This Week at InvestKaki:

Big Hits [U.S.] 💵

Moving on, here are the news that shocked the world…

Government Reopens $SPX ( ▲ 0.77% ): The Republicans have reached a deal with the Democrats to reopen the U.S. government until January 2026. At least, we can enjoy Christmas [Read More]

Softbank $SFTBY ( ▲ 3.37% ): Softbank dumped all of its Nvidia load for $5.8 billion to reinvest the money into other AI players such as OpenAI and ABB Robotics [Read More]

Anthropic $ANTHROPIC ( 0.0% ): Anthropic is spending $50 billion to invest in AI infrastructure across the United States to compete with OpenAI’s massive $1 trillion plan [Read More]

On $ONON ( ▼ 1.37% ): On, the Swiss sneaker brand with Roger Federer as a major investor, has exceeded expectations with revenue growing by 25% for 3Q 2025 [Read More]

Disney $DIS ( ▲ 1.57% ): Disney on ice? Profit beat expectations but revenue missed as ad revenue and a lack of film release impacted its topline [Read More]

Stock Feature - EShallGo

eShallGo - Leading Office Solutions Provider

Listed on Nasdaq earlier this year, EShallgo (EHGO) is quietly transforming from a traditional office-solutions provider into a next-generation enterprise-AI player.

In recent months, the company:

🧠 Launched its “Enlighten Series” AI assistants - on-premise devices that bring enterprise-grade intelligence, automation, and secure data control to businesses across China.

🌍 Expanded into the U.S. market through a strategic partnership with IT hardware brand MAXSUN, tapping into North America’s fast-growing performance computing and DIY hardware space.

⚙️ Rolled out its LuminaSphere Intelligence AI platform, laying the groundwork for “digital employees” that automate real-world enterprise workflows.

With strong execution, local dominance, and international reach, Eshallgo is positioning itself as one of China’s most intriguing small-cap growth stories - riding the twin tailwinds of AI adoption and improving U.S.–China trade sentiment.

P.S. Find out more information about the stock here: https://ir.eshallgo.com.

Big Hits [Asia] 📊

Here are the news covering the Asia market…

Foxconn: Foxconn registered better-than-expected results, driven by AI spending by ajor tech firms. Revenue grew by 11% from a year ago [Read More]

Singapore Airlines: Singapore Airlines’ profit crashed by 82% due to its Air India losses and lower interest income [Read More]

Oiltek: Oiltek’s 3Q results are mixed. Profits are up by 6.2% but revenue is down by a third after its edible and non-edible refinery businesses [Read More]

Food Empire: Food Empire a real empire now? Revenue grew by 28% for 3Q 2025 and was driven by its Russia and Ukraine, Kazakhstan and CIS segments [Read More]

SingPost: SingPost is trying to make a comeback. However, its profits for 1H 2026 declined by 78% as it loses profits from its divested Australian operations [Read More]

Reports 📝

See below for our handpicked analyst reports:

Stock | Headline | Link |

|---|---|---|

Walt Disney | Attractive valuation with strength in experience | |

AMD | Positive investor day projections for AI sector | |

Tencent Music | Undervalued with accelerating growth | |

DBS | Attractive dividend yields with stable earnings | |

UMS Integration | Higher potential earnings from new customers |

Socials of the Week

It’s always a bad day when you have to do some impairment. And ST Engineering is not having a good day.

Stock of the Week

On, a Swiss sneaker brand quietly (or loudly) taking over the world.

If you remember, we highlighted On when we talked about Roger Federer’s wealth off the court on this LinkedIn post here.

On’s share price rose by a whopping 20% as it releases its 3Q results and raises financial guidance for the year.

Sales rose by 35% to US$993 million.

Profits are up by 5 times to US$148 million.

Do you know what’s interesting?

