 3Q 2025.

The Singapore government is targeting to increase tourism receipts by 60% in the next 15 years.

The risks however, are worth considering. The airline industry are inevitably tied to the tourism industry.

A sudden restrictions in travel (whether due to a pandemic, conflicts or others) could cripple the airline industry.

3. Thai Beverage

We were as surprised as you when we found Thai Beverage on this list.

Thai Beverage is a Thai company listed in Singapore, and is a beverage producer, distributor and seller in Southeast Asia.

It mainly sells beer (37% of revenue), and spirits (35%), with some dabbling in food businesses.

Thailand remains its main source of revenue at 65%, followed by Vietnam (17%), Malaysia (6%) and Singapore (4%).

Thai Bev is currently trading at a PER of 11 times, lower compared to its historical average of 14 times. Furthermore, it provides about 5.1% in dividend yields and has consistently maintained a dividend payout ratio of 50% to 60% over the past 5 years.

Thai Bev is fairly valued at this point according to SimplyWallSt’s DCF valuation.

Source: SimplyWallSt

Financially, Thai Beverage’s revenue has grown by 30% in 2024, while profits were up by 22% also.

Being an alcoholic company, Thai Beverage’s outlook is tied to how often people drink. A big part of its sales are driven by the trend of eating out, where beer and alcohol goes hand-in-hand.

Guess what? Thailand is the top 2 country in Asia in terms of eating out. 25% of its people eat out at least once every day.

Source: Rakuten

4. Mapletree Pan Asia

Mapletree has been making the news lately, with Temasek reportedly considering to merge Mapletree Investment with Capitaland.

Mapletree Pan Asia is a commercial real estate investment trust that invests in and manage office and retail assets.

Most of its assets are in Singapore (57%), followed by Hong Kong (26%) and China (9%).

Retail assets make up a majority at 50% of assets under management, followed by business parks (28%) and office (22%)

Source: Mapletree Pan Asia

It is currently trading at a relatively low PER of 13.3 times compared to its peers’ average of 20.5 times. Dividend yield is at 5.4%.

DCR valuation from SimplyWallSt indicates that the company is undervalued by 18.5%.

Source: SimplyWallSt

Mapletree Pan Asia is currently going through a rough patch financially.

Revenue has been declining for 7 straight quarters since 4Q 2024.

Profits have also been very volatile.

Moving forward, the management of the REIT has been divesting its non-core assets to focus on its core ones in Singapore.

5. CapitaLand India Trust

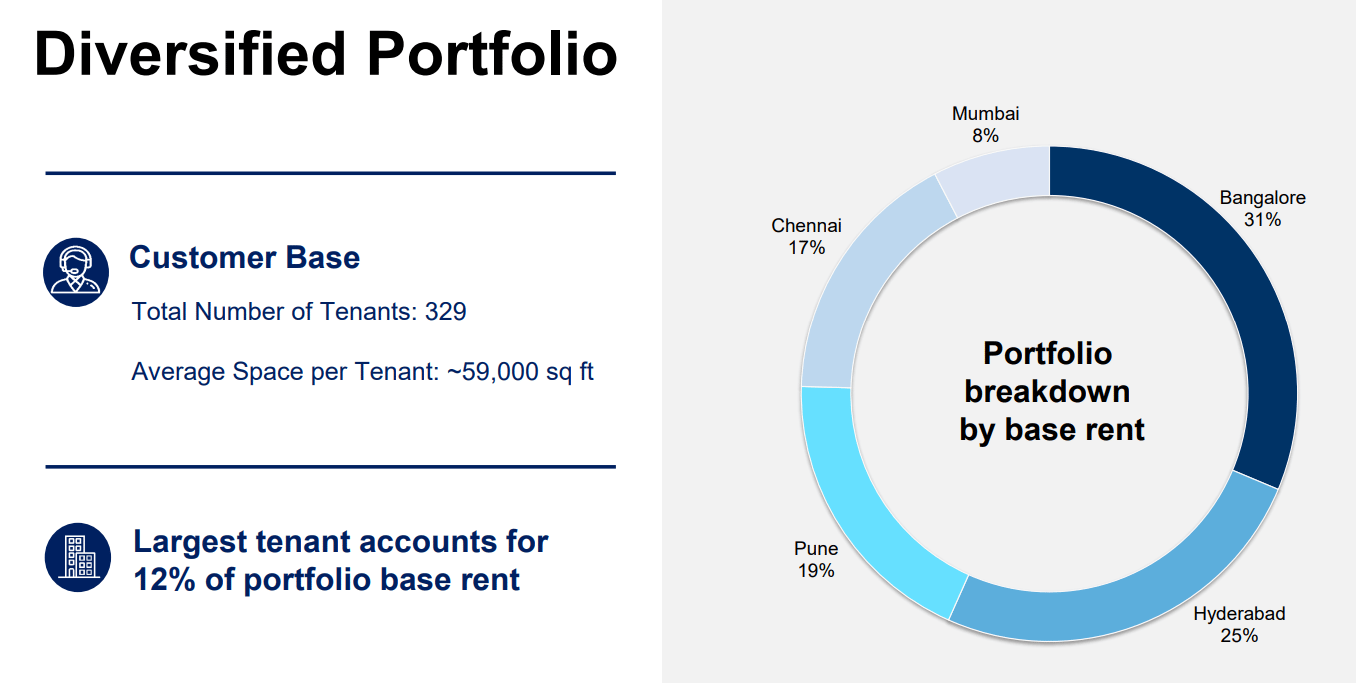

CapitaLand India Trust is a REIT focused on business park properties in India. It has 10 IT business parks, three industrial facilities, one logistics park and four data centre developments.

Most of its assets under management are in Bangalore (31%), Hyderabad (25%) and Pune (19%).

Source: CapitaLand India Trust

It is currently trading at an extremely low PER of 3.8 times compared to its peers’ average of 20 times. It has a dividend yield of 5.6%.

Financially, revenue has been growing at a 9.7% clip every year from 2020 to 2024. Distributable income has remained relatively steady at around SG$100 million over the past 5 years.

With the boom in Artificial Intelligence globally, much of that activity and investments have also gone to India.

India has the required IT skill force and expertise for AI.

And it has been welcoming investments from AI companies.

If you enjoy exploring stocks through clean visuals and data-driven insights, Simplywall.st is worth checking out. It’s an intuitive way to uncover investment ideas and understand the fundamentals behind every chart you see.

👉 Find out more here.

Cheers,

James Yeo