Centurion Accommodation REIT (CAREIT) will make its trading debut on the Mainboard of the Singapore Exchange at 2pm on September 25.

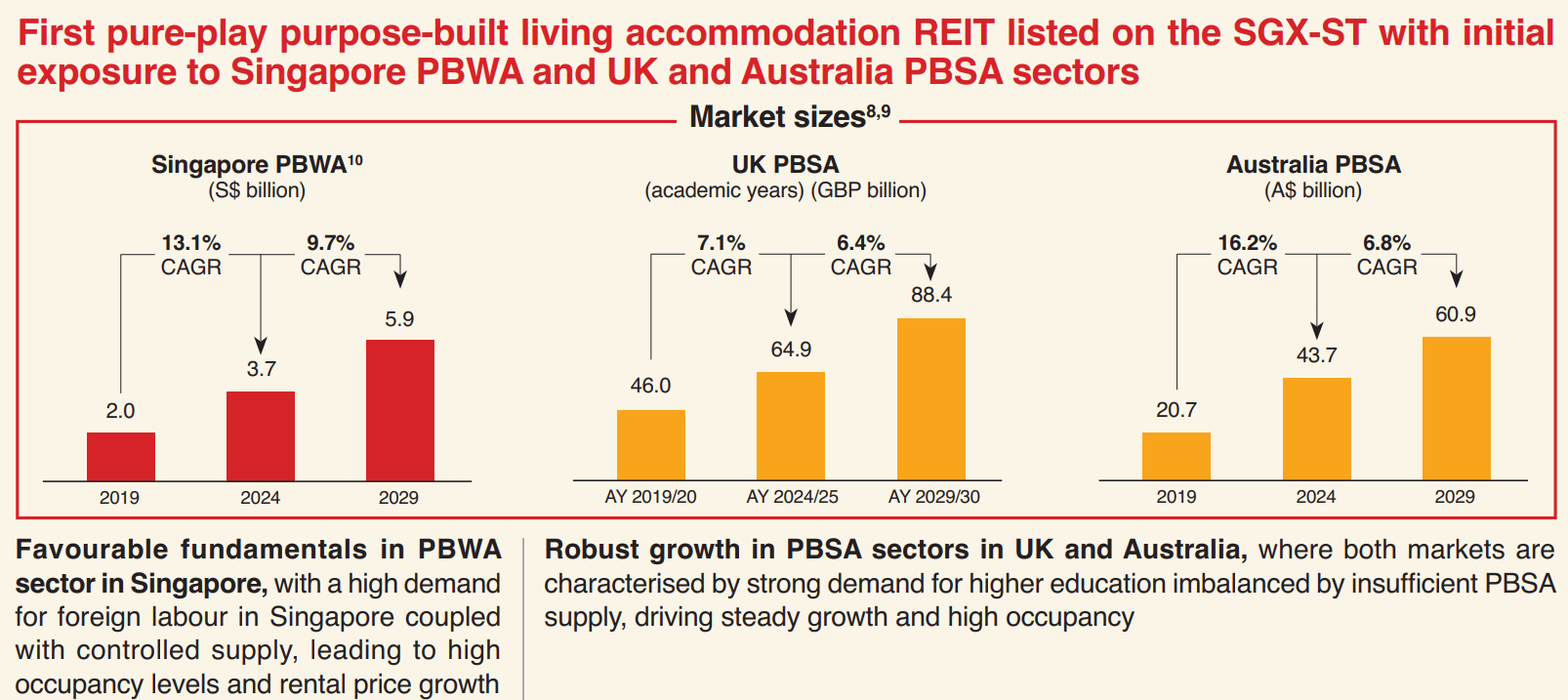

This isn’t just another REIT listing as it’s the first pure-play purpose-built living accommodation REIT in Singapore, and the second-largest Mainboard listing this year.

Here are 7 things you need to know before you decide if this IPO belongs on your radar.

1. A diversified portfolio across Singapore, UK, and Australia

With a portfolio of workers’ and student accommodation assets across multiple markets, CAREIT is positioning itself as a unique play in the resilient living sector.

The REIT’s initial portfolio consists of 14 assets worth about S$1.8 billion: five purpose-built workers’ accommodation (PBWA) assets in Singapore, eight purpose-built student accommodation (PBSA) assets in the UK, and one PBSA asset in Australia.

A forward purchase agreement has already been signed for a second Australian asset, Epiisod Macquarie Park in Sydney, which will complete in early 2026. Once included, the enlarged portfolio will comprise 15 properties valued at approximately S$2.12 billion.

The assets are strategically located - workers’ accommodation near Singapore’s industrial hubs and student housing within reach of major universities. This sector and geographic spread helps hedge against concentration risks and provides exposure to resilient demand drivers.

2. A sizable IPO raising over S$771 million

CAREIT is seeking to raise S$771.1 million from its IPO at an offering price of S$0.88 per unit. The deal consists of an international placement of 248.96 million units and a Singapore public tranche of 13.2 million units.

