One of my favourite investment figure is retiring: Warren Buffett.

And I can’t help but feel bittersweet about it.

Throughout the years. Warren Buffett was a shining beacon on what investments should be - simple and ‘compounding’.

In this week’s newsletter, I am dedicating it to his legacy and how he has influenced my journey!

Big Hits [U.S.] 💵

Moving on, here are the news that shocked the world…

Movie Tariffs $NFLX ( ▲ 2.66% ) $DIS ( ▲ 1.57% ) : Hollywood ain’t gonna like this. Trump has ordered a 100% tariffs on movies made overseas and exported to the U.S. [Read More]

Palantir $PLTR ( ▼ 1.35% ) : Whoops! Palantir’s share price dropped by 12% in a single day, even though its earnings beat expectations. Investors have cold feet over its astronomical valuations now [Read More]

Skechers $SKX ( ▼ 0.11% ) : Moving on out of here! Skechers is being brought private by 3G Capital for $63 per share. And of course, they are subjected to Trump tariffs [Read More]

Disney $DIS ( ▲ 1.57% ) : Disney’s earnings beat expectations for the second quarter as its streaming numbers have gone up while announcing a new theme park in Abu Dhabi [Read More]

Uber $UBER ( ▲ 0.93% ) : Uber’s 1Q 2025 results were mixed. Gross bookings were slightly lower than expectations but EBITDA grew by 35% to US$1.9 billion [Read More]

Learn AI in 5 minutes a day

This is the easiest way for a busy person wanting to learn AI in as little time as possible:

Sign up for The Rundown AI newsletter

They send you 5-minute email updates on the latest AI news and how to use it

You learn how to become 2x more productive by leveraging AI

P.S. Every click helps me get you all the information you need for your investing journey!

Big Hits [Asia] 📊

Here are the news covering the Asia market…

Alibaba new IPO? $BABA ( ▲ 0.22% ) : Alibaba is trying to list Ant International, its overseas arm, in Hong Kong. The company houses the payment platform, Alipay [Read More]

OCBC: Financial results for 1Q 2025 were within expectations. Profits fell by 5% to SG$1.9 billion but trading, insurance and wealth management businesses did well. [Read More]

UOB: UOB missed expectations as profits were flat at SG$1.5 billion. Net interest income was up by 2% driven by higher loan demand [Read More]

DBS: DBS missed expectations also. It blames Trump’s tariffs for causing uncertainties but the higher global minimum tax increased taxes for the company [Read More]

ST Engineering: Revenue rose by 8% to SG$2.9 billion for 1Q 2025, driven by defense and public security segments. [Read More]

Analyst Reports 📝

See below for our handpicked analyst reports:

Stock | Headline | Link |

|---|---|---|

Shopify | Strong 1Q results with no tariff impact | |

Alphabet | Decent advances in its AI division | |

Li Auto | Strong PHEV offerings | |

Sheng Siong | Record year of new store openings | |

CapitaLand Investment | Strong balance sheet |

Story of the Week 📹

If there is a real story where it involves a cowboy riding off into the sunset, Warren Buffett’s one is top of the list.

After 60 years helming Berkshire Hathaway with Charlie Munger, he is finally riding off with a hefty US$160 billion in net worth.

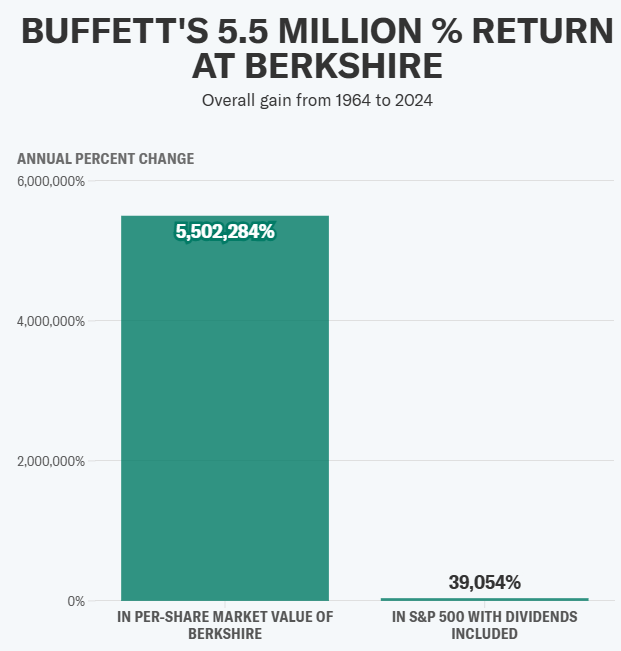

His track record has been impeccable in Berkshire.

It’s not even close how much Warren Buffett has outperformed the market.

I still remember when I picked up the book he recommended, “Intelligent Investor”. Apparently, that book to him, was “by far the best book written on investing”.

I agree too.

Throughout the years, I had learnt 3 important things from Buffet

Fundamental research into everything about the company comes first. Read and read, till you can tell someone the front and back of the company.

Never invest in a company you don’t understand.

When everyone sells, you buy. When everyone buys, you hold cash and wait for them to sell again.

These principles formed the core of my investment beliefs and have carried me through thick and thin.

As for Mr Warren Buffett, happy retirement and I wish you all the best.

Free Tool of the Week

Many things happened this week, but one caught my eye.

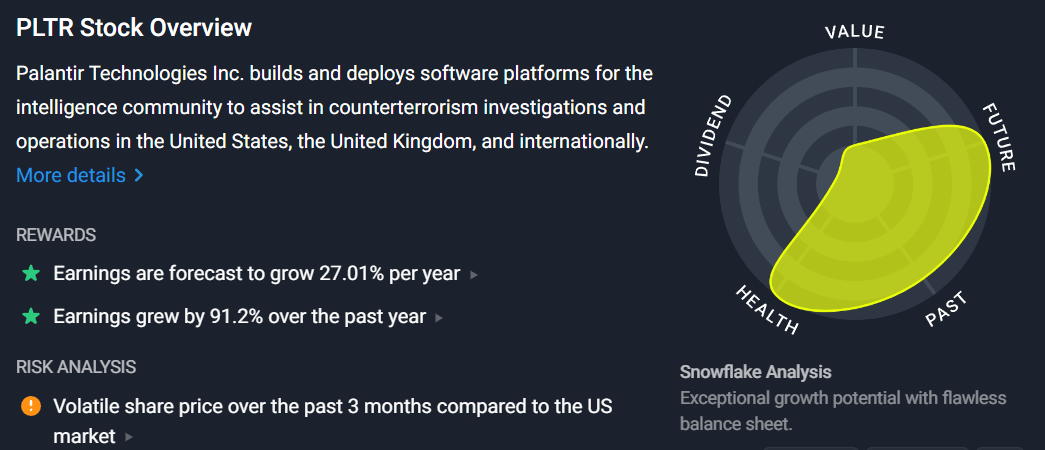

Palantir, the software company that uses AI, had beaten expectations but share price fell by 12%.

I was looking for a way to analyze the company and found myself going back to SimplyWallSt’s useful tool called ‘Snowflake Analysis’ and this is what I saw.

Two things came to mind. Palantir is a value investor nightmare. Valuations are so high that it’s hard to find any opportunity to enter.

However, its future growth is tremendous. And it’s sitting at a very healthy financial position.

Interested in using the tool? Use my link when you are registering for one!

Hope the above is fruitful for you all!

Cheers,

James Yeo