This Week at InvestKaki:

Big Hits [U.S.] 💵

Moving on, here are the news that shocked the world…

Trump Bailout $SPX ( ▲ 0.47% ): You know what they say? Create a problem, then sell a solution. Trump is preparing a US$12 billion bailout for farmers, after his tariffs decimated farming. [Read More]

Federal Reserve $SPX ( ▲ 0.47% ): The Federal Reserve reduced interest rates by 25 bps to a range of 3.50% to 3.75% but officials are increasingly divided as Trump seeks to influence the Fed [Read More]

Paramount $PSKY ( ▲ 1.14% ): Paramount wants to crash the Netflix-Warner Bros party. It has offered US$108 billion for Warner Bros, higher than Netflix’s offer of US$72 billion [Read More]

Nvidia $NVDA ( ▲ 2.5% ) : Trump has approved Nvidia’s sales of H200 chips to China, but wants 25% cut for its China sales. But China has not said anything about allowing this [Read More]

Costco $COST ( ▼ 0.36% ): Costco once again exceeded expectations for 3Q 2025. U.S. consumers have been flocking to it as they look for value deals. [Read More]

Shoppers are adding to cart for the holidays

Over the next year, Roku predicts that 100% of the streaming audience will see ads. For growth marketers in 2026, CTV will remain an important “safe space” as AI creates widespread disruption in the search and social channels. Plus, easier access to self-serve CTV ad buying tools and targeting options will lead to a surge in locally-targeted streaming campaigns.

Read our guide to find out why growth marketers should make sure CTV is part of their 2026 media mix.

Big Hits [Asia] 📊

Here are the news covering the Asia market…

Baidu $BIDU ( ▲ 0.71% ): Baidu is considering whether to spin-off its AI chip unit, Kunlunxin (Beijing) Technology Co. Ltd for a listing on the market. [Read More]

Keppel REIT: Keppel REIT is acquiring one-third of Marina Bay Financial Centre Tower 3 for SG$938 million from HongKong Land Holdings [Read More]

OCBC: OCBC is investing in Green Esteel (controlling shareholder of BRC Asia) to develop a hot briquetted iron facility in Sabah that is worth US$1.5 billion [Read More]

Sembcorp: Sembcorp is acquiring Australian energy retailer, Alinta Energy for A$6.5 billion to expand its renewable energy capacity [Read More]

Toku: Toku, an AI-powered customer experience platform, has lodged a preliminary prospectus with SGX for a proposed listing on the Catalist board [Read More]

Reports 📝

See below for our handpicked analyst reports:

Stock | Headline | Link |

|---|---|---|

Costco | Strong 3Q results, with digital focus driving growth | |

Broadcom | Strong AI chip demand growth from Anthropic | |

Baidu | Undervalued with upside of AI on advertising | |

CSE Global | Resilient orders with new partnership with Amazon | |

LHN | Robust Coliwoo growth |

The most powerful weapon in the world is compounding interest!

Stock of the Week

If you think the Warner Bros saga is over, think again.

Paramount Skydance (fresh off its recent merger) is crashing the Netflix-Warner Bros party by offering a much higher US$108 billion offer for Warner Bros.

Netflix offered US$72 billion to acquire Warner Bros streaming and content side (excluding its traditional cable channels).

This is turning into a blockbuster saga. Both sides have been furiously bidding with each other for Warner Bros - whose fortunes have declined in recent years as revenue and margins decline with a lacklustre offering.

Warner Bros shareholders will be forced to look at this offer, as it represents about 40% higher than Netflix’s offer.

I have an inkling on why Paramount is doing this.

If Netflix does indeed manage to buy Warner Bros streaming segment (HBO Max), it will become the biggest streaming player in the U.S. market with a one-third market share.

Paramount Skydance is afraid of this as its recent merger did not go down well with some of its investors.

It is after all, still making a big loss of US$6.2 billion in 2024.

However, this deal could change things up for the company.

Firstly, Warner Bros is still profitable and have many IPs that could boost the company’s outlook for the near-term.

Secondly, it could stem the rise of Netflix in the streaming industry while it figures out how to compete.

Regardless, if Paramount Skydance manages to outcompete Netflix in acquiring Warner Bros, this could open up a whole new ball game in the market.

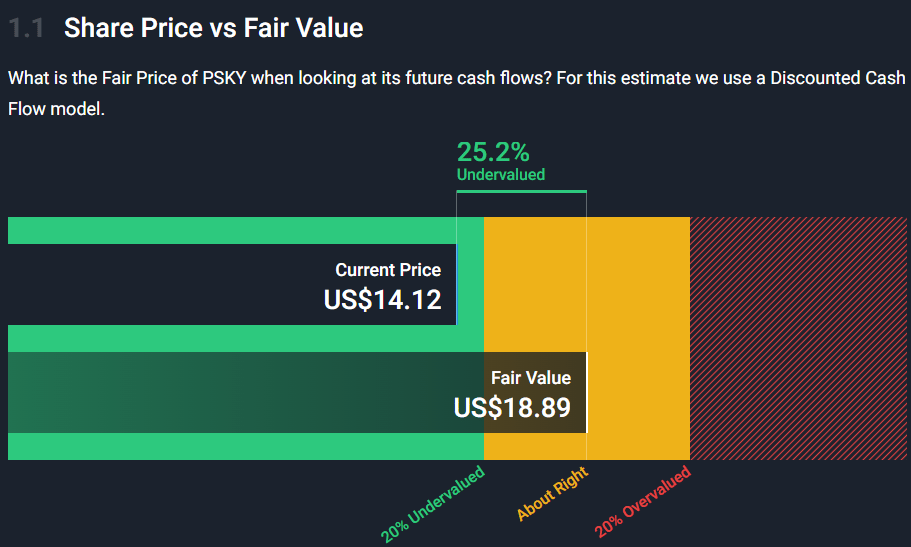

SimplyWallSt’s analysts peg the company as being undervalued by 25%.

Source: SimplyWallSt

Hope the above is fruitful for you all..

Cheers,

James Yeo

Socials of the Week