^In case you forgot how to apply for IPOs 🫣

Beyond that, the REIT has attracted strong cornerstone support - 16 cornerstone investors, including names like abrdn Asia, Lion Global Investors, Principal Global Investors, and Cohen & Steers, have collectively subscribed for more than 614 million units.

Such backing from established institutional investors signals confidence in the REIT’s strategy and fundamentals.

For retail investors, the IPO subscription opened on September 18 and will close on September 23 at noon, with the trading debut set for September 25.

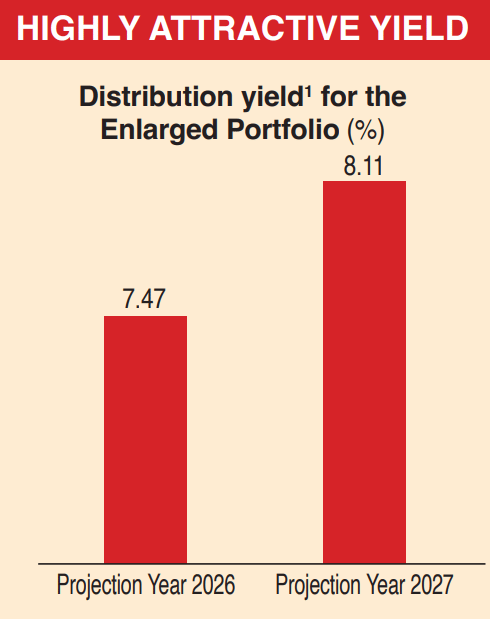

3. Projected yields look attractive

Income generation is at the heart of every REIT, and CAREIT’s numbers stand out.

Based on the IPO price, the REIT projects distribution per unit (DPU) yields of 7.47% for FY2026 and 8.11% for FY2027.

These forecasts are supported by expected gross revenue of S$209.1 million in FY2026 and S$218.2 million in FY2027, with net property income (NPI) forecast at S$151.7 million and S$159.1 million respectively.

Good sign when NPI > Distributable Income 😐

Compared to the current Singapore REIT market, where average yields hover around 6% for diversified plays, CAREIT’s forecasted returns look compelling.

4. Strong demand dynamics underpinning workers’ and student housing

In Singapore, the demand-supply imbalance for PBWA is stark. With an estimated 400,000 to 500,000 foreign workers compared to only 124,700 permanent PBWA beds, the market is undersupplied.

Rents have surged from around S$250 per bed in 2019 to roughly S$550 today, and high occupancy rates of above 96% suggest this trend has staying power.

Meanwhile, in the UK and Australia, student housing demand continues to be buoyed by both domestic enrolments and international inflows, particularly from China.

CAREIT’s PBSA assets reported an occupancy rate of 97.5% in the three months ended March 31, 2025. These dynamics point toward steady revenue streams in both segments.

5. Long land tenures and stable lease structures

One often overlooked factor in assessing REITs is lease tenure. About 86% of CAREIT’s portfolio, by property value, comprises assets with either freehold titles or leaseholds exceeding 30 years.

This compares favourably to industrial or data centre leases, which often run just three decades. Longer tenures mean reduced refinancing or land renewal risks in the medium term.

In addition, the PBWA portfolio enjoys tenant stickiness with an average retention rate above 85%, while the PBSA properties operate under established brands like “Dwell” and “Epiisod,” further enhancing occupancy stability.

6. Prudent capital structure with room to grow

CAREIT is starting life with conservative gearing. Its leverage ratio at IPO stands at 20.9% and is projected to rise to around 31% following the fully debt-funded acquisition of Epiisod Macquarie Park.

To add on, the REIT retains debt headroom of about S$558.8 million before hitting the 45% gearing, giving it ample flexibility to pursue future acquisitions.

With Singapore dollar-denominated reporting - rather than US dollar structures that have recently struggled with forex volatility - CAREIT also offers some insulation against currency swings, a point its CEO Tony Bin highlighted in media briefings.

7. Growth pipeline supported by its sponsor

CAREIT isn’t starting from scratch. It benefits from the backing of Centurion Corporation, its sponsor, which is one of the largest PBWA operators in Singapore with a portfolio of more than 70,000 beds across six countries.

Through a right of first refusal (ROFR) agreement, the REIT has access to Centurion’s future pipeline of assets, giving investors visibility into potential inorganic growth. In addition, asset enhancement initiatives are already underway.

For example, Westlite Toh Guan, a 7,330-bed PBWA asset, is adding 1,764 beds in an expansion expected by late 2025. This combination of organic enhancements and sponsor support should provide steady momentum after listing.

Conclusion

Centurion Accommodation REIT’s IPO is shaping up as one of the more interesting offerings in Singapore’s REIT space this year.

It combines exposure to 2 resilient accommodation sectors with strong demand fundamentals, attractive projected min. 7.5% yield, and the credibility of a seasoned sponsor.

For investors seeking income with a defensive tilt, CAREIT’s debut is one worth watching closely.