Lum Chang Creations (LCC) has launched its IPO on Catalist and its public offer (1mil shares at S$0.25) is over 47.3 times oversubscribed!

Its specialist focus and rapid growth have made the listing one to watch for small-cap investors.

1. A niche leader in urban-revitalisation fit-outs

LCC specialises in conservation, luxury retail and hospitality projects that demand heritage compliance and premium workmanship.

This focus secures repeat work from government agencies, hotel chains and private developers, giving it meaningful scale without razor-thin margins.

2. IPO structure and proceeds

The offer comprises 49 million shares at S$0.25, raising S$12.25 million.

Only 1 million shares are for the public, while 48 million go to institutional and accredited investors, valuing the firm at about S$78.8 million upon IPO.

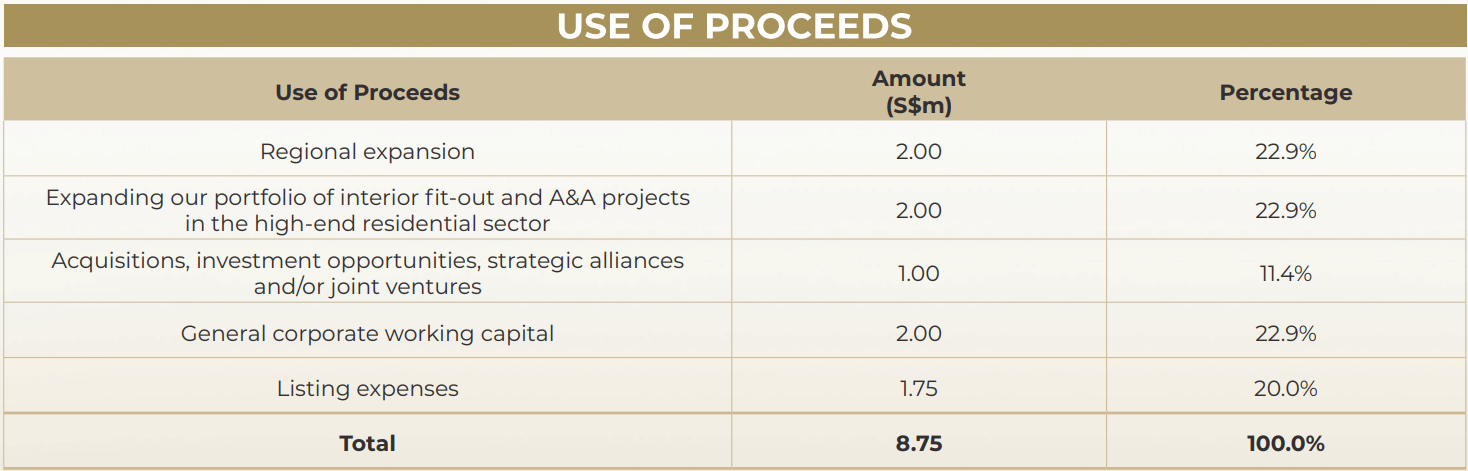

Roughly one-third of the funds will expand core capabilities, a quarter will seed high-end residential fit-outs, and the rest covers strategic investments, working capital and listing expenses.

