Not going to lie, I use to fantasize about riding in one of these Transformers on the top. I get to pilot a robot and turn into a car.

Every boy’s wet dream before puberty hits.

But these days, we are getting something similar - robotaxis.

Fully autonomous, with on one inside but you, as you are carried to your destination.

Tesla, Waymo and Uber recently upped their robotaxi game. Let’s take a deep look into it this week!

Big Hits [U.S.] 💵

Moving on, here are the news that shocked the world…

Iran-Israel ceasefire $SPX ( ▲ 0.77% ) : President Trump negotiated a ceasefire between Iran and Israel, and markets breathed a sigh of relief [Read More]

Tesla $TSLA ( ▲ 2.39% ) : Guess who got robotaxis running? Tesla did. And it’s test-run has got investors foaming at the mouth. [Read More]

Uber X Waymo $UBER ( ▲ 0.93% ) $GOOGL ( ▼ 0.19% ) : Uber and Waymo (owned by Google) are also making robotaxi moves, by opening up robotaxi services in Atlanta. [Read More]

Blackberry $BB ( ▲ 1.81% ) : Hold up! Blackberry is on the news? And it generated US$1.9 million in profit and surpassed expectations. Call me a positive berry indeed! [Read More]

AeroVironment $AVAV ( ▲ 0.35% ) : The drones are here. Drone maker AeroVironment surpassed financial expectations and the company expects to make US$2 billion in 2026. [Read More]

Big Hits [Asia] 📊

Here are the news covering the Asia market…

Alibaba $BABA ( ▲ 0.22% ) : Out with the old, in with young? Nine executives and company veteran are leaving to make way for younger leaders, which include former CEO, Daniel Zhang [Read More]

ST Engineering: Sale! ST Engineering is selling its US construction equipment company, LeeBoy for US$290 million to Fayat Group [Read More]

OCBC: Johor is a goldmine for investments. OCBC has financed RM11 billion in investments since 2024, and intends to finance another RM3 billion more in 2025 [Read More]

AEM: AEM raised its revenue guidance for 1H 2025 to a range of US$185 million to US$195 million from US$170 million [Read More]

Chizu IPO: Daruma, the owner of Chizu Cafe, has announced an IPO for the Singapore Exchange market [Read More]

Analyst Reports 📝

See below for our handpicked analyst reports:

Stock | Headline | Link |

|---|---|---|

Micron | Strong 2Q results, with HBM segment driving revenue | |

Broadcom | Strong 2Q results, driven by AI demand | |

Haidilao | Disciplined cost management | |

Sheng Siong | Defensive and recession-proof play | |

CapitaLand Integrated Commercial Trust | Continued organic growth and positive rental reversion |

Story of the Week 📹

Are robotaxis going to be the future?

If you remember the movie I, Robot acted by that actor that slapped the crap out of Chris Rock, then you would have seen driverless cars on the road.

When Will Smith instructed the car to give him manual control, his superiors were pissed. They warned that it was dangerous and that it could lead to accidents to other people.

That is one of the draw of driverless cars.

It is supposed to be safer, as humans tend to make more mistakes on the road.

But for ride-hailing companies, driverless cars are the future for them.

It doesn’t need a driver. So, they don’t need to pay drivers, whose salaries are always increasing every year.

It could lead them down a path to profitability.

