Mysterious love letters arrived at the offices of Presidents around the world.

They were marked, “Dear Beloved Leader, hope you have been well. Didn’t hear from you so I wrote. Anyway, here’s a tariff. Get back to me before 1 August. Waiting for you. XOXO”

Such is the whirlwind romance of international trade.

And now, these countries are moving away from the U.S. and into China with open arms.

Big Hits [U.S.] 💵

Moving on, here are the news that shocked the world…

Tariff letters $SPX ( ▲ 0.77% ) : Trump had imposed tariffs on 14 countries with rates ranging from 25% to 40%, with a deadline of 1 Aug for them to negotiate. [Read More]

WK Kellogg $KLG ( 0.0% ) : Ferrero Rocher is acquiring WK Kellogg for US$3 billion and the deal could be closed by the end of the week. [Read More]

Apple $AAPL ( ▲ 2.24% ) : Apple could be making a recovery in China? iPhone sales rose by 8% in 2Q 2025 - the first time it achieved a positive growth since 2023 [Read More]

Delta Airlines $DAL ( ▲ 3.51% ) : Delta registered a 10% growth in revenue for 2Q 2025 driven by higher-priced seats and its lucrative American Express partnership [Read More]

Datadog $DDOG ( ▲ 1.77% ) : Datadog got that dog in it. It is being included in the S&P 500 with a market cap of US$50 billion, replacing Juniper [Read More]

Start learning AI in 2025

Everyone talks about AI, but no one has the time to learn it. So, we found the easiest way to learn AI in as little time as possible: The Rundown AI.

It's a free AI newsletter that keeps you up-to-date on the latest AI news, and teaches you how to apply it in just 5 minutes a day.

Plus, complete the quiz after signing up and they’ll recommend the best AI tools, guides, and courses – tailored to your needs.

Big Hits [Asia] 📊

Here are the news covering the Asia market…

FWD Group: Looks like Li Ka Shing’s son, Richard Li caught a break. FWD Group, an insurance company, debuted on the Hong Kong market after failing to list in the U.S. in 2021 [Read More]

Lum Chang IPO: Lum Chang Creations, is planning to list and raise SG$12.3 million in the Catalist market in Singapore [Read More]

Food Empire: Fresh investments! Food Empire plans to invest US$37 million in India to expand its spray-dried soluble coffee manufacturing facility in Andhra Pradesh [Read More]

Guocoland: Guocoland obtained a SG$619 million green club facility to acquire and develop its River Valley Green (Parcel B) project. [Read More]

PSC Corp: PSC Corp could be delisting. Goh Seng Hui has acquired 11.5% of PSC Crop for a total stake of 43% currently. It is now making a mandatory offer for SG$0.40 per share [Read More]

Analyst Reports 📝

As the first MAS-licensed brokerage in Singapore to offer lifetime commission-free trading across US, HK, and SG markets, Longbridge is committed to delivering a truly low-cost investing experience - with zero hidden fees and no barriers.

📣 This month only: Fund your account and enjoy $0 platform fees, plus unlock exclusive Welcome Rewards worth up to SGD 800!*

⏰ Deposit by 31 July 2025, 11:59 PM (GMT+8) to receive your New Investor Welcome Pack, which includes:

✅ Free shares from top companies like NVIDIA, Apple, Google, and AMD*

✅ $0 platform fees on US, HK, and SG stocks — giving you unmatched savings on every trade

✅ Up to 90 days of guaranteed 6% p.a. interest when you subscribe to Longbridge Cash Plus

👉 Start your investing journey with an edge. Claim your Welcome Pack and enjoy $0 trading fees with Longbridge here today*!

*TnCs Apply.

*This advertisement has not been reviewed by the Monetary Authority of Singapore. This information is provided for reference only and shall not be construed as investment advice, recommendation, offer, invitation, solicitation, or inducement. Investing involves risks, and the price of investment products can rise or fall, sometimes significantly, which may lead to a loss of investment principal. Before making any investment decisions, it is highly recommended that investors carefully review the relevant sales documents and risk disclosure statements, seek independent professional advice, and take into consideration all relevant risk factors based on their own needs and judgment.

See below for our handpicked analyst reports:

Stock | Headline | Link |

|---|---|---|

Healthy user growth and improved monetisation | ||

TripAdvisor | Starboard investment could unlock value | |

Moutai | Capacity to overcome industry downturn | |

Sheng Siong | Store expansion to grab more market share | |

Keppel Infrastructure Trust | Strong dividend yield and long contracts |

Visual of the Week 📹

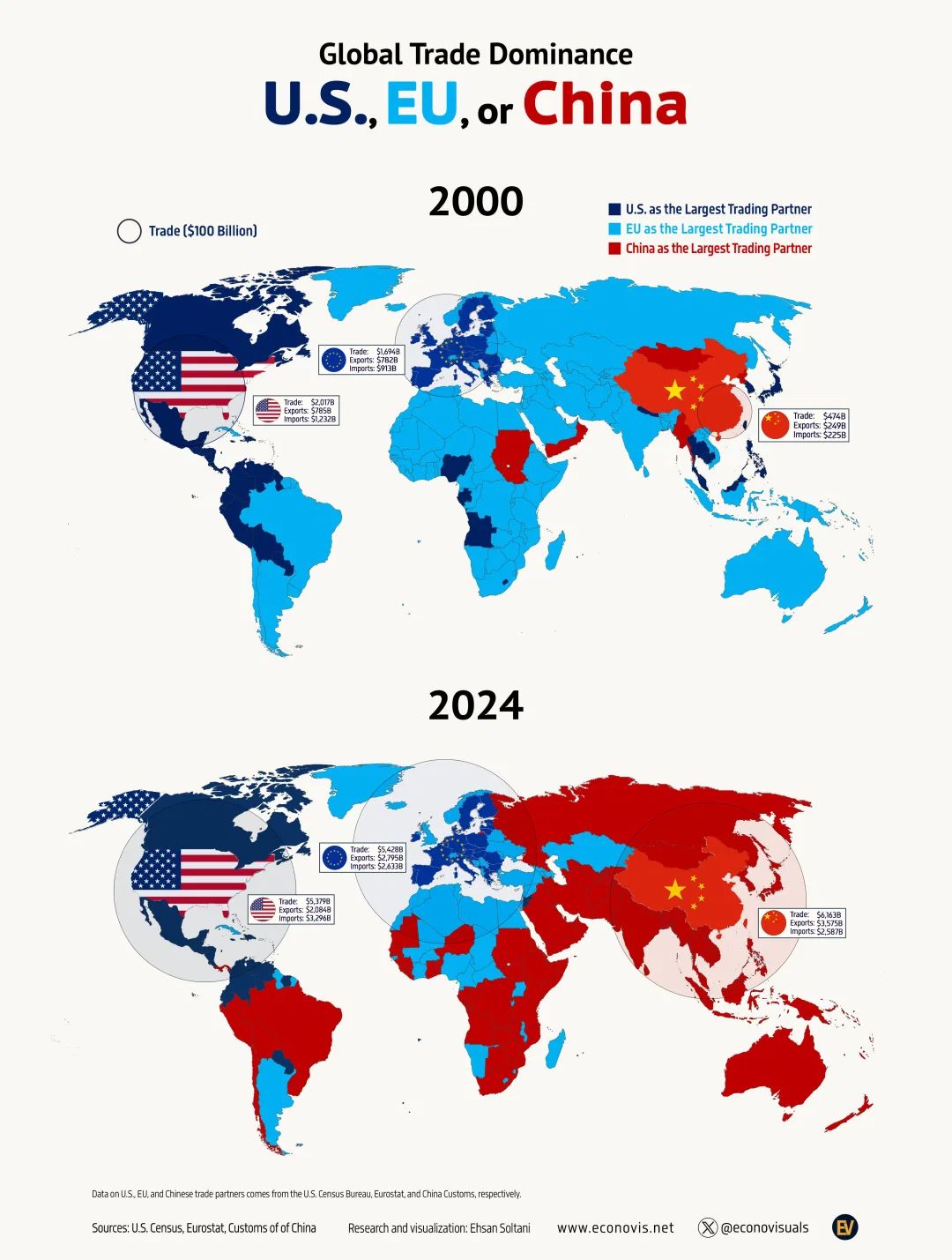

You know what’s surprising?

Europe was actually the biggest trading partner for most of the world in 2000.

Not the U.S.

But that aside, this infographic illustrates something important to today’s tariff wars - China has upstaged both the U.S. and Europe

Made in China began in the early 80s, with President Deng Xiaoping having his famous saying,

“It doesn't matter if a cat is black or white, if it catches mice it's a good cat.”

Socialism with Chinese characteristics took hold. He opened up industries to trade and investments, and China didn’t look back.

According to data from OEC, China is the number one country in the world for total exports, and the second biggest economy (after the U.S.).

The rise in trade and exports have lead to meteoric growth in many Chinese sectors:

Electrical and Electronics: 30% of China’s exports

Mechanical and machinery: 16%

Textile: 8%

Metals: 8%

Transportation:7%

With Trump tariffs on many Asian countries now (pending negotiation again until 1 August 2025), trade with China is expected to grow even more.

South Korea, Japan and ASEAN are more than eager to sell more to China if talks break down with the U.S. Here are China’s top import partners in the region

South Korea: 7.6% of China’s imports

Japan: 6%

Indonesia: 3.2%

Malaysia: 2.6%

Singapore: 1.9%

Thailand: 1.8%

When one door closes, another opens.

Stock of the Week

Nvidia - the new US$4 trillion behemoth.

3 years ago, no one expected Nvidia to reach this height. They said US$1 trillion was the height, then it hit US$2 trillion.

Again, people doubted it and then it hit US$3 trillion. Surely, this is the end.

How wrong were the naysayers.

Share price is up 20% since the beginning of the year, but the road has been bumpy.

Trump tariffs especially the ones on China, dropped Nvidia like a fly. This is on top of export restrictions placed on Nvidia’s chip exports to the Middle Kingdom. Price was down to as as low as US$94 in April 2025 from the peak of US$149 in January 2025.

The concern? China makes up 13% of Nvidia’s revenue in 2024.

And its dominant Chinese market position of 95% in 2022 has eroded to 50% in 2025. Huawei has effectively filled that gap in China.

However, with the U.S. and China effectively reaching some sort of trade agreement, investors have flocked back to Nvidia.

What a ride it has been.

Nvidia’s latest quarterly results ending April 2025 show that it is still on top of the AI game.

Revenue grew by 69% to US$44.1 billion

Profit is up by 26% to US$18.8 billion

If anything, Nvidia’s resilience through all this is proof that it can maintain and even grow its already dominant global market position.

Hope the above is fruitful for you all..

Cheers,

James Yeo