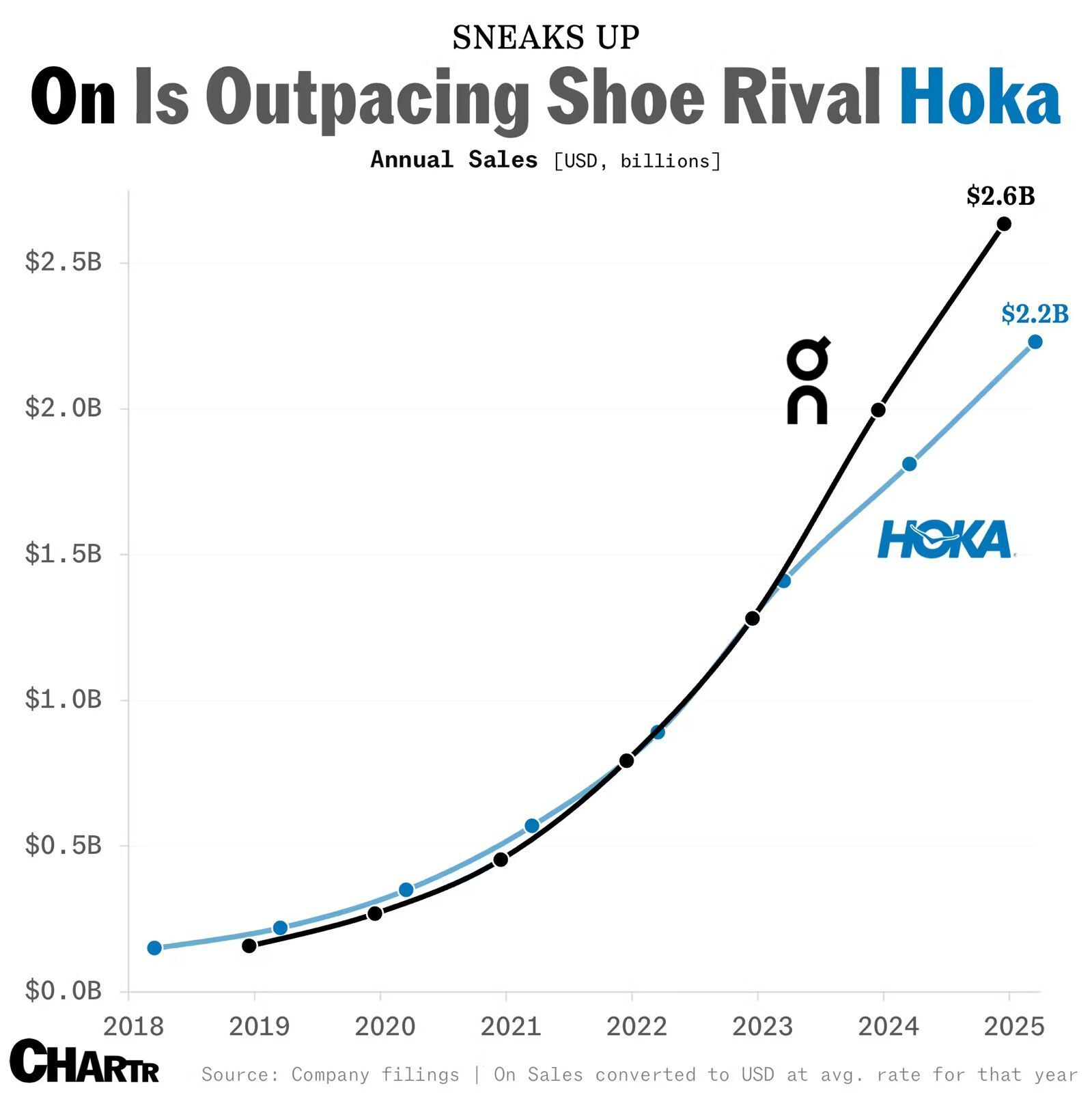

On Holdings sales have outpaced its rival Hoka in the last 2 years.

On’s CEO also said that all its shoes will be ‘full price through the holiday season’.

That’s because the company is pricing its products as a luxury, premium brand.

However, not all has been smooth-sailing.

The stock is still down by 23.4% since the beginning of the year.

The company was hit by uncertainties over Trump tariffs

60% of its revenue is derived from the United States

This strong 3Q results have lifted the company, as it seeks to expand its market share, to compete with the likes of Nike, Asics and Adidas.

On is at the 4th position in the footwear market with a market capitalisation of $14 billion.

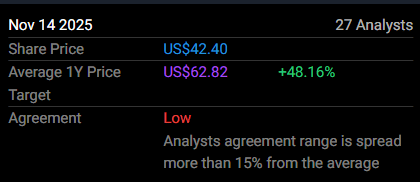

Analysts put ON at a target price of US$63 with an implied upside of 48.1%.

Source: SimplyWallSt

Hope the above is fruitful for you all..

Cheers,

James Yeo