**For those who met me at REITs Symposium, scroll down to the bottom to download the slides as promised 😄

Remember the film, “The Good, the Bad, and the Ugly”?

A western epic about cowboys having face-offs (and also, very long close-ups of their faces), battling in the wild wild west.

The Republicans seem to think Trump’s bill literally named One Big Beautiful Act is a Good idea.

The Democrats, naturally, think of is a Bad idea.

Me? Well, I think it’s … Ugly.

Find out more on what I think about the bill in the Meme of the Week!

Big Hits [U.S.] 💵

Moving on, here are the news that shocked the world…

Tesla $TSLA ( ▲ 1.51% ) : Robocop might have a taxi next month. Tesla is planning to launch a limited service for its robotaxis next month in Texas. The catch - only 10 to 20 robotaxis [Read More]

Nippon Steel: Nippon Steel is desperate. It has renewed its merger with U.S. Steel (which was rejected by Biden) by upping its investments to US$14bn in the U.S. [Read More]

Target $TGT ( ▼ 0.03% ) : Target kind of hit and missed its target. 1Q 2025 profits were up by 10.4%, but revenue was down by 3%. It blames weak consumer appetite and tariffs [Read More]

Lowe $LOW ( ▼ 0.54% ) : Lo and behold. Lowe’s 1Q 2025 results exceeded expectations, at least from profits. It cited that home professionals (contractors) drove sales more than DIY folks [Read More]

Regeneron X 23andMe $REGN ( ▼ 0.67% ) : Well, you can’t be forever 23. Regeneron Pharmaceutical is buying bankrupt 23andMe for US$256 million. [Read More]

The easiest way to stay business-savvy

There’s a reason over 4 million professionals start their day with Morning Brew. It’s business news made simple—fast, engaging, and actually enjoyable to read.

From business and tech to finance and global affairs, Morning Brew covers the headlines shaping your work and your world. No jargon. No fluff. Just the need-to-know information, delivered with personality.

It takes less than 5 minutes to read, it’s completely free, and it might just become your favorite part of the morning. Sign up now and see why millions of professionals are hooked.

P.S. Every click helps me get you all the information you need for your investing journey!

Big Hits [Asia] 📊

Here are the news covering the Asia market…

CATL : CATL’s trading debut has been electrifying. Shares rose by 16% on its first day as CATL managed to raise US$4.6 billion in the biggest IPO in the Hong Kong market [Read More]

SingTel: SingTel’s profits up by 405% for full-year 2025? Well, that’s because it registered a SG$1.6 billion gain from divestments. Without it, profits grew by 9%. [Read More]

Wee Hur: BIG contract. Wee Hur Holdings secured two projects worth SG$440 million from the Housing Development Board [Read More]

DFI Retail: After selling Yonghui, DFI Retail’s profit declined by 18% for 1Q 2025, and was also hit by a cigarette tax in Hong Kong that reduced sales [Read More]

Frencken: Good Frencking news! Both revenue and profit grew by 12% each for 1Q 2025, driven by its mechatronic and semiconductor divisions [Read More]

Analyst Reports 📝

See below for our handpicked analyst reports:

Stock | Headline | Link |

|---|---|---|

Zoom | Solid 1Q results, with new products potentially increasing sales | |

Palantir | Increased demand for government and commercial customers | |

Alibaba | Strong AI growth potential | |

Frasers Logistics & Commercial Trust | Strong positive rental reversion | |

Sea Ltd | Strong loan growth in its finance portfolio |

Meme of the Week 📹

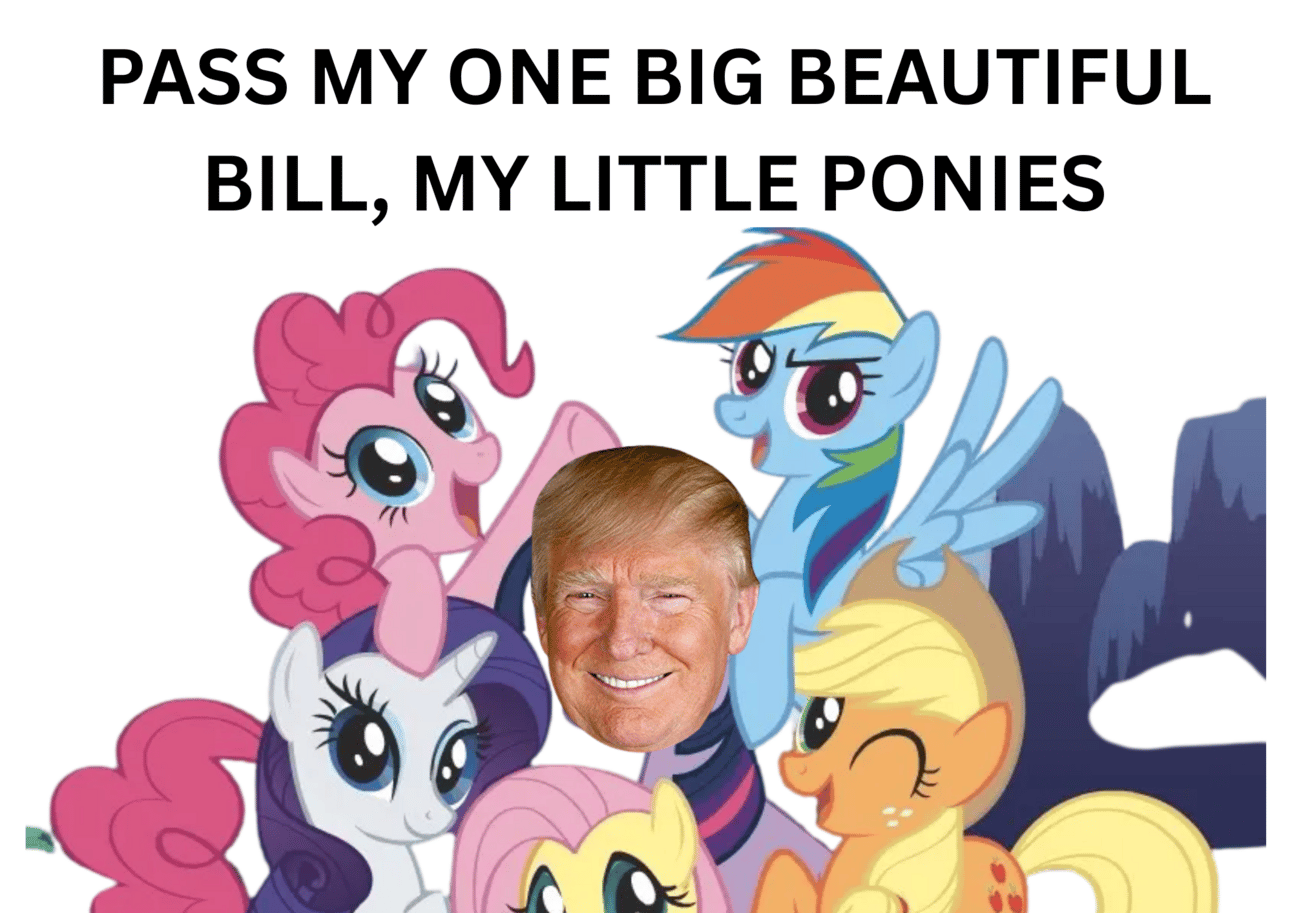

For some god damn reason, I am reminded of this image when I heard about President Trump’s One Big Beautiful Bill being passed at the House.

Trump, surrounded by all his Republican ‘ponies’ passing this bill, convinced that it will Make America Great Again.

And it passed by a razor-thin margin of ONE vote.

Here’s the gist of the bill

Cuts on income and business tax

Increase in tax reliefs/deductions

Reduce spending on food aid. Expand requirement for people to qualify for food aid

Reduce Medicare spending

Cut money for Planned Parenthood

Remove tax on gun silencers (?? what?)

Government contribute $1,000 to people who open ‘Trump’ accounts for their kids

$46.5 billion for Trump’s Mexico wall and deporting immigrants

$150 billion for the defense sector

Will they really help?

Your guess is as good as mine.

First two items on cutting income and business tax, and increase in tax reliefs will certainly be good in the short-term for U.S. consumers. More money = more buying.

And if you open a ‘Trump’ account for your children, the government will contribute $1,000. The catch is that you can only access 50% of the funds when your child turns 18, and the full amount by the time they are 30.

The rest … well … debatable.

If Trump even wants to debate whether they are good.

He will probably yell '“You are FAKE NEWS. FAKEEEE NEWSSS!” to people who question his policies anyway.

The food aid issue. Well, the Supplemental Nutrition Assistance Program (SNAP) fed 41 million Americans in 2024.

Like what Trump said to Walmart, ‘Eat the tariffs!’. He probably wants Americans to NOT eat then.

And the markets didn’t really eat up Trump’s bill that well.

S&P 500 declined by 1.9% since 21 May 2025.

Dow Jones also declined by 1.9% since 21 May 2025.

Good luck to all the investors out there.

FREE Resources For You

What a day …

I was so thrilled to see so many of you at the REITs Symposium event. I am glad that you all benefited from my talk on the 6 Defensive Stocks to Ride Out Potential Recession.

As promised, here is the slide that I hope you can benefit from

Pictures are worth a thousand words.

If you want to see some of the photos that I will be sharing on LinkedIn, follow me here. Looking forward to seeing everyone there.

Something to Inspire You

With all the doom and gloom in the world now and the constant bombardment of negative news, it’s hard to find positive, inspiring stories.

But I recently read one.

The story of Alabama Chanin - a small slow-fashion company in Florence, Alabama.

If you have been thinking about how to integrate Environmental, Social and Governance (ESG) into your investments, this is a good company to learn from.

You see, their founders had a problem.

Fast-fashion and the garment/textile industry in general has huge ESG problems.

High environmental pollution (discharge of dyes and chemicals into rivers in many developing countries)

Widespread labour exploitation in sweatshops

High wastage as garments are quickly discarded if they don’t sell well

Workers are paid below living wages

News of global fashion brands engaging in these kind of practices are common. And when they hit the news, share prices of these brands typically drops and many investors are burned.

That is why many investors are now looking at the ESG components of companies.

Alabama Chanin fulfills almost all of these ESG

The cotton is home-grown, processed, and spun in the U.S. There are clear documentation of how this process is done.

The business employs local workers in Florence that were laid off when U.S. companies moved production to developing countries.

Workers are paid fair wages as 25% to 50% of the retail price of their garments goes to them.

Many critics have pointed out that Alabama Chanin’s business could not be sustained when they were established in 2000.

Prices are high because the costs are all localised to the U.S.

It is small and lacks scale.

However, fast forward to now, the company is still around. In 2018, they generated a revenue of $3 million according to the book Fashionopolis by Dana Thomas, and has expanded to include a cafe and learning academy.

It’s time for us to seriously consider the ESG components of a company also, rather than the financial performance only.

And Alabama Chanin is a shining example of this.

Hope the above is fruitful for you all!

Cheers,

James Yeo