This Week at InvestKaki:

Big Hits [U.S.] 💵

Moving on, here are the news that shocked the world…

Walmart-Google $WMT ( ▲ 0.64% ) $GOOG ( ▼ 0.91% ): Are we going to be slave to the algorithm? Walmart and Google are working together to enable Gemini users to shop Walmart products [Read More]

JP Morgan $JPM ( ▲ 0.91% ): JP Morgan’s earnings beat expectations despite profits declining by 7%. Meanwhile, revenue rose by 7%, driven by trading and net interest incomes segments [Read More]

Goldman Sachs $GS ( ▲ 0.1% ): Goldman Sachs earnings topped expectations. Even though revenue declined by 3%, profits were up by 12% driven by its equities division [Read More]

Bank of America $BOFA.TSX ( ▲ 0.72% ): Earnings exceeded expectations as both revenue and profits grew by 7% and 12% on the back of net interest income, asset management, and trading segments [Read More]

Wells Fargo $WFC ( ▼ 0.06% ): Another beat. Wells Fargo’s revenue and profit grew by 4% and 6% respectively [Read More]

⏰ Last Day to Join the InvestKaki Giveaway

Just a quick reminder that today is the final day to participate in the InvestKaki investing giveaway.

I know the past few weeks have been packed for most of us but don’t miss out on the attractive prizes like SuperKakis Premium 1-Year Membership and S$100 Grab E-Vouchers!

It only takes a few minutes to participate, and you can boost your chances by completing more actions or referring friends.

👉 Join before it closes tonight 23:59pm:

https://gleam.io/W75on/investkaki-giveaway

💡 Exclusive Longbridge Promotion (Ending Today)

Separately, for those who are reviewing their brokerage setup for the new year, there’s an exclusive Longbridge promotion running.

🎁 New users on Longbridge Singapore (MAS-licensed brokerage) can enjoy, with a minimum S$2,000 deposit:

A 12% p.a. interest boost

Free stock rewards worth up to S$1,200 when you deposit and trade

Up to S$70 in US options trading gifts

Lifetime $0 commission and platform fee coupons for SG, US, and HK stocks

Affiliate Exclusive: Or you can simply just get S$18 by depositing S$100 today!

👉 Sign up via my link here to access the full rewards.

Offer ends 31 Jan. T&Cs apply. This advertisement has not been reviewed by the Monetary Authority of Singapore (MAS).

Big Hits [Asia] 📊

Here are the news covering the Asia market…

Omnivision: Share price rose by 16.2% on its first day of trading, raising about HK$4.8 billion. It is the third largest digital image sensor provider globally with 13.7% market share [Read More]

Assembly Place IPO: Assembly Place, a co-living operator, is listing in the market to raise about $18.3 million to expand its rooms to about 10,000 by 2030 [Read More]

GKE Corp: Revenue was up by 5.3%, while profits were down by 57.5%. Its core warehouse and logistics segment drove revenue growth. [Read More]

HC Surgical Specialists: Revenue declined by 1.6% but profits are up by 17.5% as it recognises gains on non-operating items [Read More]

Centurion Accommodation REIT: The REIT has completed the acquisition of EPIISOD Macquarie Park in Sydney, Australia for A$345 million [Read More]

Reports 📝

See below for our handpicked analyst reports:

Stock | Headline | Link |

|---|---|---|

Morgan Stanley | Strong 4Q results, driven by investment banking and trading | |

Blackrock | Higher AUM with more inflows | |

TSMC | Higher AI demand | |

Coliwoo | Leading co-living player | |

Food Empire | Ceasefire between Russia and Ukraine to be positive |

Help us make better ads

Did you recently see an ad for beehiiv in a newsletter? We’re running a short brand lift survey to understand what’s actually breaking through (and what’s not).

It takes about 20 seconds, the questions are super easy, and your feedback directly helps us improve how we show up in the newsletters you read and love.

If you’ve got a few moments, we’d really appreciate your insight.