3. Strong revenue and profit momentum

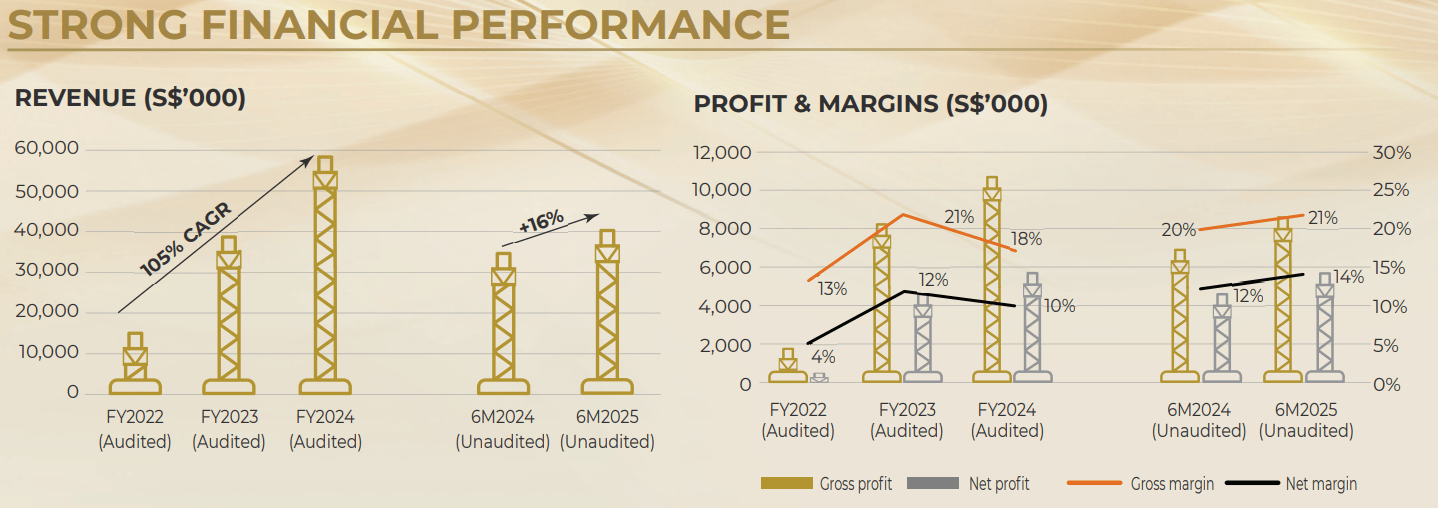

Revenue jumped from S$14 million in FY 2022 to S$59 million in FY 2024 - indicating an impressive 105% CAGR!

Net profits was even better, skyrocketing from S$0.5 million to S$5.6 million (>10x).

1H FY2025 profit surged 37.5% year-on-year to S$5.5 million and lifting net margins from 12% to around 14%.

4. Clear capital deployment roadmap

Lum Chang Creations have also mapped out a clear plan for its IPO proceeds.

Roughly 34% of the IPO proceeds will fund larger projects and equipment; 23% is slated for a new high-end residential division targeting landed properties and penthouses and 11% will support potential M&A or joint ventures, particularly in Malaysia

The balance will go to general working capital and offsets listing fees. This allocation signals management’s intent to balance organic growth with selective bolt-on opportunities.

5. Dividend policy signals income intent

The board plans to recommend dividends of at least 30% of net profit for FY 2025-26.

Based on FY2024 earnings, that equates to a prospective yield of about 2% at the offer price. If profit growth continues on its recent path, the payout could lift in tandem, offering investors a mix of growth and income.

6. Valuation: price-to-earnings (P/E) multiples

At S$0.25, the implied trailing P/E is about 14x, while annualising 1H FY2025 profit suggests a forward multiple near 7-8x.

By comparison, listed specialist contractors such as OKP Holdings and Boustead Projects currently trade between 9.6x and 8.4x trailing 12m earnings.

LCC’s offer therefore sits at a modest premium to its peers on a trailing basis and has to justify its valuation from the robust growth prospects ahead.

7. Risks Involved

There are also definitely risks that investors have to be aware of such as:

Order-book conversion: Revenue remains project-driven; timing of new wins could cause earnings swings.

Manpower and cost pressures: Tight labour markets and foreign-worker policies may squeeze margins if not managed.

Regional execution risk: Plans to expand into Malaysia will test management’s ability to replicate its niche advantages outside Singapore.

Conclusion

Lum Chang Creations brings a compelling growth story underpinned by specialist expertise, strong financial momentum and a defined use of IPO proceeds.

While its valuation looks reasonable when viewed on forward earnings, investors should weigh order-book visibility, manpower costs and liquidity constraints before drawing conclusions.

As with any small-cap listing, sustained performance after the first year of trading will be the true gauge of long-term value.

P.S. Was this forwarded to you? Join 9,000+ smart investors getting weekly insights direct to their inbox: investkaki.com

P.P.S. Check out this link where we consolidate all the 1-Min Stock Rundown posts together as well!

Cheers,

James Yeo