This Week at InvestKaki:

Big Hits [U.S.] 💵

Moving on, here are the news that shocked the world…

Trump Tariffs $SPX ( ▲ 0.47% ) : India meme-d on Trump. So, he took it personally and imposed a 50% tariff on the country. Though, it’s probably because it still sells oil to Russia [Read More]

Pfizer $PFE ( ▼ 0.63% ) : Things are going well for Pfizer. It has raised its profit guidance for the year as Covid vaccine and other drugs have been driving sales. The problem? Trump asked it to reduce prices [Read More]

DuPont $DFT ( 0.0% ) : Slow and steady does the job nicely. 2Q 2025 revenue and profits both grew by 3% and 15% respectively, driven by its electronics and industrial segments. [Read More]

AMD $AMD ( ▲ 3.63% ) : AMD’s 2Q results were mixed. Revenue was as expected, but profits missed. Data centre revenue was disappointing and it says it has already taken a hit from Trump tariffs [Read More]

Disney $DIS ( ▼ 1.44% ) : Is the magic back? Well, Disney’s 3Q 2025 results exceeded expectations. Profits doubled to US$5.3 billion on the back of streaming and theme parks. [Read More]

Big Hits [Asia] 📊

Here are the news covering the Asia market…

China’s Ship Behemoth: China HSSC Holdings is absorbing China Shipbuilding Industry Company to form China’s biggest shipbuilder and of the world's too [Read More]

DBS: Bittersweet. DBS’ profit is up by 1% for 2Q 2025 but is down by 5% for 1H 2025. Meanwhile, revenue grew by 5% for 1H 2025. [Read More]

UOB: Uh Oh, UOhBee is in trouble. Profits are down by 3% for 1H 2025 as the bank warns that ‘macroeconomic uncertainties’ are hammering customers’ sentiments [Read More]

SGX: Meanwhile, SGX is on a roll? Profits for the full-year of 2025 is up by 8.4% to $648 million driven by cash equities and derivatives segments. [Read More]

Parkway Life REIT: Parkway Life REIT is living the steady life. Distribution income per unit grew by 9.5% to $50 million for 1H 2025 [Read More]

Analyst Reports 📝

See below for our handpicked analyst reports:

Stock | Headline | Link |

|---|---|---|

Airbnb | Resilient demand with international expansion | |

Apple | Additional US$100 billion investment in the U.S. | |

Tencent | Online gaming resilience and adoption of AI | |

Frasers Logistics & Commercial Trust | Steady dividend yield with strong balance sheet | |

Frencken Group | Positive outlook from customers |

Technical Terms Explained

Big news from the week!

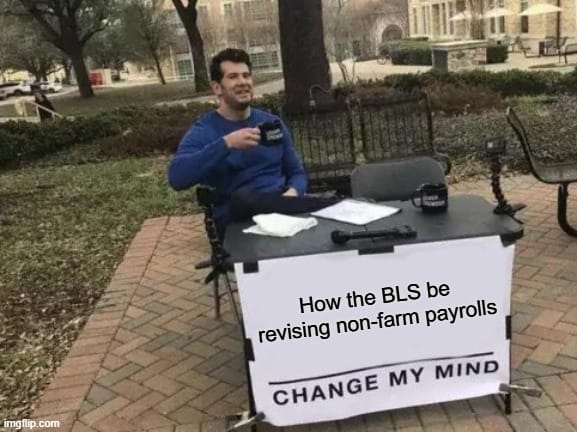

United States non-farm payroll employment for May and June 2025 has been revised down by 258,000 from 291,000 previously to 33,000 currently.

If you are scratching your head now wondering what is this, you have come to the right place!

Don’t let the fancy name distract you.

Non-farm payroll employment just means how many Americans have a job in the U.S. excluding the agricultural sector.

It covers about 80% of the American workforce, and is an important economic indicator for investors to follow as

It describes the state of the U.S. job market

Relates directly to whether Americans have a job and are they spending

The statistics is provided by the Bureau of Labour Statistics (BLS), and is revised twice throughout the year.

The reason why it’s revised is because BLS computes the numbers based on survey responses. The higher the survey response, the more accurate and vice versa.

Here’s why this is important to you.

This revision in numbers means two interpretations

Previously, investors thought the economy was doing well, with 298,000 jobs added to the U.S. economy.

Now, investors have changed their mind as only 33,000 jobs are added.

The bottom line is that the U.S. economy was thought to be going strong, but now, it is probably on the brink of a recession.

Stock of the Week

Disney - Where Dreams come True… Or Die.

The last couple of years have been tough for the company after a series of movie flops after its cash-cow Avengers Endgame ended.

But something might be on the horizon.

Disney’s 3Q 2025 results have exceeded expectations.

Profits doubled to US$5.3 billion in 3Q 2025

Revenue rose slightly by 2%.

Key to this performance?

Streaming is up, while people are spending more in their theme parks.

But this result have to be looked at with a thin razor.

The high profit in 3Q 2025 is mainly due to tax benefits from the purchase of Comcast’s Hulu stake.

Operating income for Disney only increased by about 8%

That said, Disney still has a competitive advantage in its own markets. It still generates consistent and growing operating cash flow throughout the years. Its balance sheet remains robust.

It’s hard to ignore Disney’s almost monopolistic position.

Trading View’s analysts have Disney at a target price of US$135 with a potential upside of +20%.

Hope the above is fruitful for you all..

Cheers,

James Yeo