Hey SuperKakis 👋

Quick portfolio check-in, especially with a bit of market wobble and headlines flying around.

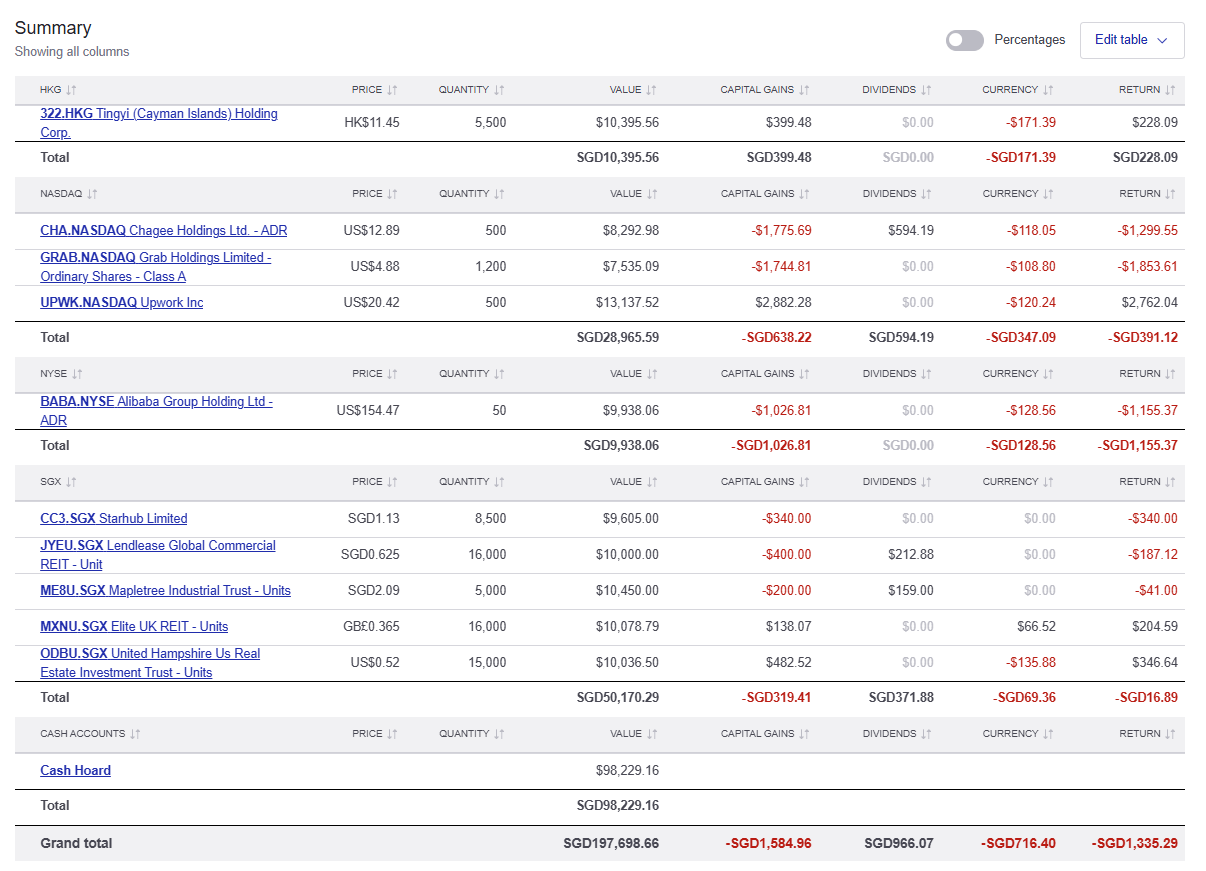

But first, download the portfolio holdings below:

While the portfolio is down slightly, I am glad we maintained a $98K cash hoard to deploy and if you were to ask me about the market volatility…

Short version: I’m not fazed by the recent dip in market value.

Reason: volatility + uncertainty is exactly why we keep a healthy cash buffer.

Right now, cash gives us optionality.

And I’m choosing to deploy part of it deliberately, not emotionally.

Why the recent dip doesn’t bother me

A few reminders on how this portfolio is built:

This is a barbell-style portfolio – quality growth on one end, income resilience on the other

Short-term price swings are expected; business quality changes much slower

Cash is not “dead money” – it’s dry powder for moments like this

When markets are noisy, I fall back to process, not predictions.

That’s where my specially designed 5M framework comes in.

BUY Trade Alert #1: Buying Netflix (S$10,000) on Friday US market open

I’ll be adding Netflix using the 5M lens:

Mastery (3/3)

Streaming is not new to us. Netflix’s model, content economics, and subscriber engine are well understood.

Moat (3/3)

Pricing power is real. Despite multiple price hikes, churn remains manageable and engagement stays strong.

Metrics (3/3)

Revenue growth + improving free cash flow tell me the business is maturing without stalling.

Management (3/3)

Execution has been consistent – from originals to monetisation (ads, pricing tiers).

Margin of Safety (2/3)

Not cheap on headline P/E, but reasonable when weighed against scale, dominance, and cash generation.

👉 Total: 14/15 on my scorecard.

This isn’t about catching a bottom.

It’s about adding to a high-quality compounder during uncertainty.

📌 Bonus: We’ll be doing a “Stock-of-the-Month” deep-dive case study on Netflix later this month so everyone can see the full 5M breakdown step by step.

BUY Trade Alert #2: Buying Digital Core REIT (S$10,000) – Monday SGX open

Next up: Digital Core REIT.

What changed?

A NEW 10-year lease secured with an investment-grade global cloud provider

Portfolio occupancy jumps from 81% to 98%

Annualised NPI from this facility up ~35%

Tenant bears fit-out costs

3% annual rental escalation, no break option

WALE extended from 4.7 years to 5.7 years

On top of that, as shown above, Digital Core REIT is one of the most cheapest (34% discount to NAV) and highest yield (7.1% distribution yield) of all the Data Centre REITs right now.

Big picture takeaway

I’m not reacting to fear in the market; I’m rebalancing with intent.

Quality growth when sentiment is shaky

Income assets when fundamentals re-rate quietly

Cash remains available if volatility gives us more chances

That’s how we compound our wealth steadily over a long term basis.

RECAP: Next 3 moves ✅

Execute Netflix buy (US open, Friday)

Execute Digital Core REIT buy (SGX open, Monday)

Publish Netflix Stock-of-the-Month 5M case study

More updates soon.

As always, stay steady and think long term.

Cheers,

James -staying-sane- Yeo

![[SuperKakis Portfolio] Staying Calm 🧭 + Two New Portfolio Actions](https://media3.giphy.com/media/v1.Y2lkPTI0NTBlYzMwMDF3NGFpNHZpMG9qN3cyaGU5aG9senlid3dmNWF6NWQzNmFwbW00MyZlcD12MV9naWZzX3NlYXJjaCZjdD1n/anSiSGG5YaXeBn5gv4/giphy-downsized.gif)