This Week at InvestKaki:

Big Hits [U.S.] 💵

Moving on, here are the news that shocked the world…

Tesla $TSLA ( ▲ 1.51% ) : Elon is probably regretting his decisions. Revenue and profit for Tesla missed expectations as its $7,500 tax credit for EVs will expire soon [Read More]

Chipotle $CMG ( ▲ 0.51% ) : Chipotle’s financial results were within expectations. However, it has lowered its forecast to a flat growth for 2025 [Read More]

Oracle X OpenAI $ORCL ( ▲ 9.64% ) : Oracle and OpenAI will collaborate to develop 4.5 gigawatts of Stargate data centre capacity in Abilene, Texas [Read More]

Paramount X Skydance $PARA ( ▲ 1.04% ) : FCC gave its green light. Paramount and Skydance can now merge in a $8 billion deal [Read More]

General Motors $GM ( ▼ 4.23% ) : General Motors results were within expectations. However, it has warned that it might take a $5 billion hit from tariffs [Read More]

Former PepsiCo Exec Invented A Plastic That Dissolves in Water

If anyone knows a thing about plastic’s impact on the planet, it’s Manuel Rendon. The former PepsiCo executive and environmental engineer is using his 20 years of expertise to solve one of the world’s biggest problems with Timeplast.

Up to 450 million metric tons of plastic are wasted each year. Microplastics seep into our bodies, and mountains of bottles pile up in the ocean. But Timeplast has patented a water-soluble, time-programmable plastic that vanishes without harming the environment.

Major players are already partnering with Timeplast for its patented technology—their sales grew 6,000% in the first month.

You have just a few days left to invest as Timeplast scales in its $1.3T plastic market, from packaging to 3D printing. Become a Timeplast shareholder by midnight, 7/31.

This is a paid advertisement for Timeplast’s Regulation CF Offering. Please read the offering circular at invest.timeplast.com.

Big Hits [Asia] 📊

Here are the news covering the Asia market…

Pfizer X 3SBio: Pfizer will pay 3SBio $1.25 billion in upfront payment to have exclusive right to sell 3SBio’s cancer drug outside of China [Read More]

EMDP: The Monetary Authority of Singapore has appointed Avanda, Fullerton and JP Morgan to manage SG$1.1 billion from the Equity Market Development Program [Read More]

DFI Retail: Dividends! DFI Retail Group has announced a special dividend of SG$0.44 per share for 1H 2025 as underlying profit attributable to shareholders surged 39% y-o-y to US$105 million ($134.51 million) [Read More]

SIA Engineering: SIA is flying high. Revenue and profits for 1Q 2026 are up by 33% and 29% respectively due to higher demand for maintenance repairs and overhaul services [Read More]

Lum Chang Creations: Lum Chang Creation’s share price closed 22% higher on its first day of trading [Read More]

Analyst Reports 📝

See below for our handpicked analyst reports:

Stock | Headline | Link |

|---|---|---|

Paramount | Merger with SkyDance to deliver cost efficiencies | |

IBM | Stable customer base and strong growth momentum of Red Hat | |

Kuaishou Technology | Driven by online marketing growth and contribution from Kling AI | |

Lum Chang Creations | Driven by conservation and interior fit-out works from government | |

