This Week at InvestKaki:

Big Hits [U.S.] 💵

Moving on, here are the news that shocked the world…

Softbank $SFTBY ( ▲ 1.95% ): Masayoshi Son is on a buying spree. He is now purchasing DigitalBridge, a data centre company for $4 billion [Read More]

GM $GM ( ▲ 3.29% ): General Motors is crushing the competition. Share price is up by 55% for the year and has beaten all of its competitors, including Tesla [Read More]

TSMC $TSM ( ▲ 4.45% ): The U.S. has granted TSMC an annual license to import U.S. chipmaking equipment and tools into China. [Read More]

Citibank $C ( ▼ 1.92% ): Citibank is taking a $1.1 billion hit in its Russia operations, after selling it to Renaissance Capital as it faces sanctions from the U.S. and the West [Read More]

Warner Bros $WBD ( ▲ 0.71% ): Warner Bros is once again, planning to reject Paramount Skydance’s bid for its company in favour of the initial Netflix deal [Read More]

Big Hits [Asia] 📊

Here are the news covering the Asia market…

BYD: BYD reached its sales target for 2025, selling 4.6 million cars, and is up by 7.7% from 2024. However, it faces an environment of intense price war [Read More]

Singapore economy: Singapore recorded a stronger-than-expected economic growth of 4.8% in 2025, despite the volatile global trade environment [Read More]

Capitaland Ascendas REIT: The REIT has completed the acquisition of three properties from a Warburg Pincus-Lendlease Global joint venture for $566 million [Read More]

Sembcorp: Sembcorp has completed the acquisition of 300MW of solar assets, through a 100% stake in Indian solar operator ReNew Sun Bright [Read More]

CSE Global: CSE Global has secured data centre contracts worth up to US$145 million from the United States [Read More]

Reports 📝

See below for our handpicked analyst reports:

Stock | Headline | Link |

|---|---|---|

Dollar Tree | More streamlined business units | |

Airbnb | Expansion into hotels and international markets | |

Baidu | Undervalued ad business with AI upside | |

Centurion Corp | Resilient earnings and capital recycling | |

Geo Energy Resources | Doubling in sales |

Posts of the Week

The difference between Warren Buffett and Rick Guerin

Stock of the Week

BYD is enjoying a mini-resurgence throughout the holidays.

Share price is up by 4.4% since Christmas.

While it has crashed quite severely from its year-peak of HKD130, its recent sales for 2025 has shown that the company is indeed, top of the world.

It delivered a record total of 4.6 million cars for 2025, far surpassing Tesla’s projected deliveries of 1.64 million cars.

As the dust settles, now is a good time to evaluate BYD’s valuations and see whether it’s a good time to enter.

Firstly, BYD is now trading at a price-to-earnings ratio of about 23 times, which is considered relatively high compared to its peers’ average of 8.9 times.

Source: SimplyWallSt

However, we need to take into account that the industry is now in a fierce price war cycle, that has decimated margins and profits. So, many investors have been selling Chinese EV stocks to cut back on losses.

BYD certainly has suffered, but not as much. Its high PER indicates that investors are still bullish on its market position in China, and prospects internationally.

It has announced that it aims to sell 1.6 million cars internationally in 2026 (about 50% increase from 2025)

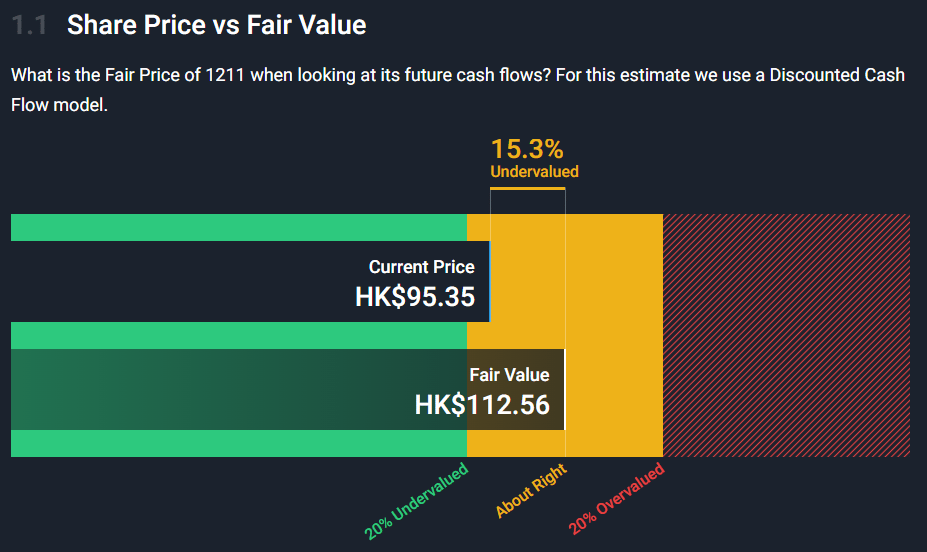

From a discounted cash flow perspective, BYD is considered undervalued by 15%.

Source: SimplyWallSt

Analysts are now also targeting HKD133.23, with an implied potential upside of +40%.

Source: SimplyWallSt

Hope the above is fruitful for you all..

Cheers,

James Yeo