Co-living is the new marriage, from some Gen-Z or millennial (but I am a millennial).

The Assembly Place is listing in the Singaporean market and is creating some hype. Investors will be glad to know that the company is hitting all the right tones with the current investing climate.

Here are 7 things to know about the The Assembly Place’s IPO.

1. What the Company is About?

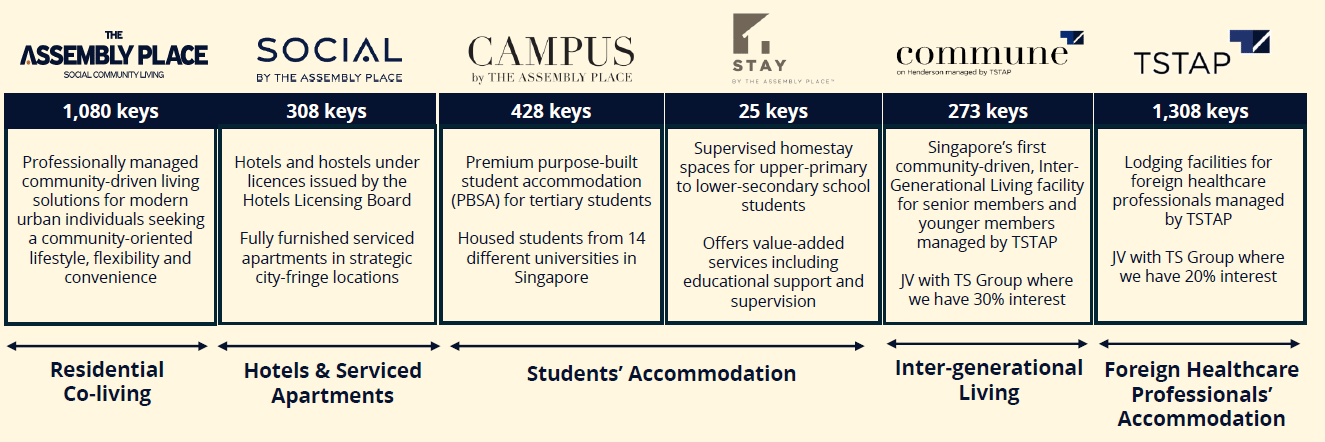

The Assembly Place (TAP) rents out rooms and accommodations to working people with employment passes, students, healthcare professionals, and tourists in Singapore.

Generally, the company serves about five markets - foreign healthcare accommodation, residential co-living, hotels & serviced apartments, students accommodation, and inter-generational living (senior living).

Source: The Assembly Place Corp Presentation

Currently, the company has 3,422 keys (or rooms) across 100 property assets in Singapore.

Foreign healthcare accommodation makes up the highest keys at 1,308, followed by residential co-living (1,080), and student accommodation (453).

What does this tell us? The Assembly Place’s outlook will depend on

The attractiveness of Singapore to foreign workers

Reputation of Singaporean universities to foreign students

Singapore’s tourism market

We will cover these industries’ outlook later. But what catches my eye is the business model of TAP - it is asset-light.

What TAP does is negotiate leases with property owners (not buy them), refurbish and renovate the properties, market them, and rent out the rooms to prospective clientele.

It does not bear the risks of owning the properties. Instead, it puts up the initial renovation costs. I believe this is the reason it expanded rapidly in the past 4 years.

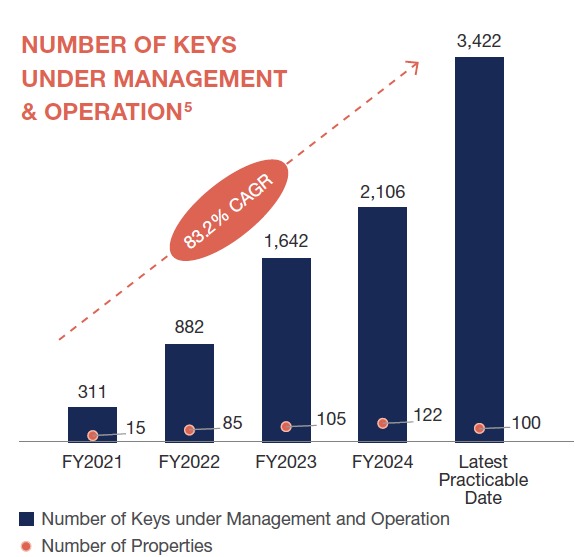

In just 4 years, TAP’s keys grew by 10 times from 311 in 2021 to 3,422 currently.