Posts of the Week

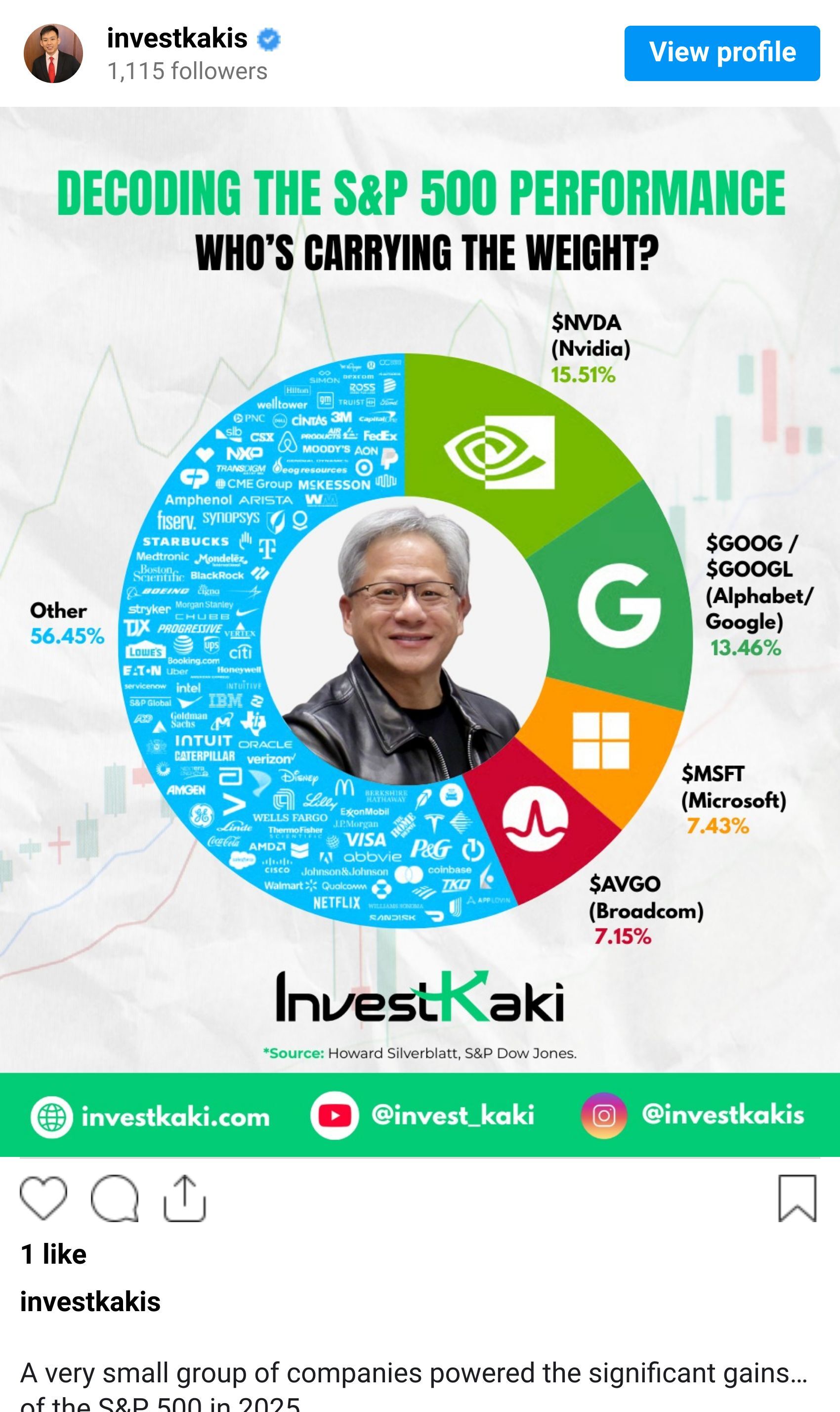

When you need a carry on your Dota and LoL games …

👉 Follow us on Instagram here!

Stock of the Week

TSMC has been making the news again …

Share price was up by 6.8% last week as its 4Q 2025 earnings have once again, blew market expectations away.

Revenue was up by 20.5%, while profits grew even stronger at 35%.

Most of these growth was driven by higher shipments of the 3nm and 5nm chips which are more sophisticated.

Just when you think the AI boom is over, TSMC once again delivers record results. The High Performance Computing (HPC) segment that tracks the AI sector, rose by 48% for 2025, by far its best-performing segment, contributing 58% of revenue.

The automotive segment demand rose by 34%, followed by Internet-of-Things and smartphone segments.

Source: TSMC 4Q 2025 Results

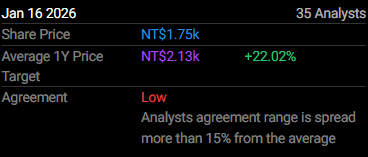

The AI boom still has a lot of legs to run on, and TSMC is at the heart and centre of it. Analysts have TSMC at a target price of NT$2.13K with an implied upside of 22%.

Source: SimplyWallSt

Hope the above is fruitful for you all..

Cheers,

James Yeo