SIA Engineering | Strong 1Q 26 results |

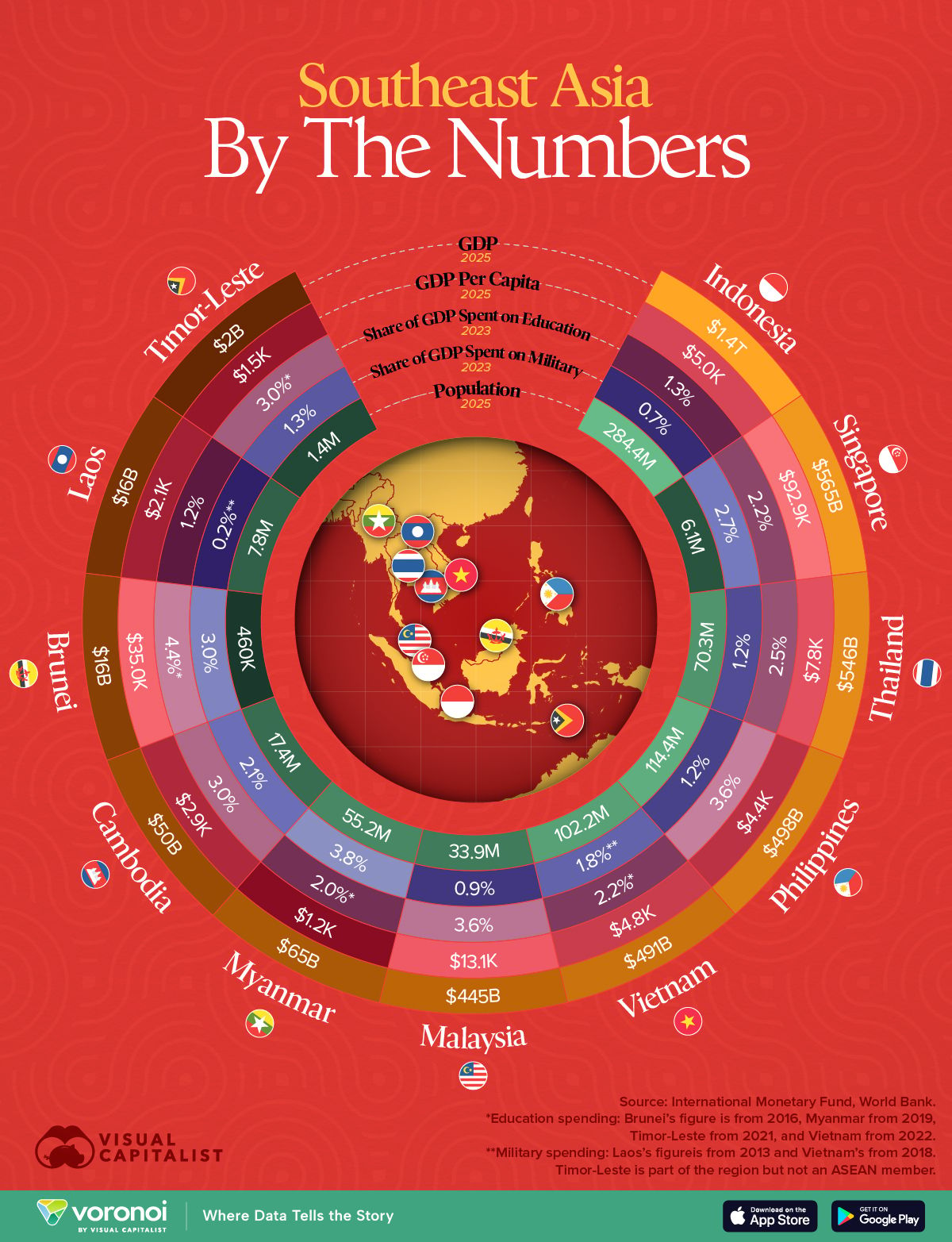

Visual of the Week 📹

As we brace for Trump tariffs on the region next week, I figure this will be a good time to revisit the economics of our ASEAN region.

Let’s talk about my home country, Singapore first.

Higher GDP per capita in the region at US$93k.

Second biggest economy

High proportion spent on education and military

Singapore is basically my base and safety net. Companies here are very mature, and deeply connected to the world through trade and finance. They export a lot to the region, and also to the major economies in the world (especially China and U.S.).

There are risks in Singapore, but probably not as much compared to other markets in the region. Government is stable and boasts strong institutions going overseas like DBS, Singtel etc. The downside is that the economy is highly reliant on trade with the world.

Malaysia is probably more on the safety side, as it already has the third highest GDP per capital in the region. The potential upside is quite decent also, considering many Singaporean companies want to expand to Malaysia now in the Johor Bahru-Singapore area.

Vietnam is probably one of the hidden gems at this point. It managed to negotiate a deal with Trump for its tariffs. And it also has very close trade ties with China. The country could be the next manufacturing powerhouse in the region.

Finally, Thailand. If I ignore its political troubles now, it is a country rich in its tourism and manufacturing capabilities.

ETF of the Week

Amova E Fund ChiNext Index ETF (Amova ETF) has just made its splash on the Singapore Exchange on 22 July 2025.

And you could benefit from it.

Amova ETF is an exchange-traded fund that is designed to mimic the price performances of the ChiNext Total Return Index.

ChiNext is a benchmark of China’s innovative and venture enterprises on the Shenzhen Stock Exchange and has the top 100 largest and most liquid A-share stocks.

Its top 5 constituents consist of

CATL: 20.8%

East Money Information: 8.3%

Shenzhen Inovance Technology: 4.0%

Shenzhen Mindray Bio-Medical Electronics: 3.9%

Wens Foodstuff Group: 2.9%

Amova ETF is ideal for investors looking for more risks on the China market as it has a good balance of large-, mid-, and small-cap stocks.

It also has a currency hedge of SGD against the RMB for Singaporean investors to minimise the currency rate changes.

The manager is Nikko Asset Management, with the underlying fund manager of E Fund Management Co.

For more information, you can have a look at the ETF here.

Hope the above is fruitful for you all..

Cheers,

James Yeo