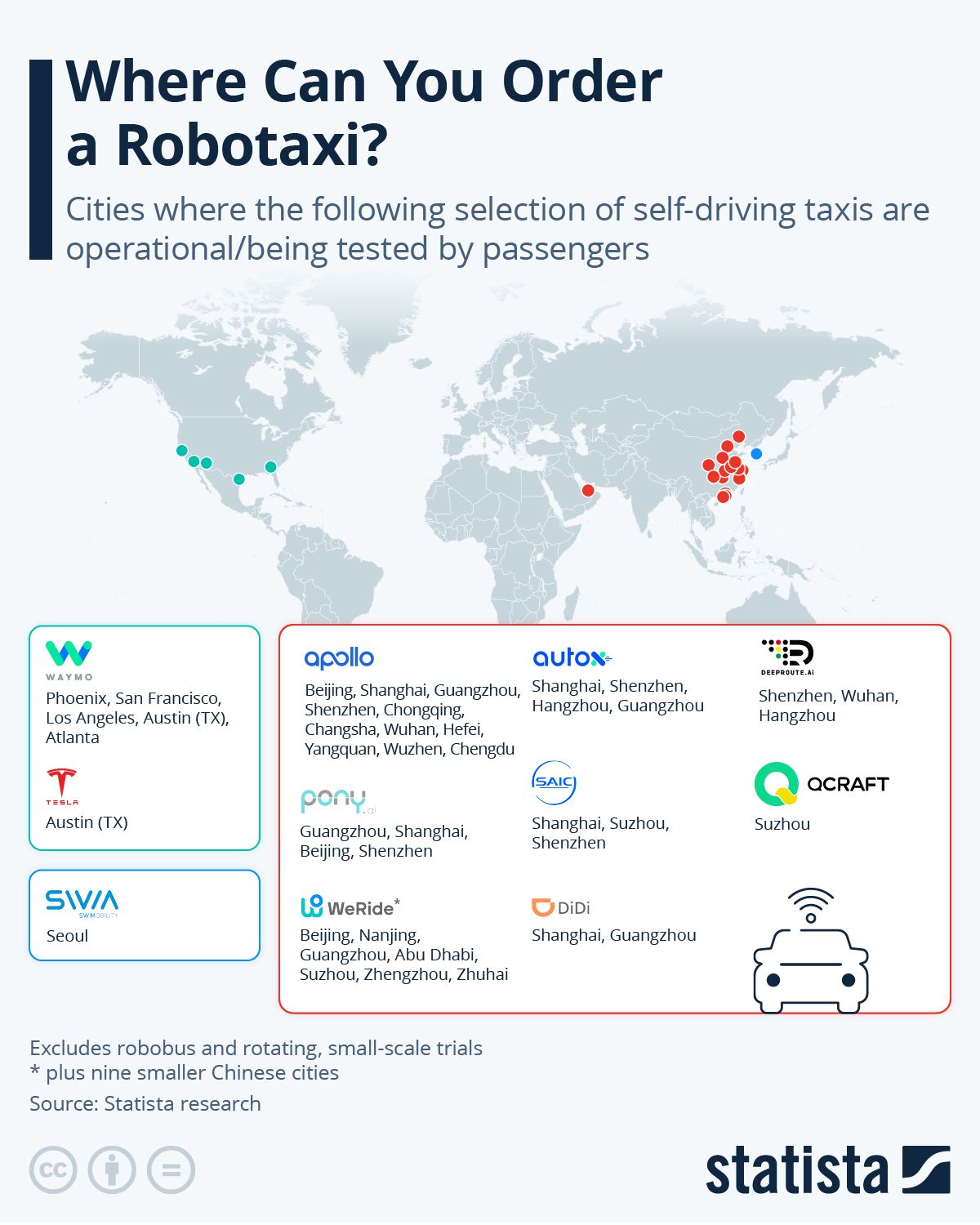

In the U.S. currently, Waymo is the biggest robotaxi company. And it partners with Uber to tap their vast network of clients.

Clients can opt to select a Waymo car through Uber. And Waymo has delivered 10 million rides since 2020.

But the Chinese are better.

Apollo Go, owned by Baidu, has ran 11 million rides. And it is already expanding into the United Arab Emirates, Hong Kong, Switzerland and Turkey,

PonyAI and WeRide are also rushing to scale up their robotaxi rides in China.

And they all have good reason to do so. Here are their accumulated losses

Uber: -US$20 billion

Didi: -US43 billion

PonyAI: -US$1.3 billion

WeRide: -US$1.2 billion

Waymo doesn’t report financials but it was reported that it incurred US$2 billion in operating losses in 2024.

Meanwhile, Apollo Go doesn’t report financials also but it is still reportedly making losses.

Robotaxis are the future … for their survival.

Stock of the Week

Uber is at an … interesting position.

The ride-hailing company is entering its 16th year in operation. And finally, it turned a profit for two consecutive years of 2023 and 2024.

2023: US$1.9 billion

2024: US$9.9 billion

These two years have effectively helped Uber erased a third of its accumulated losses from US$33 billion in 2023 to US$20.8 billion.

And investors have rewarded the company.

Share price is up by almost 50% for the year.

Its valuations are reasonable at a price-to-earnings ratio of 16 times.

Does Uber still have legs though? Yes

Collaboration with Waymo is expected to boost revenue and profits.

Uber dominates close to three quarters of the U.S. market, with Lyft at second position with the remaining quarter.

Does it still have risks? Totally

Waymo could turn around and beat Uber with driverless cars.

A recession could devastate demand for ride-hailing and deliveries.

Market analysts have Uber at a target price of US$97.53 with an implied upside of +6.8%.

What do you think? Think Uber is a MUST BUY?

Hope the above is fruitful for you all!

Cheers,

James Yeo