Man, not again.

Recession concerns are coming up again because of Trump tariffs.

And they are brutal for the markets.

The U.S. economy just contracted in the latest quarter, sending many into a panic. Many are unsure about what to expect now.

In the Meme of the Week section, I outline my thoughts and data that that I am looking at for a recession.

Big Hits [U.S.] 💵

Moving on, here are the news that shocked the world…

Meta $META ( ▲ 0.32% ) : Meta’s 1Q 2025 results exceeded expectations as revenue and profits grew by 16% and 37% respectively [Read More]

Microsoft $MSFT ( ▲ 1.18% ) : Microsoft’s quarterly results also beat expectations with both revenue and profits up by 13% and 18%, driven by its Cloud division [Read More]

IBM $IBM ( ▲ 2.67% ) : IBM is making a US$150 billion bet over the next five years in the U.S. to make quantum computers [Read More]

Starbucks $SBUX ( ▲ 1.83% ) : Starbucks’ results was weaker-than-expected, but that’s to be expected considering the turnaround plan it initiated [Read More]

Hims & Her X Novo Nordisk $HIMS ( ▼ 0.32% ) : Hims & Her will now be allowed to sell Novo Nordisk’s slimming syringe, Wegovy [Read More]

P.S. Every click helps me get you all the information you need for your investing journey!

Big Hits [Asia] 📊

Here are the news covering the Asia market…

Standard Chartered: Quarterly results beat expectations as profits grew by 19% driven by its wealth management and global markets businesses [Read More]

Yangzijiang: Yangzijiang Financial is planning to spin off its maritime business and list it on the Singapore Exchange in the next 6 to 12 months [Read More]

ST Engineering: ST Engineering has just secured about SG$4.4 billion of contracts in 1Q 2025. The majority is from its aerospace segment. [Read More]

iFast Corp: Profits are up by 31.2% for 1Q 2025 driven by the turnaround of iFast Global Bank and its wealth management business. [Read More]

Sheng Siong: Both revenue and profits grew by 7.1% and 6.2% respectively boosted by eight new stores and higher sales from the Hari Raya season [Read More]

Analyst Reports 📝

See below for our handpicked analyst reports:

Stock | Headline | Link |

|---|---|---|

Amazon | Strong 1Q 2025 results and attractive valuation | |

Airbnb | Shares undervalued with investments stoking LT growth | |

BYD | New product launches and overseas expansion | |

CapitaLand Commercial Trust | Positive rental reversion | |

Singapore Exchange | Rebound in share price with higher trading volume |

Meme of the Week 📹

The 9-letter R word is back in the media.

If you didn’t know, the U.S. economy declined by 0.3% in 1Q 2025 compared to a growth of 2.4% in 4Q 2024.

Technically, it is not a recession yet. Only when the economy contracts for two consecutive quarters will it be one.

But the writing is already on the wall.

You see, Trump tariffs have this unfortunate impact on consumer and business sentiments. If you don’t know what it is, think of them like how consumers and businesses are vibing with the economy,

If consumers don’t feel confident, they will buy less things. When less things are bought, companies don’t make money. Less profits mean higher chance of laying off people.

The Michigan consumer sentiment - which tracks how strongly consumers are feeling - has declined to its lowest level of 52.2 since the high inflation episode in June 2022.

If that is not enough, inflation is now back in the U.S. due to the tariffs.

This is the perfect storm for stagflation. Think of stagflation as you just lost your job because your company went bankrupt because of the economy. And you come back from work to find out that your grocery bill has increased by twice the amount.

Slow economic growth and high inflation.

The last time this happened was during the late 1970s and early 1980s. Oil prices were so high that the U.S. had to contend with slow GDP growth while everyone paid and arm and a leg to drive around.

Definitely not a fun ride.

Free Tool of the Week

A recession is scary.

It has the potential to wipe out your investment portfolio in a blink of an eye.

But it doesn’t have to be that way.

One way I deal with a recession is to look for companies that are resistant or immune to a recession.

These are the companies that, rain or shine, will always be here.

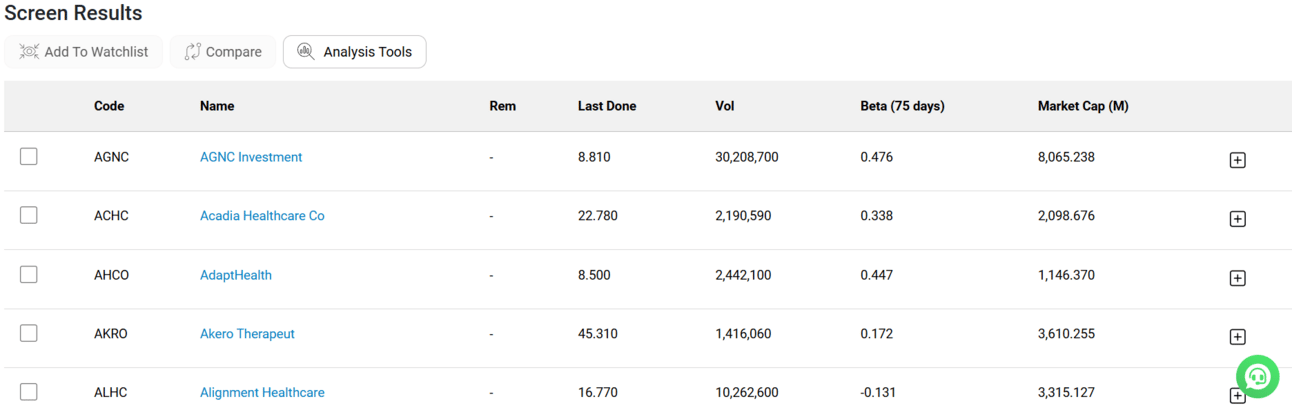

One indicator that I see is called the beta. It measures the correlation of the company’s share price to the overall stock market.

High-beta stocks mean that the company is very risk compared to the market

Low-beta stocks mean that the company is less risky.

I find myself using Shareinvestor’s stock screener to look for companies with beta that is below 0.5 times.

These are the companies I found.

Interested in using the tool? Use my code: JYSCA5 when you are registering for one!

Hope the above is fruitful for you all!

Cheers,

James Yeo