Source: TAP Prospectus

It’s more accurate to think of TAP as an operator that leases out rooms, but with specific branding and offerings.

2. What are the Details of its IPO?

TAP will list at a price of $0.23 per share, and is seeking to raise about $18.3 million. This will give TAP an indicative market valuation of $88 million, putting it in the small-cap space.

TAP will be utilising $12.7 million from the proceeds to

$5.7 million: Expand its portfolio through investing in renovation for new leases, joint ventures with other players, and expand overseas.

$4 million: Co-investments with property asset owners to acquire minority stakes

$1 million: Working capital

$1.9 million: Listing expenses

Ultimately, TAP’s gameplan is to expand its keys to 10,000 by 2030. That is growing three times from its current position in 4 years, and is an ambitious target to achieve.

However, I do think this is quite achievable for two reasons.

Firstly, TAP does not incur much renovation or refurbishment costs when they enter into an agreement with the asset owners. I teased this out from its prospectus from the following passage.

“Apart from these renovations, our Group did not undertake any significant renovation or refurbishment of our property assets during the Relevant Period. Any significant renovation or refurbishment, if necessary, are typically carried out by the property asset owners.”

Secondly, TAP has quite a wide network of asset owners that it can … tap into. The network comes from both Eric Low and Eugene Lim as they both have extensive experience in the Singapore real estate industry.

3. How is its Financial Performance?

From the trend on its number of keys/rooms, it’s fair to say that TAP’s financial performance has been very strong since its inception in 2021.

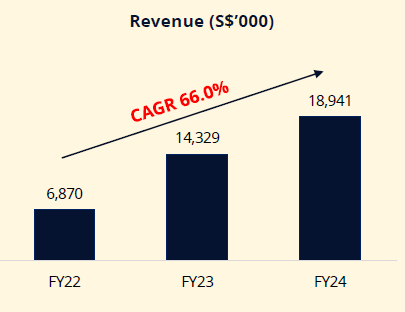

Revenue in particular, grew with an average CAGR of 66% since 2022 to 2024, and is now on pace to deliver a 23% growth in revenue for 2025 (1H 2025: $11.6 million).

Source: TAP Corp Presentation

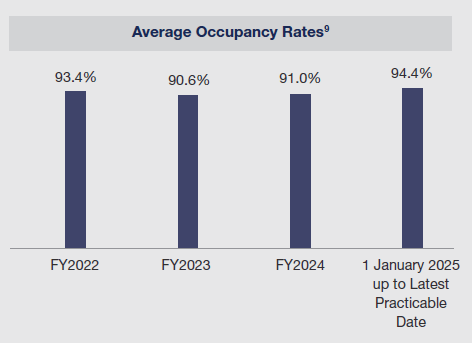

Much of this growth was driven by its demand for community-driven stays, as it has delivered consistently high occupancy rates in its assets (>90%).

If you take into consideration that its number of keys have grew by 10x, it’s not hard to see why it is delivering the kind of growth that you are seeing.

Source: TAP Prospectus

Meanwhile, profits are a bit more volatile. It generated a positive profit of $0.4 million in 2022 but plunged to a loss of $0.9 million in 2023.

It then, recovered to a big profit of $6.2 million in 2024. It’s difficult to get a good view on this as the company’s valuation of its leases changes every year, and sometimes results in big losses on valuations.

So, I decided to take a look at its operating cash flow instead. Cash is king, the picture becomes clearer.

Operating cash flow doubled from $4.8 million in 2022 to $9.0 million in 2023. It then grew to $12.7 million in 2024, and is on pace to deliver about $14 million in 2025 (1H 2025: $6.9 million).

Not only is TAP’s revenue is growing at a strong rate, its operating cash flows are also showing the same trend.