This Week at InvestKaki:

Big Hits [U.S.] 💵

Moving on, here are the news that shocked the world…

Nvidia $NVDA ( ▲ 0.68% ) : Nvidia’s 3Q result blew past expectations. Revenue and profit grew by 62.5% and 65.3% respectively as data centre demand drove much of its growth [Read More]

Alphabet $GOOGL ( ▼ 0.19% ) : Alphabet getting an A+ from Warren Buffett. Berkshire Hathaway bought about US$4.3 billion of its stocks [Read More]

Adobe $ADBE ( ▲ 3.44% ) : Adobe is purchasing Semrush for US$1.9 billion to take advantage of its AI capabilities in the marketing space [Read More]

Walmart $WMT ( ▲ 0.75% ) : Walmart raised its earnings forecast after revenue and profits grew by 5.8% and 29% on higher e-commerce sales [Read More]

Target $TGT ( ▲ 1.92% ) : Target is not on target this quarter. Profits dropped by 19% as it continues to face stiff competition within the industry. [Read More]

Shoppers are adding to cart for the holidays

Over the next year, Roku predicts that 100% of the streaming audience will see ads. For growth marketers in 2026, CTV will remain an important “safe space” as AI creates widespread disruption in the search and social channels. Plus, easier access to self-serve CTV ad buying tools and targeting options will lead to a surge in locally-targeted streaming campaigns.

Read our guide to find out why growth marketers should make sure CTV is part of their 2026 media mix.

Big Hits [Asia] 📊

Here are the news covering the Asia market…

PDD Holding: PDD Holding’s profits rose by 14%, boosted by heavy marketing and discount campaigns improved demand in China [Read More]

CSE Global: CSE Global’s 3Q revenue rose by 20.5% driven by its electrification business that rose by nearly 40%. [Read More]

Nam Cheong: Nam Cheong’s earnings were down by 3% for 3Q, while revenue declined by 15% as it comes off from a high base from last year’s strong performance [Read More]

Sanli Environmental: Profits were up by 32% as it disposed of a property at 28 Kian Teck Drive. However, revenue was down 3.3% on lower contribution from completed projects [Read More]

Hongkong Land: Hongkong Land reported lower profits by 13% as Hong Kong properties contributed less while it incurred more cost for prime properties investment in China [Read More]

Reports 📝

See below for our handpicked analyst reports:

Stock | Headline | Link |

|---|---|---|

Nvidia | Strong 3Q results with AI bubble potentially overblown | |

General Motors | Undervalued with tariff good news | |

Trip.com | Strong overseas performance | |

Food Empire | Strong brand performance in the Balkans | |

SATS Ltd | Record results supported by cargo |

Interested in a billionaire story this week?

Stock of the Week

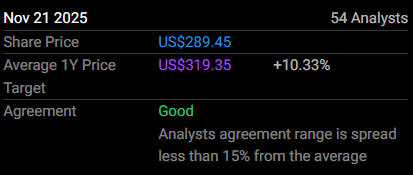

Alphabet is our stock of the week.

And for a simple reason.

Berkshire Hathaway has taken a US$4.3 billion in the tech company. And Warren Buffett has given his seal of approval.

Share price has risen by as much as 6% since the announcement.

Year-to-date, it has risen by 51%, making it one of the stand-out performer of the Mag 7.

There are two important shifts happening to Alphabet.

Scaling of its AI capabilities for commercial purposes. Gemini AI now has 650 million customers.

Google Cloud segment’s revenue rose by 34%.

Furthermore, Alphabet is trading at a relatively cheaper valuation.

Price-to-earnings ratio is at 28 times compared to other Mag 7 companies like Amazon (30.4x), Nvidia (44.2x), Tesla (258 times).

And Alphabet still has legs to run.

Source: SimplyWallSt

Hope the above is fruitful for you all..

Cheers,

James Yeo

Socials of the Week